Dow at new highs

You'll recall that the '21st Century' version of the Dow Theory to which I subscribe (www.thedowtheory.com) had already reverted to an uptrend on the very first trading session of this year. According to traditionalists, however, the buy signal on this occasion only occurs once both the Dow Industrials and Transports have both made new closing highs.

Plainly, the '21st Century' signal was the timelier one here, which is the whole point. The Dow has since risen 2.2 per cent and the S&P 2.1 per cent. As traders, we want the timeliest signals possible, without sacrificing quality. Just as the great Marc Rivalland refined WD Gann's swing charts so as to make them respond faster, Jack & Bart Schannep have done with the work of Charles Dow and his successors.

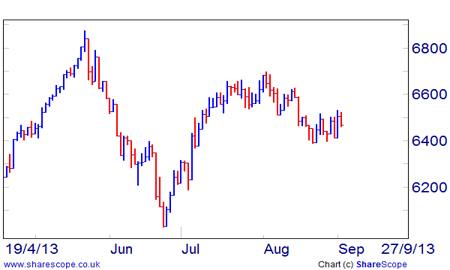

Overbought FTSE

As a result of this latest burst higher, the S&P, Dow and FTSE are all now in overbought territory on their daily charts, with relative strength index readings at or above 70 per cent. What's more, one measure of mood has now entered the danger zone too. The latest Investors Intelligence Advisors Sentiment survey shows a gap of 30.9 points between bulls and bears.

Lots of happy people

The first signs of overboughtness and exuberance are best treated as amber, rather than red, lights in my experience. In strong rallies, it is quite normal for these readings to flash danger for some time before the market actually goes into reverse. A good example of this was in spring 2010, another liquidity-driven rally. Back then, the FTSE remained overbought for most of a month, while the II survey reading got stuck above 30 per cent for even longer.

I do not doubt that we will have a correction at some point in the weeks ahead. The main question is whether it will be another significant shake-out or a mild affair. With so much liquidity sloshing around the financial system, my money would be on a mild one. However, another euro-panic or a US debt-related scare could clearly change that. The more stretched the present rally becomes, the harder the bump might become.

As a bull, I do not dread a bit of downside in the market. In fact, I would welcome it. Corrections help set up further entry opportunities. I feel much happier buying when I see the indices as in the early to middle stages of a fresh rally, rather than in its latter, overheated phase. It will also offer a good chance for some longer-term bears to repent and to switch sides.

S&P's next target

In the near term, I therefore look for further gains in the indices. This should involve a push towards 6300 for the FTSE, 1515 on the S&P and 14022 on the Dow. While there is clearly a risk that stocks begin their correction sooner than I am expecting, this does not concern me too much. I have foregone more profits by bailing out too early in the past than I have from getting caught out as the market turns.