Ever since companies traded on the Alternative Investment Market (Aim) were deemed permissible for individual savings account (Isa) investment at the start of August, retail investor interest in the junior market has reignited. More buoyant stock market conditions have obviously helped, but Aim transactions leapt in August and interest has remained strong.

Smaller company campaigners had been lobbying for years for Aim stocks to be included in Isas while those opposed to the idea argued that Aim stocks were too risky to open them up for the retail investing public to stash in their tax-free wrappers. But those who accuse of Aim being a 'casino' have been drowned out as investors have rushed to stock up on Aim companies in their Isas, coming as they do with the added bonus of being Inheritance Tax exempt if held for more than two years.

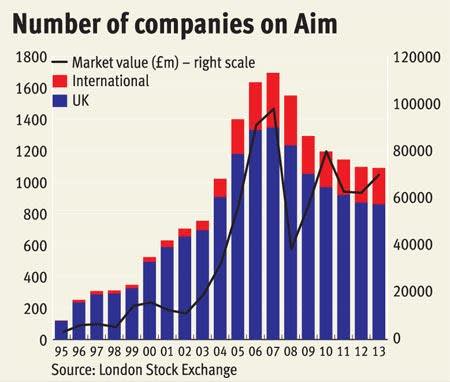

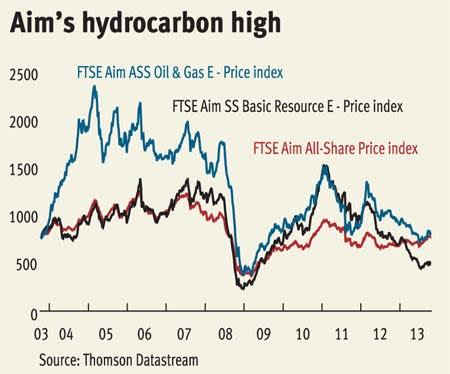

Despite its reputation as the home of early-stage and riskier stocks, Aim has matured a great deal since the pre-financial crisis era when it became a bloated 1,500-strong market stuffed with cash shells and early-stage mining and oil and gas explorers. There are still a good number of such companies, but today Aim is home to dozens, if not hundreds, of solid, growing companies, many of which are now paying decent dividends. Such is the diversity of Aim's constituents that it is now possible to build a conventional portfolio to fit any investment appetite, be it growth, income, value or blue sky speculation.

Indeed, Aim is home to some very substantial companies - the top seven Aim companies are worth north of £1bn, with the largest company, online clothing retailer Asos, nudging the scales at £4bn. This group also includes the owner of the iconic Canary Wharf estate in London's Docklands, Songbird Estates. Among the top 50, Aim also plays home to well-known names such as handbags maker Mulberry, brewer Young & Co, wine retailer Majestic Wine and restaurants chain Prezzo – all long established and substantial companies that have found a settled home on the Aim market and not felt the need to make the step up to the main market. And the success of companies such as Asos, which 10 years ago was quoted at 4.5p a share and recently topped £57, illustrates the returns that can be made from finding the right companies on Aim and simply adopting an old-fashioned buy-and-hold strategy.

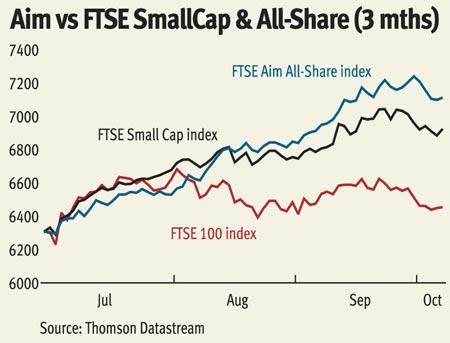

Also on the plus side, the Aim market is more closely aligned with the health of the UK economy than the global-facing blue chips of the FTSE 100, so any sustained UK recovery should benefit it the most. In fact, this is reflected in the recent performance of Aim, which, bolstered by improving UK economic data, has risen by 11.5 per cent in the three months to 4 October compared with a 0.6 per cent rise in the FTSE 100 and 3.7 per cent in the FTSE 250.

It's worth remembering that Aim remains home to some weird and wonderful companies - investors can still get exposure to investments as varied as Vietnamese infrastructure, Colombian oil and gas, African iron ore, Indian companies and Chinese medicines, and that is still within the top 50 Aim companies by market capitalisation. Below that level there are hundreds of companies with huge potential, ranging from online gaming companies such as 32Red to animal feeds specialists like Anpario, mobile technology businesses like Monitise and even the first quoted English vineyard in the form of Gusborne.

