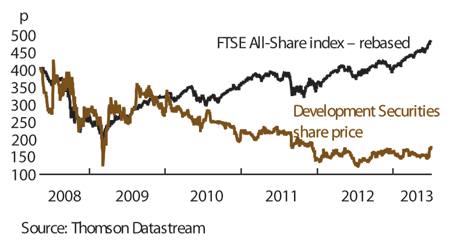

Development Securities (DSC) is a classic case of a company that the market is undervaluing for ephemeral reasons of cycle and fashion. The developer's shares trade at 170p, yet its forecast net asset value (NAV) - which very conservatively accounts for development projects at cost - is 254p. That 33 per cent discount compares with the shares of peers such as Helical Bar and St Modwen that both trade at a 14 per cent premium to forecast NAV. Over a three-year investment horizon, during which time substantial development profits should be generated, we don't think such a wide discount is sustainable.

- Big discount to net asset value

- Substantial development profits expected

- Regional property shows signs of bottoming out

- Excellent long-term track record

- Investment portfolio remains weak

- Development projects are small-scale

Admittedly, we have called this stock wrong in the past. We tipped it as a recovery play back in the relief rally of 2009 at 289p - then a discount to book value of 364p - only to watch the value of its property drop. Yet we are now reasonably confident that the portfolio really has reached bottom, for two reasons.

First, the company is finally starting to post development profits. It raised equity in 2009 and again in 2010 to invest at the bottom of the property cycle. These investments started to bear fruit in the year to 28 February, when the company generated trading gains of £28.1m. Further schemes in the pipeline are expected to produce a further £97m of development profits over the next three years, which equates to 80p a share.

Development Securities used to be known for undertaking big office schemes, which it typically pre-sold to institutional investors to minimise its risk. But chairman David Jenkins recently noted that these are "traditionally a late-cycle performer", which the company was therefore likely to avoid for the foreseeable future.

The company's development capital is instead tied up in about 40 small mixed-use projects, mainly in Greater London and the south east, particularly near Crossrail stations. Yet it continues to spread its equity by working in joint ventures. One typical site adjacent to Greenwich train station in southeast London, acquired in 2010 with regeneration specialist Cathedral Group, has been carved up and sold on as housing, student accommodation, a Travelodge hotel and business incubator units - generating £1.3m of planning profits, with more to come next year.

DEVELOPMENT SECURITIES (DSC) | ||||

|---|---|---|---|---|

| ORD PRICE: | 170p | MARKET VALUE: | £208m | |

| TOUCH: | 170-172p | 12-MONTH HIGH: | 175p | LOW: 115p |

| DIVIDEND YIELD: | 2.8% | TRADING PROPERTIES: | £153m | |

| DISCOUNT TO NAV: | 33% | |||

| INVESTMENT PROPERTIES: | £260m | NET DEBT: | 48% | |

| Year to 31 Dec | Net asset value (p) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2009 | 297 | -11.4 | -16.8 | 4.8 |

| 2010 | 272 | 2.6 | 1.7 | 4.8 |

| Period to 28/29 Feb | (p) | (£m) | (p) | (p) |

| 2012** | 254 | -10.2 | -10.3 | 5.6 |

| 2013 | 251 | 0.8 | 2.0 | 4.8 |

| 2014* | 254 | 11.5 | 8.4 | 4.8 |

| % change | 1% | 1352% | 320% | 0% |

Normal market size: 2,000 Matched bargain trading Beta: 0.7 *Peel Hunt estimates, underlying profit and EPS forecasts not comparable with prior periods **14-month period | ||||

The second reason to believe Development Securities is now back in growth mode is that the property write-downs that have dogged the company for the past half decade should be very close to an end. Like other listed developers, Development Securities holds some property assets for the cash they generate, rather than for a short-term redevelopment opportunity, to reduce reliance on highly-cyclical trading profits.

This £260m investment portfolio, focused on regional property, has been haemorrhaging value (£12.9m last year) in a very thin regional-property market. "Most of the people selling are weak holders being forced to sell by the banks. A clearing process is under way," explains chief executive Michael Marx.

To bet that this clearing process has run its full course would be too bold a call. A full 23 per cent of outstanding UK property loans are still under water, according to an influential report by De Montfort University. But the pace of declines has been slowing, with index provider IPD reporting regional property value declines of just 0.04 per cent in April. We remain of the view (Tired of London) that patient investors will make money by taking a contrarian bet on higher-quality regional portfolios.