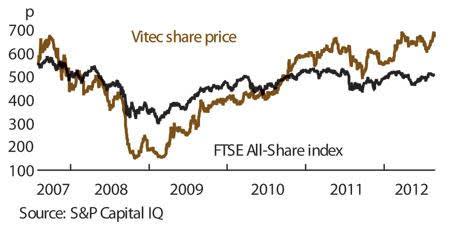

Vitec has put sophisticated cameras in some odd places, most recently London's Olympic swimming pool and the Big Brother house. Now, its antennas and telemetric systems have reached Mars, but its bosses have their feet firmly on the ground. So, after a big strategic push and strong results, Vitec's shares look worth buying.

- Strong first-half results

- Made some smart acquisitions

- Olympics benefit in second half

- Profit margins widening

- Loss on sale of staging business

- US defence contract delays

That Vitec got to the red planet at all is down to Haigh-Farr, a US company it bought in December. Its kit, which is fitted to the parachute cone of the Mars entry vehicle, beamed data to the boffins at NASA. Haigh-Farr makes miniaturised transmitters for military drones and guided missiles, too, and is already generating profits for Vitec.

It's a similar story at Camera Corps (CC), which cost just £8m in April and sits within Vitec's Videocom division, which makes a living from broadcasters and selling to the military, aerospace and government sectors. CC has already chipped in £1.4m of revenue and operating profit of £0.3m, and will do more in the second half after supplying small remotely operated high-definition cameras for the Olympics.

These are smart acquisitions, but management, led by chief executive Stephen Bird, is not afraid to sell, either. Clear-Com, an underperforming wireless audio equipment business, went in 2010 and offloading the low-margin staging business last month looks sensible. That operation lost £0.5m in the first half of 2012 after sales slumped by a third and its disposal will cost Vitec over £2m.

Its disposal will help return profit margins to pre-recession levels this year. Mr Bird thinks margins in the mid-teens are achievable. They leapt 1.6 percentage points in the first half of 2012 to 10.7 per cent, generating 21 per cent growth in underlying operating profit - 9 per cent excluding acquisitions - to £18.9m, from a modest increase in sales. Videocom did best. Of course, Haigh-Farr and CC helped, but there was strong demand among Asian broadcasters, especially for high-definition kit, LED lighting and robotic camera pedestals. Vitec is already working with Al-Jazeera as it refits studios in Qatar, and major projects elsewhere in the Middle East and South Korea are in the pipeline.

VITEC (VTC) | ||||

|---|---|---|---|---|

| ORD PRICE: | 687p | MARKET VALUE: | £300m | |

| TOUCH: | 673-687p | 12-MONTH HIGH: | 700p | LOW: 488p |

| DIVIDEND YIELD: | 3.2% | PE RATIO: | 12 | |

| NET ASSET VALUE: | 292p | NET DEBT: | 55% | |

| Year to 31 Dec | Turnover (£m) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2008 | 338 | 25.5 | 48.0 | 18.3 |

| 2009 | 315 | 1.8 | 7.50 | 18.3 |

| 2010 | 310 | 21.7 | 42.8 | 19.0 |

| 2011 | 351 | 23.8 | 34.7 | 20.5 |

| 2012* | 364 | 29.6 | 56.3 | 22.0 |

| % change | +4 | +24 | – | +7 |

Normal market size: 400 Matched bargain trading Beta: nil *Investec Securities estimates (earnings are not comparable with historic figures) | ||||

Admittedly, defence work is lumpy and orders from the US Department of Justice - worth $7.6m (£4.8m) last year - were much lower. Yet sales of wireless products for US state police helicopters still grew, ensuring divisional profits jumped 40 per cent to £8.4m on sales up 12 per cent to £74m. And Vitec's share price will respond well to news of US government-funded contracts when they come.

And imaging - Vitec's photographic unit - is exciting. Organic sales grew 4 per cent, despite the problems at staging, and profits rose 8 per cent to £10.4m. More professional photographers are buying its equipment and amateur snappers love the new premium, Manfrotto Powerbrand products, driving market share gains in the US and Europe. Hiring broadcast equipment for Olympics coverage also proved lucrative for the much smaller services division, which will ship kit to the US for November's presidential election.

There's plenty to drive Vitec's share price. Broadcast and video markets are expected to grow 7 per cent a year, and both the photographic and military sectors by 5 per cent. True, Vitec's bosses did not upgrade their full-year profits guidance when reporting half-year figures, but there is potential for an earnings surprise, given £10m of Olympics money is still to come, the US election and the sale of the staging division.