Aim's maturing profile, and welcome diversity, means it is now possible to apply classic portfolio construction techniques to build a tax-exempt Isa portfolio to suit any need. We have picked a selection of our favourite Aim stocks which allows investors to take a 'pick 'n' mix' approach, blending together companies that offer good growth prospects with more stable dividend payers alongside value situations and even a smattering of potentially fast-growing blue-sky opportunities in one tax-free portfolio. For more on how to construct the ideal portfolio, see our award-winning feature, The Ideal Portfolio, published 11 May 2012, its follow up, The Ideal Share Portfolio, 22 March 2013 and also Dominic Picarda's Market Tactics landing page for a series of features on asset allocation.

While we would not recommend putting all your investments into the Aim market - we always preach diversification as part of a balanced investment approach - the merits of the Aim market at the moment stack up as well as they have for many years. And with greater numbers of investors taking an interest in Aim stocks, driven by their Isa eligibility, it is likely that liquidity in the better-quality Aim stocks will also improve, demolishing another of the long-held arguments against investing in Aim.

Pick 'n' Mix - THE BEST OF AIM FOR YOUR ISA

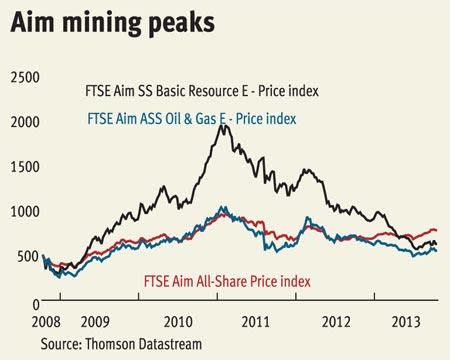

Our selection is by no means exhaustive, but it does draw upon the experience of our sector writers, each of whom has proposed their favourite Aim stocks. It is worth highlighting that despite the dominance of the natural resources and oil & gas sectors on Aim – they account for almost a quarter of all the companies on the market - very few resources stocks made our list. Our natural resources correspondent Matthew Allan says: "We believe most of the mining sector is stuck in a trading range which could last for another one or two years. Most commodity markets are now in or nearing oversupply, according to data from Citigroup, meaning it will take a while for recent capital expenditure cuts and project deferrals to impact prices significantly given tepid global economic growth. Early-stage explorers can still add value during this period via the drill bit, but with risk capital increasingly hard to come by, it will be near impossible to monetise all but the very best discoveries."

We accept that there are a good number of quality companies in the oil & gas and minerals sectors, some of which provide decent growth, earnings and even yield prospects and are worth tucking away for the long term - but only a handful make our recommended list, which we've split by their investment characteristics to help you indentify the Aim shares that will give you the exposure you require.

VALUE

Hayward Tyler (HAYT) sells boiler circulating pumps (BCP) to power plants and ultra-durable electric motors to oil companies. Known as Specialist Energy Group until February, it has undergone a major restructuring involving heavy cost-cutting, overhauling the supply chain and improving efficiency. A wealthy backer, Indian engineer McNally Bharat, took a £5m stake in April last year at 50p a share, more than twice the market price at the time. That's gone a long way toward repairing Hayward's balance sheet, helping the company agree new bank facilities and negotiate better terms with suppliers.

Even after rallying 79 per cent to 50p since our buy tip (28p, July 2013), Hayward shares trade on just 9.8 times broker finnCap's earnings forecasts for the year to March 2014. That's a substantial discount to both the FTSE All-Share oil equipment and industrial engineering sectors. But it shouldn't be. About 1,200 extra power plants are proposed, mostly in India and China, each of which will need up to four of Hayward's £250,000 pumps. They keep nuclear reactors cool, too. Meanwhile, oil companies use its huge subsea motors, worth up to £1.5m each, to drive pumps at depths of up to 3,000m. Wells typically use three of them and industry heavyweight Schlumberger estimates over 11,000 subsea wells will be in operation by 2020. What's more, the so-called topside pump market (above sea level on offshore rigs) is growing at 12 per cent a year. Hayward recently won £3.5m of work in the North Sea and expects more there, and in Korea and Africa, too.

Breedon Aggregates (BREE) is heavily geared to benefit from an economic recovery, or more specifically, it will benefit from the inevitable acceleration in infrastructure spending that will accompany an economic recovery. And the company has all the tools to take advantage of the upturn, owning 37 quarries, 22 asphalt plants and 48 concrete batching plants. This all adds up to aggregate reserves of nearly 400m tonnes, enough to keep it going for 76 years at current extraction rates. Breedon was created with a view to consolidating the fragmented aggregates sector, and is now the largest independent operator in the UK. And through the careful purchase of relatively cheap assets, the company is expanding its geographical spread to have quarries and operating facilities across England and Scotland. Crucially, an economic recovery will bring an increase in demand for a business with a largely fixed cost base. There is no dividend on offer yet because management remains focused on picking up relatively cheap assets. So investors will have to be in for the long haul.

