A Ferrari 250 GTO originally built for British racing legend Sir Stirling Moss sold for a record $35m (£22.7m) in 2012. A decade earlier it had been bought for a mere $8.5m. A McLaren F1 has gone for over £3.5m and prices for £1m-plus cars are accelerating fast. The classic car market is in the throes of another boom, and it's not just the super-rich who can benefit.

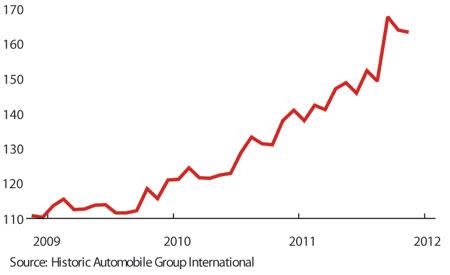

According to an index of classic cars compiled by Historic Automobile Group International (HAGI), valuations rocketed by 19 per cent in the first nine months of 2012 and by over 25 per cent over the past year. Since 1980, HAGI's index of collectible Ferrari's has grown on average more than 15 per cent every year.

Tangible assets like art, wine, stamps, coins and antiques have always been an option for investors seeking diversification. They've been especially popular whenever economies hit the buffers, particularly now with inflation wiping out returns on bank deposits and volatile stock markets proving bad both for the heart and the wallet.

There's little sign of demand for vintage motors slacking off, either. John Collins, owner of Ferrari dealership Talacrest, has sold 30 cars worth over £40m since the start of April. "They've all been cash buyers," he says. "Some cars don't even get on the website they're sold so quickly."

A Le Mans winning Aston Martin DBR1 parked on his forecourt with a £20m sticker in the window, sits alongside a Ferrari 330 P4, one of only three in the world and yours for $25m. "I've had some big offers, but I'm in no rush to sell," says Mr Collins. "What am I going to do with the money?"

But in the current climate, neither car is likely to hang around for long if activity at specialist auction houses is anything to go by. Over $260m of classic cars sold at this year's Pebble Beach Concours d'Elegance in Monterey, California, and another sale held by RM in Battersea in October took over £14m in an evening.

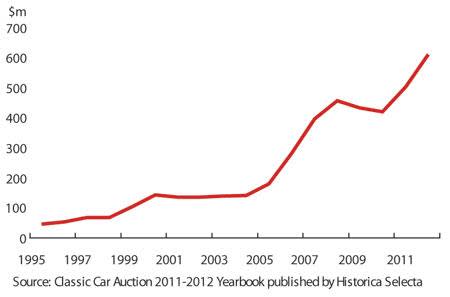

In fact, major auction houses sold cars worth $610m in the year to 31 July, according to the latest Classic Car Auction Yearbook published by Historica Selecta (see box), up 20 per cent on 2011. Eight years ago, it was just $141m. Average prices jumped by 15 per cent, too, and 94 cars sold for over $1m, twice as many as two years ago. In reality, the numbers are much higher because less than a third of sales go through auction rooms, and there's no requirement to report details of private sales, either.

There's fuel in the tank

"Buying a beautiful car above £1m is still a good idea," reckons Justin Banks at Kent dealership Godin Banks. "The top end of the market is still undervalued in the pantheon of what people with too much cash have to spend. After you've bought your Picasso, cars are small change."

And there's unlikely to be any shortage of buyers, at least as long as interest rates remain glued to record lows and wealthy baby boomers can afford to turn boyhood dreams into reality. A new breed of client in their 30s is getting into old cars, too, reckons Mr Collins.

Most big money motors end up in the established markets of Europe and America, but there's growing interest from China and India, and from the oil-rich Middle East where there's a long tradition of owning vintage vehicles. "Lots of classic cars went there from brand new," explains Dietrich Hatlapa, a former banker who set up HAGI in 2007. "They understand tangible assets."

If you do too, but don't have a few million pounds to spare, there is another route. A number of funds have been set up in the past few years specifically to invest in classic cars. You definitely won't find them listed in the Financial Times and their track record so far isn't great, but it's worth looking at what's on offer.

"You're more likely to take the fund route if you possess the enthusiasm and recognise the mild sex appeal of the sector, but don't know what you're doing and don't have the time," explains Martin Emmison, a partner at London law firm Goodman Derrick. Investors must also be comfortable with the state of the market, the structure of the investment scheme, and the people behind it.

