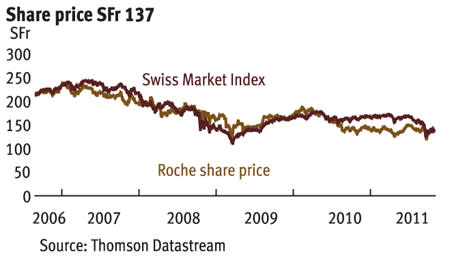

At last the Swiss franc is starting to dip. Not much fun for the hot money that took refuge in the Swiss currency, but good news for bargain hunters in equities. Shares in Swiss pharma giant Roche are now looking even better value thanks to the effort of the Swiss central bank to put a firm clamp on the Swissy's rise.

- Consistent success in clinical trials

- Diversified business

- Foreign share trading now easier

- Growing dividend

- Fair share of drug failures

- Regulatory hurdles

It's also at last possible to assess Roche's long-term prospects without the distorting effect of one-off benefits. In particular, the fear of bird and swine 'flu - neither of which turned into anything approaching a pandemic - meant high demand for its antiviral product, Tamiflu, in 2007 and 2008. This boosted profits big time until governments stopped stockpiling the medicine. But Roche seems to be prospering without the boost from Tamiflu, and the productivity of its pipeline underlines how valuable its $47bn acquisition of US biotech player Genentech in 2009 has turned out to be.

True, that acquisition means that net debt is now more than twice shareholders' funds (see table). It also prompted fears that Genentech's ability to produce innovative drugs could be stifled by the traditional pharma giant. So far, such fears look misplaced as Genentech appears to be as productive as ever - Roche's latest drug to be made ready for regulatory submission is a Genentech discovery called vismodegib, a drug to treat skin cancer that cannot be cured with surgery. There are about 2m cases of skin cancer annually in the US.

Additionally, Roche seems to have some promising clinical data for dalcetrapib, a successor drug to hypertension treatments such as Pfizer's blockbuster Lipitor. Analysts at RBS's investment bank reckon that a recent safety study on dalcetrapib has raised its chances of achieving commercial success from one in 10 to about one in three. Dalcetrapib does not seem to be displaying the uncertain safety characteristics that sank Pfizer's attempt at replacing Lipitor with a product called torcetrapib, a drug in the same class. The accompanying efficacy data, while still in its early phases, prompted RBS to raise its sales forecast for dalcetrapib to CHF1.5bn by 2017.

ROCHE (ROG) | ||||

|---|---|---|---|---|

| ORD PRICE: | CHF137 | MARKET VALUE: | CHF116bn | |

| TOUCH: | CHF136-137 | 12M HIGH: | CHF151 | LOW: 115 |

| DIVIDEND YIELD: | 5.5% | PE RATIO: | 10 | |

| NET ASSET VALUE: | CHF12.8 | NET DEBT: | 223% | |

| Year to 31 Dec | Turnover (CHFbn) | Pre-tax profit (CHFbn) | Earnings per share (CHF) | Dividend per share (CHF) |

|---|---|---|---|---|

| 2008 | 45.6 | 14.1 | 10.4 | 5.0 |

| 2009 | 49.1 | 10.2 | 9.07 | 6.0 |

| 2010 | 47.5 | 11.2 | 10.1 | 6.6 |

| 2011* | 44.3 | 12.4 | 12.5 | 6.7 |

| 2012* | 45.9 | 13.7 | 13.8 | 7.5 |

| % change | +4 | +11 | +11 | +12 |

BETA: 0.8 *RBS forecasts (Earnings not comparable with) £1 = CHF1.38 | ||||

Roche's diversity is another attraction as investors tend to penalise those pharma companies that rely too heavily on research and development. Nor has Roche gone the route of the other Swiss pharma giant, Novartis, and tried to replace lost revenue by acquiring makers of generic drugs or consumer products, which are both less profitable than marketing branded drugs. Instead, Roche has tried to supplement its core pharmaceuticals business with related technology. A prime example is the diagnostics division, which now contributes a quarter of Roche's sales. Diagnostic tests are often cross-sold with related drugs. For example, Roche developed a test to see which patients would respond best to a blockbusting cancer drug, Avastin. Not only did the test reach new patients, it also meant a double sale for the company if the test proved successful.

True, owning shares in overseas companies can deter UK investors, especially as dividends on Swiss companies are subject to a withholding tax. However, access to foreign shares via online brokers has improved considerably in the past few years and trades can now be settled through the UK's Crest system. Also, the UK has a tax treaty with Switzerland, so taxpayers can either claim relief on their income tax or write to the Swiss tax authorities for reimbursement. That means investors should see the benefit from the company's growing dividend, which should generate a yield of 5.5 per cent on 2012's forecast pay-out (see table). The pay-out should be further bolstered by steadily falling net debt; forecast by RBS to fall from CHF19bn to CHF7bn by 2013.

Meanwhile, investing in Roche comes with the usual caveats about the risks of drug development and regulatory hurdles. The company recently failed to convince the US drugs regulator to allow Avastin to be prescribed for breast cancer in the US.