Baker Finsbury Food (FIF) has steadied its operations following the disposal of its 'Free From' business and a share placing which allowed it to slash its debts (by 73 per cent in the last financial year) and reintroduce a dividend. Now, armed with a better balance sheet, the bread and cake producer is making further much-needed changes. The cake operation, which historically lacked investment because of the company's debt burden, is being given a £6m boost to improve efficiency. Investment here is significant because cake generates 73 per cent of group turnover, but margins are low. If they start to improve, it could translate into strong earnings growth. As well as supplying branded cakes and treats to supermarkets, Finsbury has an extensive selection of licensed brands, including Thorntons, Disney, Marvel and WeightWatchers, which are popular with consumers. Meanwhile, the booming bread business grew underlying pre-tax profit by 19 per cent in the last financial year. The facility that makes Vogels, Cranks and Village Bakery is being expanded as demand for specialty, high-quality bread rises, and will grow production by 60 per cent. Chief executive John Duffy says there will "almost certainly" be a small bolt-on acquisition this year, which will be earnings enhancing in the long term. The shares are trading on a forward PE ratio of just 11, which still offers great value given the potential.

With the European new car market in turmoil, manufacturers are offering UK consumers tempting financing deals to get the cars off the forecourts. As a result, sales of new cars in the UK are soaring and the car dealership industry is booming. Rising new car sales are also increasing the used car stock and leading to more lucrative aftersales - all of which is good news for Vertu Motors (VTU). Sales of new cars at Vertu grew 18.6 per cent in the first four months of the current financial year, outperforming the wider UK market. Higher-margin used-car sales are rising too, despite a declining market, and aftersales are picking up. We believe there's more upside to come from Vertu, as new car sales continue to rise, with brokers estimating 8.3 per cent EPS growth this year. Vertu's solid finances mean it has been able to consolidate a fragmented market through earnings-enhancing acquisitions - and it will continue to do so. Admittedly, the shares are a little pricier than they were just a few months ago, trading on a forward PE ratio of 15, but bear in mind the share price is only at a slight premium to the company's net asset value and the sales multiple is less than one, which is attractive.

Consultant engineer WYG (WYG) is a turnaround story that is now decisively moving into delivery stage. Years of painful restructuring to clean up the balance sheet and attract higher-quality, higher-margin work is paying off. Strong competitive positions in markets that have bright prospects such as infrastructure, energy consulting, nuclear and defence are also providing a lift. The most recent full-year results showed an underlying profit for the first time in several years, and momentum is clearly building with the company raising its forward earnings guidance several times in recent months. In its recent trading update, WYG said first-half revenues are modestly up on last year, reversing the negative trend of recent years, thanks to a pick up in work for UK defence, urban development, the construction and housebuilding sectors and several new overseas contracts. Earnings are coming off a low base so the PE ratio looks high in the near term (17 times next year's earnings), but with plenty of scope to increase margins, earnings should pick up rapidly from here. What's more, using an enterprise value-to-sales ratio approach - a better valuation measure for recovery plays - there is clear value with the shares trading at under 0.5 times compared with 1 to 1.5 times historically.

Ashcourt Rowan (ARP) has taken a while to turn itself round, as the wealth manager reshapes itself to address the more mass affluent wealth sector and not just multi-millionaires. Non-core parts of the business have been sold off, fines paid for mis-management by the previous directors, while all the activities have been pulled together on one single outsourced operating platform. Cash profits before exceptional costs have risen sharply, too, with underlying margins jumping from 2 per cent last year to over 10 per cent. Much of this has been responsible for a 24 per cent rise in the share price over the last four months, although it still trades at a discount to the wider wealth management sector. True, there is no dividend yet, but the group has still to reap the full awards of the restructuring and recent acquisitions, including £200m of assets under management that came with the purchase of assets from Generali Portfolio Management.

Other companies worth considering

■ Crystal Amber (CRS) - Investment company with an interesting portfolio which is not reflected in its share price.

■ Gulf Keystone (GKP) - Kurdistan oil producer with huge potential, which could attract buyers.