Two funds have been around for a couple of years. IGA Automobile hit the headlines early last year. Ray Bellm, Monaco-based World Sportscar champion and former British Racing Drivers Club chairman, joined up with property fund manager and car nut Grant Tromans to raise $150m from rich enthusiasts. Nick Lancaster, who once ran luxury car dealer HR Owen, and Pink Floyd drummer Nick Mason, were also involved.

It looked promising at first. They got it right by deciding to buy only the very best cars, which historically stand a better chance of making big bucks. Unfortunately for them, the launch coincided with the Arab Spring, so the Middle East oil money never came. Neither did small investors, excluded from the Guernsey-registered fund by a minimum subscription of $500,000. Regulatory hoops meant wealthy Americans were barred, too.

Total auction sales

Institutions also needed convincing. They wanted two years of fund management by the team before they'd invest, so Mr Bellm started the much smaller IGA Classic Ltd to prove up the returns. It's up more than 8 per cent since it began trading in January.

The Classic Car Fund (TCCF) pulled up within weeks of IGA going public. Run by Italian fund manager Filippo Pignatti Morano di Custoza, it has offices in Liechtenstein and Switzerland, but is based in St. Vincent. Initially, it set a minimum subscription of just €100 (£80.97) and listed in Hamburg, but it all went quiet. Now, it's back as an unlisted private fund and asking for investments of at least €10,000.

The reorganised fund, launched in September, wants to raise €3m in its first year. It's running just behind its three-month target, but is in talks with a large German bank and targeting others there and across the border in Switzerland. A spokesperson says they'll buy at least two cars "shortly" and predicts dazzling returns of 10-15 per cent a year.

A third fund launched in October. Paul Charles is behind the Family Classic Cars Fund (FCCF), based in San Juan Capistrano, California, and with a minimum investment of $10,000 (£6,196.31) hopes to put together a $120m pot. "The response so far has been really wonderful," says Mr Charles. "Most of the interest has come from the US and some in Europe." Americans must be accredited investors - worth over $1m or earning more than $200,000 a year - but anyone living outside the US is welcome.

If any of these funds can get the model to work, others will follow. Right now, though, it's a big if.

No fan of funds

Not everyone is a fan of these funds. "We turn up our nose when we read about investment funds," blasts Adolfo Orsi, motor historian and president of Historica Selecta. "All the share certificates of a certain company are exactly the same, not the classic cars." The worry is investors have little understanding of the market and its nuances, and that vintage cars should be bought for love, not just financial gain.

He has a point, but we have bigger concerns. Cars don't produce income, so the only way to profit is through capital appreciation over a long period of time. It could be a bad investment as easily as a good one and the dead costs - subscription fees, money dished out to intermediaries, insurance, maintenance and storage - will eat into profits.

That makes it hard for a fund to produce year-on-year results. IGA, for instance, was prepared to use up to 3 per cent of the fund’s kitty just to pay commission to introducing agents, or fixers. As well as a 5 per cent subscription fee, TCCF also charges an administration fee of over £13,000 a year and custody fees on top of that.

Both TCCF and FCCF charge an annual management fee of 2 per cent and will take 20 per cent of the profits if the fund’s net asset value exceeds a high watermark, typically its previous peak. That's more in keeping with fee structures adopted by the hedge fund industry, and back-end loaded fees like that shouldn't present a problem as long as the market keeps rising.

A little more concerning is valuation. Just how do you get an accurate net asset value (NAV)? Unlike the price of a share, or more traditional fund, valuing a classic car is trickier. No two are exactly the same and there's the issue of liquidity. Cars have no guaranteed buyer and about 30 per cent of those taken to auction go unsold. On the flip side, it is difficult for experts to predict what a private sale might make, which risks undervaluing the fund.

Conflict of interest

There are other problems, too. If you were to buy a cheap car at auction, would you put it into a fund? "How can you put something in a fund when you know there's a £100,000 profit in it?" argues Mr Collins, who ran a fund in the late 80s before regulation changes forced it to close. "There's too much of a conflict of interest in my opinion."

"I have considered setting up another one because people have approached me, but I would have to give up dealing," he says. "You can only do one or the other." Equally, the temptation will always be there when running both a classic car fund and a dealership to stick unsold cars into your fund.

Mr Charles at FCCF disagrees. "There is no conflict," he tells me. Investors in his fund also get to own 50 per cent of Family Classic Cars Corporation, which sells, stores, restores and maintains collectable cars, including, eventually, fund cars. He won’t say what that business is worth, but investors will share in the profits there, too.

