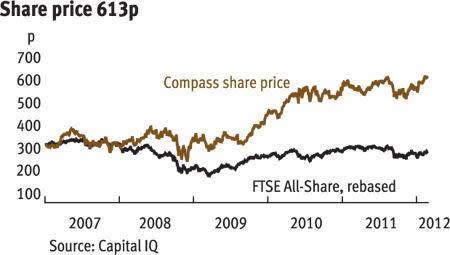

Compass is in vogue with the City, as its recent share price momentum attests. The catering giant is regarded as providing a shelter in the current economic storm. Its bosses are respected, its markets are global, its finances are strong and it has a solid growth story. What more could you want in these troubled times?

- Long-term growth in contract catering

- Focus on emerging markets

- Food price inflation may slow

- Share buy-backs

- Stagnant like-for-like volumes

- Slowdown in Europe

Okay, the catering industry is not immune to ructions in the wider economy. In fact, Compass has recently found it relatively hard going on the continent and in the UK and Ireland, which together account for a third of revenues. Operating profits from the continent nudged up 3.6 per cent last year and were flat in the UK and Ireland. Like-for-like volumes are also showing little growth. However, the group has a relatively flexible cost base, which helps mitigate some of the worst difficulties. Last year Compass also had to deal with steep food price inflation and was hit by the earthquake in Japan, which shaved almost half a percentage point off profit margins for its 'Rest of the World' territory. Despite all this, the defensive credentials shone through, and broker Shore Capital reckons that, even given a repeat of the global slump on the scale of 2008-09, Compass's earnings would only fall by about 10 per cent.

| Compass (CPG) | ||||

|---|---|---|---|---|

| ORD PRICE: | 613p | MARKET VALUE: | £11.6bn | |

| TOUCH: | 612-613p | 12-MONTH HIGH/LOW: | 624p | 498p |

| DIVIDEND YIELD: | 3.5% | PE RATIO: | 14.6 | |

| NET ASSET VALUE: | 184p | NET DEBT: | 24% | |

| Year to 30 Sep | Turnover (£bn) | Pre-tax profit (£bn) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2008 | 11.4 | 0.57 | 20.9 | 12.0 |

| 2009 | 13.4 | 0.77 | 29.5 | 13.2 |

| 2010 | 14.5 | 0.91 | 35.3 | 17.5 |

| 2011 | 15.8 | 0.96 | 36.4 | 19.3 |

| 2012* | 16.3 | 1.07 | 41.9 | 21.4 |

| % change | +3 | – | – | +11 |

Normal market size: 4,500 Matched bargain trading Beta: 0.7 *Investec Securities forecasts (profits and earnings not comparable with historic figures) | ||||

Key to the group's growth is an increased desire of organisations to save money by outsourcing catering. Compass estimates the market is worth £200bn a year, but that only half is outsourced. Compass sees big opportunities in the health and education markets. This trend is particularly evident in North America, where the group generates 43 per cent of its revenues and managed 7.4 per cent organic growth last year. What's more, despite food price inflation, it was able to lift its operating margins a touch to 7.9 per cent, resulting in a 12.6 per cent jump in constant currency operating profits to £538m.

The other area of strong growth is what Compass dubs "fast growing and emerging markets". This is a new reporting line following a reorganisation. In its full-year results management said it believed Australia and the emerging markets would produce "double digit growth for many years to come". A sign of the importance attached to this opportunity is the decision to increase the time given by chief executive Richard Cousins to exploiting opportunities in the region. The other reporting lines the group now has are North America and Japan and Europe.

Small 'infill' acquisitions have been used to help push Compass into these fast-growing markets. Indeed, £600m has been spent on buying business over the past two financial years, which has helped boost growth as well as advance strategic objectives. Management has also acquired Compass's way into offering multi-service contracts, which include more support services. This type of work now accounts for 22 per cent of revenue and provides good growth opportunities.

The strong business fundamentals are undepinned by a robust balance sheet and excellent cash generation – last year's free cash flow of £693m was not far below year-end net debt of £761m. And, despite ongoing spending on infill acquisitions, Compass has found plenty of money to hand back to shareholders. After shifting its dividend upwards in 2009-10, the group still managed to increase the payout by over 10 per cent in 2010-11 and to unveil a £500m share buy-back programme this year, which should add further support to the share price. Broker Panmure Gordon forecasts compound annual growth in earnings of 9 per cent over the next three years, which it expects to be matched by dividend growth.