Value picks

| Name | TIDM | Price (p) | Market value (£m) | Forecast PE (x) | Historic div yield (%) | 1-year change (%) | 5-year change (%) |

|---|---|---|---|---|---|---|---|

| Hayward Tyler | HAYT | 47.88 | 21.79 | 9.4 | 0 | 199.22 | -84.8 |

| Breedon Aggregates | BREE | 31.38 | 315.86 | 33.5 | 0 | 32.11 | 69.59 |

| Finsbury Food | FIF | 68.5 | 44.59 | 11.8 | 1.09 | 55.68 | 65.06 |

| Vertu Motors | VTU | 54.75 | 184.39 | 15.2 | 1.28 | 58.7 | 160.71 |

| WYG | WYG | 108 | 69.88 | 24.7 | 0 | 111.76 | -99.88 |

| Ashcourt Rowan | ARP | 193 | 52.17 | 21 | 0 | 22.15 | -87.69 |

| Crystal Amber Fund | CRS | 141 | 102.67 | 0.39 | 52.85 | 38.92 | |

| Gulf Keystone Petroleum (Di) | GKP | 182.75 | 1,624.07 | 0 | -10.42 | 1,024.62 | |

| Source: Thomson Datastream | |||||||

GROWTH

Dart Group (DTG) launched its low-cost airline Jet2.com over a decade ago and has been flying travellers in the north of England and Scotland abroad ever since. Five years later it decided to start selling package holidays, too, and Dart is now the UK’s third-largest tour operator. Most holidaymakers who book with Jet2holidays fly Jet2.com, and the rapid growth in popularity of mostly all-inclusive breaks has meant profits at the airline have taken off. Last year, Dart sold over 417,000 holidays, almost twice as many as the previous year, and it reckons it will be double that in the 12 months to March.

Greater demand for seats means higher load factors and increased yields. Boss Philip Meeson recently said the summer had gone well despite the UK heatwave, and both load factors and yields had risen again. Despite a clear seasonal bias - there's little chance of driving revenue over the winter months - Mr Meeson says the company is still cruising toward profit targets for the full year. But despite the potential scalability of Jet2holidays, Dart shares, at 249p, trade on a lowly 10.8 times forward earnings. That's a discount to TUI Travel on a multiple of nearly 12, which we believe will narrow in the coming months. Economic recovery only increases the likelihood of further profit upgrades.

Interior furnishings business Walker Greenbank (WGB) has a nice looking balance sheet, a rising dividend yield and solid overseas growth, which helped to offset a challenging UK market at the half-year stage in July. Its second-biggest market is the US and it's experiencing double-digit growth in the Far East, the Middle East and Australasia. Together, its export markets grew sales by 6.5 per cent in the first six months of the year, generating 40 per cent of total brand sales. Licensing revenue offers an additional, highly-profitable income stream and sales here jumped 26 per cent in the half year to £1m. The group has also invested heavily in its wallpaper and printed fabric manufacturing facilities, which means it can supply all of its own brands as well as those of its main rivals, which has resulted in sales and profitability being at record levels. And trading seems to be going well in the all-important autumn season, too. So far in the second half of the year, brand sales are up 3.8 per cent on last year and UK sales are ahead by 2.6 per cent – an encouraging picture. The shares have more than doubled in the past year and are trading on a forward PE ratio of 15, which seems about right to us. However, with manufacturing continuing to perform strongly, licensing income building, and brand sales strong around the world, this well-diversified business could be a solid stock for your Isa.

Blue-collar recruiter Staffline (STAF) is nothing if not ambitious. The company is aiming to treble its 2012 profits organically by 2017 and, given that this company has trebled in size twice before since its 2004 Aim listing, this is a target to be taken seriously. There are clear drivers to help it get there, such as a growing presence in the government’s Welfare to Work programme, where Staffline's scheme has been voted the UK's top provider, which leaves the company well-placed to pick up more of these contracts from underperforming peers when the contracts are reviewed. Other growth drivers include a growing presence in HGV driver training and a move into white-collar recruitment with the recent acquisition of Select Appointments. Consensus earnings forecasts currently expect earnings per share of 40.6p this year (up from 36.6p last year), rising to 45.4p next year, which puts the shares on a PE ratio of just under 13 times - and if Staffline makes its 2017 profit target, the implied PE ratio drops to mid single digit. That looks cheap for the growth on offer, especially when you throw in the almost debt-free balance sheet and the small, but nice to have, 2 per cent dividend yield.

Collectibles specialist Stanley Gibbons (SGI) has benefited strongly from the growth in demand for alternative assets in recent years as its strong brand name in stamps, built over its 186-year history, has allowed it to create successful stamp investment funds to supplement its growing retail operations. And the growth of the internet has also proved to be a particular boon to the collectibles trade, with Stanley Gibbons able to serve its UK customers better and also reach out to potentially huge new markets in the Far East. This has led to good growth, turnover rose 17 per cent in the six months to the of June, but the icing on the cake of this growth story could be the recently announced acquisition of rival Noble Investments (NBL), which adds excellence in the rare coins field as well as stamps and other collectibles. Combining the two companies may cause some short-term indigestion but the longer-term potential for growth of the combined business is excellent.