HAGI Top Index

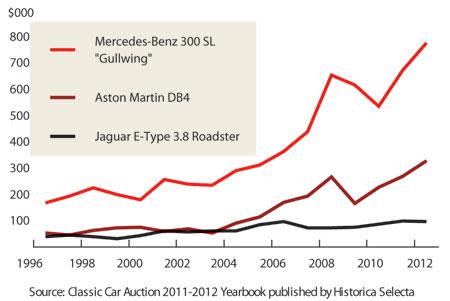

Whether European investors share his appetite for what one commentator calls "yank tanks" is another matter. Look at FCCC’s website and there are some lovely cars it could switch into the fund quite nicely. A 1958 Ferrari 250GT Berlinetta Tour de France similar to one on FCCC's front yard sold at auction last year for over £2.2m. A 1956 Mercedes-Benz 300SL Gullwing, just like the one FCCF owns, sold for nearly £550,000 at Monterey, and prices are on the up.

But there's a 1911 Delahaye Fire Truck, too, and a number of US muscle cars parked beside it. "They won't go anywhere (in terms of valuations)," reckons one sceptic. "You need very low volume, sexy European cars from the 50s and 60s that were really admired when new and really admired now." Investors will vote with their wallets.

DIY - drive it yourself

If you have the knowledge, or are prepared to do some homework, buying your own car may be a much better way to play this investment theme. It's more fun, too. "If you know your own onions you'd do it yourself," an old-hand tells me. "Why pay somebody else to do it?" You'll need a large garage, of course, and there'll be insurance, maintenance and other costs to pay, but the benefits of investing directly go way beyond the financial.

"If you're interested in cars, but know nothing about them, and think you'd like to learn and kick some tyres then have fun in owning something," says Mr Hatlapa. "And, of course, there's the benefit of having a car in the garage that dinner guests will want to sit in and listen to. It's a kind of return for someone because they derive pleasure from it." Without passion, it becomes a liability.

Should you make a profit, it'll be free of capital gains tax. "They are classified as a wasting asset, one that has a predictable life not longer than 50 years," explains Danny Cox at Hargreaves Lansdown. "Classic car funds, meanwhile, will be subject to tax on income and gains."

If that's tickled your fancy, what should you buy? It depends on who you speak to, but personal taste has as much to do with it as potential profits. "It's all about desirability, sports car pedigree and great engineering," reckons Mr Hatlapa. A decent investment-level Ferrari will set you back at least £100,000 and returns will likely be greater and come more quickly at the higher end of the market.

But the direct route doesn't have to be expensive. You can still pick up an iconic Jaguar E-Type series 1 coupe for about £50,000. Jaguar made thousands of them and it's still a liquid market. There are lots of experts and spare parts, too. The 1960s Mercedes 230SL is another head turner and costs about the same. For another £25,000 you could drive away a decent E-Type roadster.

Mr Banks believes it pays to be "a little less obvious," and you'd struggle to get much less obvious than the Facel Vega, a "rare as hell" French marque from the sixties. "It's completely leftfield," he admits. "Few have ever heard of them, or seen them, but I think they're undervalued." Mr Banks has eight in his "pension pot". After a little restoration, a Facel II that cost him £50,000 five years ago sold last year for about £200,000. He used the money to buy another three.

Cars from the seventies are a little less fashionable, but Maseratis are worth looking at. "They're a third of the price of a Ferrari and the potential for gain is much more. In my opinion, they were much better looking, too," reckons Mr Banks. "The Maserati Merak is selling for £20-30,000; it should be nearer £50,000."

Average sales price

Other great cars are even cheaper. A Bertoni-designed Alfa Romeo GT Veloce - "a fun performance type car" - can be had for as little as £12,000. Ask Mr Collins and he'll wax lyrical about old Triumphs - the TRs, GT6, MGBs and Spitfires. Mr Banks does, too.

"You can buy a nice Triumph TR4 for £10-12,000," he says. "It might not make you rich, but it won't lose a penny and will give you years of pleasure." That said, TR5s have doubled in value over the last five years, so you never know.

You might want to check in your shed or garage first. A flea-bitten 1965 Ferrari 330GT 2+2 Berlinetta sold by Bonhams in Harrogate has just gone for almost £70,000, twice its guide price. Restored, it could be worth double that. A 1966 Mini Cooper stuck in a garage for 36 years fetched nearly £18,000. Go on, have a look.