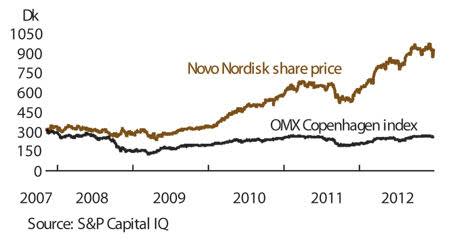

Most UK investors give little thought to Danish companies. For Novo Nordisk they should make an exception. This major pharmaceuticals group - the market value of its equity is 25 per cent more than Astra Zeneca's - offers a dominance of fast-growing markets and a drugs development pipeline that its rivals can only envy.

- Dominant market position

- Specialises in 'rich world' ailments

- Strong products pipeline

- Consistent share buy-back programme

- Odd share structure

- Currency risk

Novo Nordisk specialises in diabetes management and producing human insulin, plus other areas, such as treating haemophilia. Novo continued developing insulin products while other pharmaceuticals companies abandoned the area because they reckoned it was not sufficiently profitable (insulin can be easily replicated). However, the research paid off when Novo developed so-called 'insulin analogues'. These are proteins that mimic the medical effect of insulin, but combine greater efficacy with benefits such as the need for fewer injections. So successful has Novo been that in 2010 it overtook French pharma giant Sanofi (SAN) to become the world's largest diabetes treatment company, and now has a hugely-dominant 80 per cent chunk of the global insulin market.

Novo's dominance coincides with the growing incidence of 'rich world' diseases (in particular obesity-related diabetes) in developing countries. The International Diabetes Federation reckons that the number of diabetes sufferers in Africa, the Middle East and South East Asia will rise by 87 per cent to 175m by 2030; China already has about 90m diabetes sufferers; currently few receive treatment, although with growing affluence, that will change.

NOVO NORDISK (NOVOB) | ||||

|---|---|---|---|---|

| 'B' ORD PRICE: | 930 | MARKET VALUE: | DKK421bn | |

| TOUCH: | DKK900-930 | 12-MONTH HIGH: | 981 | LOW: 583 |

| DIVIDEND YIELD: | 2.5% | PE RATIO: | 21 | |

| NET ASSET VALUE: | DKK63.7 | NET CASH: | DKK12.4bn | |

| Year to 31 Dec | Turnover (DKKbn) | Pre-tax profit (DKKbn) | Earnings per share (DKK) | Dividend per share (DKK) |

|---|---|---|---|---|

| 2009 | 51.1 | 14.0 | 18.0 | 7.5 |

| 2010 | 60.8 | 18.3 | 24.8 | 10.0 |

| 2011 | 66.3 | 21.9 | 30.2 | 14.0 |

| 2012* | 77.7 | 26.9 | 37.4 | 18.4 |

| 2013* | 85.4 | 31.7 | 45.1 | 23.4 |

| % change | +10 | +18 | +21 | +27 |

Matched bargain trading Beta: 1.1 *Citigroup forecasts (earnings not comparable with historic figures) £1 = DKK9.32 | ||||

Aside from the demographic and economic trends, Novo's dominance is bolstered by the fact that insulin analogues are difficult to copy and expensive to make; that is, unless generics manufacturers invest in so-called 'biosimilars', compounds that are similar to, but not exact copies of, original formulations. So far, drugs regulators have been reluctant to approve biosimilars and generics firms have shied away from the capital spending needed to make them. That leaves Novo more or less free from threats to its patented products.

Unusually for a major pharmaceuticals group, Novo's development pipeline is in good shape. It has at least four products filed for approval with regulators, plus four more in late-stage trials. The pipeline includes treatments for diabetes, obesity and haemophilia.

Its most keenly-anticipated new insulin product is Tresiba (degludec), which received a boost after the US drugs regulator recently recommended the drug be approved, with the proviso that a further large study to assess its cardiovascular safety might be needed. A shot of Tresiba lasts for 24 hours, longer than any other insulin treatment. So it could challenge Lantus, a long-acting insulin made by Sanofi, which generates annual sales of $5bn (£3bn). City analysts estimate annual sales of $1.5bn for Tresiba within a year of launch.

And a big positive of Novo's shares is that - despite the 'headline' dividend yield of just 2.5 per cent (see table) - they offer a bigger total return than shares in some other pharma majors. That's because Novo is committed to buying back 5 per cent of its shares annually. When added to the dividend, that gives shareholders a potential total return of 7.5 per cent.

However, Novo comes with an odd share structure of 'A' and 'B' shares that are denominated in Danish krone. The A shares are held by the Novo Nordisk Foundation, a curious entity that has effective control of Novo. The foundation - quite like the Wellcome Trust - exists to fund medical research and distributed £70m in grants in 2011. Outside investors have to buy the B shares, which get just a tenth of the A shares' voting powers. The good news is that these are listed on the London market, where there is a decent amount of trading. The krone provides a currency play that may or may not work out well.