Matchtech (MTEC) occupies a sweet spot in the recruitment market, having carved out a niche position supplying engineers for the UK aerospace and automotive industries. These industries are hiring and skilled engineers can be hard to find; Matchtech, with its established track record and specialised sector knowledge, is well-placed to help. First-half results showed how this sweet spot is paying off, with underlying operating profit jumping 41 per cent year on year to £4.8m. And in a sign of confidence, Matchtech increased its half-year dividend for the first time in five years. A recent trading update suggests that momentum has continued to build, with preliminary results delivered this week slightly ahead of previous expectations. The current consensus forecast is for earnings to rise to 32.8p in 2014. The shares have had a stellar run - up 120 per cent in a year - but the yield is still a good bet for income seekers at 3.5 per cent. And while the forward PE ratio of just under 14 times is not hugely cheap, it is still well below many larger peers that trade on closer to 20 times.

Growth picks

| Name | TIDM | Price (p) | Market value (£m) | Forecast PE (x) | Historic div yield (%) | 1-year change (%) | 5-year change (%) |

|---|---|---|---|---|---|---|---|

| Dart | DTG | 253.25 | 368.01 | 11.2 | 0.74 | 231.05 | 730.33 |

| Walker Greenbank | WGB | 146.5 | 86.44 | 15.4 | 1.04 | 113.87 | 606.02 |

| Staffline | STAF | 625 | 158.24 | 15.4 | 1.41 | 175.94 | 1,215.79 |

| Stanley Gibbons | SGI | 310 | 89.1 | 17.7 | 2.18 | 42.86 | 128.78 |

| Noble Investments (UK) | NBL | 251.5 | 41.53 | 14.4 | 2.19 | 30.65 | 95.72 |

| Matchtech | MTEC | 497.5 | 122.14 | 16.2 | 3.17 | 115.37 | 142.09 |

| Source: Thomson Datastream | |||||||

INCOME

The low point for Fairpoint (FRP) was in 2008, when, only recently renamed from Debt Free Direct, the UK's leading provider of debt repayment plans known as individual voluntary arrangements (IVAs) warned that profits would be around £4.3m against analyst’s expectations of nearer £13.5m. The cause of the collapse reflected a shrinking and less profitable IVA market just at a time in the economic cycle that the very opposite should have been happening, due to banks' unwillingness to call in non-performing loans. The company learned from this by focusing on generating a more diverse revenue stream, and over the last five years it has developed a useful income from arranging debt management plans and pursuing mis-selling claims on behalf of its IVA clients. So much so that nearly half of group revenue is now non-IVA sourced, although it is fair to point out that IVAs are still a decent source of revenue. In fact, the improvement in cash generation has paid for an increase in the dividend payout at the half-year stage, and forecasts for the full-year suggest a yield of around 4.8 per cent. The dividend is well covered, too, and, despite the shares moving up 50 per cent from the start of the year, they still trade on a miserly forward PE ratio of nine, a significant discount to the sector average of around 18.

Construction and fit-out specialist Interior Services Group (ISG) has been a strong performer of late as results have confirmed the solid job management has done in refocusing the group after it threatened to be caught out by the slowdown in infrastructure and construction following the financial crisis. And with the economic winds changing in the UK especially, ISG's exposure to both construction and the retail, office and banking sectors it primarily serves through its fit-out business is now viewed as a strength rather than a potential weakness. Meanwhile, the pain the company felt from its exposure to the UK in 2008-10 has prompted moves to expand overseas through acquisitions in Germany and Brazil most recently, and overseas engineering services contributed £88m of revenues in the year to June. The rising share price has moved the forward PE ratio above 11 times, but this is not exorbitant and a potential yield in the region of 4 per cent marks ISG out as a quality Aim income stock.

Specialist insurance investment, reinsurance and services business Randall & Quilter (RQIH) appears to have significant latent growth built into its business to accompany a tempting yield of around 6 per cent. As well as the potential for better returns on its investment portfolio if equity markets have a decent end to the year, a restructuring of its US insurance services business should yield further results in the coming months and the company is investing in doubling the capacity of Syndicate 1991 in 2014, which promises to deliver growth there, too. Numis Securities forecasts EPS of 14.2p for the full year, which means the shares trade on an undemanding 10 times earnings and the track record of maintaining the dividend bodes well for that tasty 6 per cent payout.

With 24 shopping centres in towns such as Huddersfield, Norwich and Carmarthen, NewRiver Retail (NRR) offers broad exposure to Britain's recovering regional economy. It was floated in 2009 by David Lockhart, who had sold his previous Aim-traded vehicle, Halladale, close to the 2007 market peak.

The strategy is to buy cheap, ideally from distressed sellers, and then to 'reposition' centres for growth. This may involve bringing in new tenants - the company has a good track record of signing up supermarkets, restaurants and discount stores - or possibly a light refurbishment. Last December, the US bond-fund giant Pimco formed a joint venture with NewRiver to buy five malls from Zurich Assurance - a remarkably vote of confidence in the company's value-oriented approach.

Mr Lockhart is very income-focused, and has tried to balance rapid growth with big dividends. Based on last year's dividend of 16p, at 240p, the shares are now yielding 6.6 per cent. Equity issuance has eroded dividend cover of late, but any shortfall remains manageable and should be plugged by acquisitions. Buy.

First Property Group (FPO) is a property fund manager focused on Poland and the UK. Its management track record is excellent - it correctly identified toppy UK pricing in 2005-07 and sold its assets, and its Polish funds top the local performance league tables. But a difficult environment for fundraising has weighed on its shares, which, at 22p, trade on 10 times last year's earnings and yield 4.9 per cent. However, roughly two-thirds of First Property’s assets under management are in a fund for the USS (the pension fund for universities) that expires in two years. If it is not able to renew or replace this mandate, profits would collapse.

Yet, given its track record, we think it is safe to assume the company will find alternative funds to manage. Ever entrepreneurial, the company has started to invest in the UK housing market, buying bombed-out offices and converting them into homes in joint ventures with high-net-worth individuals. Institutional investors are notoriously conservative, but the recovering regional property markets have garnered enough attention that First Property’s fundraising efforts are now likely to bear more fruit.

Worth considering

■ Juridica Investments (JIL) - profiting from investment in US litigation cases, and generating significant cash returns in the process.

Income picks

| Name | TIDM | Price (p) | Market value (£m) | Forecast PE (x) | Historic div yield (%) | 1-year change (%) | 5-year change (%) |

|---|---|---|---|---|---|---|---|

| Fairpoint | FRP | 125 | 53.02 | 8.6 | 4.56 | 44.51 | 257.14 |

| ISG | ISG | 272.5 | 106.08 | 11.9 | 3.3 | 86.01 | 71.38 |

| Randall & Quilter | RQIH | 148.5 | 105.68 | 11.4 | 5.7 | 50.52 | 36.94 |

| Newriver Retail (Reg S) | NRR | 241 | 160.8 | 17 | 5.31 | 30.45 | na |

| First Property | FPO | 22.5 | 25 | 10.7 | 4.8 | 34.33 | 40.63 |

| Juridica Investments | JIL | 148.5 | 155.48 | 8.3 | 0 | 44.88 | 36.87 |

| Source: Thomson Datastream | |||||||

BLUE CHIP

These companies may be relatively highly rated but their recent track records, coupled with a continued potential for growth, mark them out as among Aim’s best stocks.

With a market capitalisation of £4.2bn, big enough to sit in the FTSE 100, Asos (ASC) is one of few truly blue-chip companies listed on Aim. But the shares come with an equally big price tag, trading on a forward PE ratio of 78. But they’re popular with investors because quarter after quarter, Asos reports staggeringly high double-digit sales and profit growth on a level that other retailers can only dream of. For example, the shares rose 13 per cent last month as Asos reported a 47 per cent rise in fourth-quarter retail sales to £208m, leaving full-year sales ahead by 50 per cent. Sales were up 49 per cent in the UK, 59 per cent in the US, 73 per cent in Europe and were 26 per cent higher in the rest of the world. The final quarter saw a 460 basis point improvement in the retail gross margin. Sales are forecast to continue to grow strongly - City analysts have upgraded earnings forecasts for this year and next - and Asos's international expansion looks to be going to plan. So, the question is whether you could justify buying shares at that price for your Isa. We have long been nervous of Asos's sky-high valuation but the shares continue to defy gravity and for those who believe the structural growth of the internet still has plenty of life in it, the shares are worth considering.

Majestic Wine (MJW) is a good company, with net cash in the bank and a competent senior management team. The shares have been slow, but steady burners, rising 18 per cent year-to-date. Sixteen new stores were opened last year and customer numbers grew by 56,000, which isn't bad for a company with a market capitalisation of £350m. Majestic's biggest competitors are the supermarkets - pretty daunting rivals - but the vintner has several things going for it that they don't: it has always operated a store-based delivery model so adapting to online shopping isn't an issue, customer service is great, staff know what they're talking about, the product selection is wide and stores offer fun events, such as wine tastings, to attract shoppers. In the last financial year, like-for-like sales in the UK grew 1 per cent, which was positive given the tough consumer backdrop, and customers traded up, too, with fine wine sales 9.4 per cent higher than last year, giving Majestic an advantage over supermarket plonk. Cutting the minimum online order to six bottles has driven online sales and investment in the commercial business is paying off. Majestic Calais is another profitable operation, offering a further income stream. The valuation is high for a general retailer, with the shares trading on 18 times earnings forecasts for this year, but with brand awareness rising as the store roll-out continues and a service and product offering that puts supermarkets to shame, Majestic's slow but steady progress could offer investors some fine returns over the long term.

Pop open the bubbly: Majestic Wine increased customer numbers by 56,000 in 2012.

Did you know that Aim is home to a well-capitalised and growing bank whose business model is not reliant on access to the wholesale credit markets and whose retail deposit base grew by 30 per cent in the first half of the year? It is no great surprise if you haven't as Secure Trust Bank (STB) has flown under the radar quite successfully so far, but it is now becoming difficult to ignore. The bank, which spun out of Arbuthnot Banking Group (ARBB) in 2011, is growing fast - underlying profits rose by 37 per cent in the first half - as it grabs market share from the struggling mainstream banking sector. Its loan book grew by 41 per cent and customer numbers by 64 per cent in the first half of this year and, although it can fund its activities from its growing deposit base, the bank has taken advantage of cheap borrowing rates to ramp up its ability to lend to small- and medium-sized enterprises of late. The shares are still tightly held - Arbuthnot holds 70 per cent of the company - and relatively pricey at around 20 times forecast earnings. But Secure Trust is establishing itself as a quality challenger to the big boys and looks eminently capable of maintaining its growth rates for the medium term at least.

No additives needed: Nichols the maker of Vimto, has seen its share price increase by 168 per cent over the past three years.

Nichols (NICL), the beverage company behind Vimto, Sunkist, and Panda, has been a steady growth story over the past three years - its shares are up 168 per cent in the period. And while the shares are not cheap, trading on 25 times forward earnings - a significant premium to peers - the company is well-run and still well-placed to grow. In the UK, where trading conditions have been tough, a focus on profit, rather than sales, is paying off. The company also has a cash-rich balance sheet, which means it has plenty of scope to expand its operations abroad. The Middle East and Africa are core established regions for Vimto, and in Africa a distribution partnership with the Coca-Cola Bottling Company has already boosted sales. New products are in the pipeline for 2014, when Nichols is also due to enter two new markets. So, even if earnings growth won't be as fast-paced as before, it's likely to remain steady, as margins improve and the company expands overseas. Panmure Gordon upgraded the stock to a buy in July, nudging EPS forecasts up by 5 per cent, citing geographic expansion as a further catalyst, sector-leading returns on invested capital and forecasting 9 per cent EPS compound annual growth between 2012 and 2015.

Blue chip picks

| Name | TIDM | Price (p) | Market value (£m) | Forecast PE (x) | Historic div yield (%) | 1-year change (%) | 5-year change (%) |

|---|---|---|---|---|---|---|---|

| ASOS | ASC | 5,060 | 4,178.60 | 102.6 | 0 | 124.39 | 1613.8 |

| Majestic Wine | MJW | 537.5 | 351.25 | 18.7 | 2.94 | 19.98 | 225.76 |

| Secure Trust Bank | STB | 2,225 | 348.17 | 19.5 | 2.61 | 71.48 | na |

| Nichols | NICL | 1,150 | 425.14 | 24.9 | 1.57 | 45.57 | 420.36 |

| Source: Thomson Datastream | |||||||

BLUE SKY

Malaysian speciality chemicals group Platinum Nanochem reversed into Biofutures International in March and renamed the company Graphene Nanochem (GRPH). Its biofuels are already selling well, and have just been approved for sale in the huge US market. Margins there are higher, and the American transportation fuels market is expected to be the world’s biggest by 2017, worth $102bn (£64bn). That's great, but the real blue-sky potential lies elsewhere.

Using waste from the local palm oil industry as feedstocks gives Nanochem a huge cost advantage, which means the biofuels business can generate even more cash to bankroll the commercialisation of its graphene production technology. Discovered in 2004, the wonder material - a single sheet of carbon atoms arranged in honeycomb lattice - is 200 times stronger than steel and a far better conductor of electricity and heat than copper. Whichever company can produce industrial-scale quantities of the stuff at low cost will reap huge rewards. And it could be Nanochem. It holds intellectual property for a process known as Catalyx - a method that extracts graphene from biogases such as methane, cheaply. Oil services giant Scomi is about to start using its high-performance graphene-enriched drilling fluid in what is thought to be the first bulk deployment of graphene by any company anywhere.

Nanochem's shares have fallen recently, largely due to a shutdown at its chemicals plant in Malaysia while capacity is expanded. It will be up and running again by February, but outsourcing production will affect margins. Clearly, there is significant execution risk here, but the shares, at 60p, trade on just 5.8 times Panmure Gordon's EPS forecasts for 2014 - a huge discount to peers. Yet with earnings tipped to soar by 60 per cent the following year and double in 2016 to nearly 33p, the broker reckons the shares are worth 131p. As the company meets key milestones, it could be more.

Few companies on Aim can boast of their blue-sky credentials like Nanoco (NANO). The Manchester-based company is a leading manufacturer of quantum dots, which are tiny light-emitting particles that are tipped to be a major component of next-generation television and computer screens, as well as other commercial applications such as lighting and solar cells. Advocates of the fledgling technology say quantum dots are more efficient than other semiconductor technologies while maintaining high performance and, crucially Nanoco's ethical credentials are enhanced by the fact that its quantum dots are heavy-metal-free.

And while it's certainly still early days, there are signs the technology is catching the eye of major electronics makers. Collaboration deals with a number of Asian electronics giants have hinted at its potential and a licensing deal with US chemicals giant Dow Chemical earlier this year provided investors with further major third-party validation of the technology; Dow has agreed to pay for a large-scale production facility in Asia with production expected to start in the first half of 2014.

Given that Nanoco is currently loss-making and that commercial sales of quantum dots have yet to kick off, shares in the company come with a health warning. The already hefty valuation may also dissuade investors. But with lucrative royalties on the horizon from its agreement with Dow for use in the electronic displays market, and Nanoco continuing "to make progress in its other core target markets of general lighting and solar energy", potential catalysts exist and the shares may just be worth the extra risk.

One company to decisively buck the sell-off in emerging markets shares is Chinese biotech and healthcare company Hutchison China Medical (HCM). Shares in the Chinese drug developer, which is part of the giant Hong Kong-based conglomerate Hutchison Whampoa, have gained 25 per cent over the past 12 months after an important deal with Swiss company Nestlé to co-develop plant-derived medicine HPML-004 for gastric treatment. The drug is currently undergoing extensive Phase III clinical trials that will report sometime in mid-2014. The biotech research division also has at least five oncology products in its pipeline that are currently at the Phase I stage of development. In addition, there is also an extensive Chinese medicine business which analysts value at around $400m (£247m). The company also earned a $6m (£3m) milestone from Janssen Pharmaceuticals as part of an agreement to develop novel inflammation/immunology medicines. But the major newsflow in 2014 will be in connection with the Nestlé joint venture and analysts will wait for this before revising their forecasts. Panmure Gordon is currently forecasting a loss per share for 2013 of 5.43¢.

Condor Gold's (CNR) La India gold-silver project in the relatively pro-mining nation of Nicaragua as one of the most promising undeveloped deposits controlled by an exploration company on Aim. So far, Condor has discovered 2.38m ounces of gold and 2.28m ounces of silver at the project, which Condor believes would support a 150,000 ounce per year open pit and underground mining operation. Importantly, estimated cash operating costs of $575 an ounce are in the lower quartile.

The price of gold is the biggest factor in the investment equation, however. The yellow metal has fitfully tumbled from a high of $1,900 an ounce in late 2011 to $1,310 today. If gold can mount a serious recovery in the near future, the fortunes of Condor and its shareholders would undoubtedly be transformed. If not, investors will be nervously eyeing Condor's diminishing cash pile, which stood at £5.1m as of 30 June.

Another speculative Aim stock, albeit one with an impressive management pedigree is Fastnet Oil & Gas (FAST); an early-stage oil & gas explorer with interests in five offshore licences in Ireland, in addition to an 18.75 per cent net carry in the highly promising Foum Assaka licence area, offshore Morocco.

Investors have been partially drawn to Fastnet because of the number of figures within its executive and advisory boards who previously developed Cove Energy, an East Africa driller that scored big in the Rovuma Basin before it was snapped up by Thai state oil company PTT Exploration & Production last August for $1.9bn (£1.25bn).

Shareholders who have shown faith in the ability of the ex-Cove management to replicate that kind of result won't have long to wait. That's because Fastnet has set out with the explicit intention of realising value from the business within three years. That means proving-up assets and selling to someone with deep pockets. There are obviously no guarantees in oil & gas exploration, but Fastnet's Carol Law, a near 30-year industry veteran, is no less confident of achieving success in the offshore licences in Ireland than she was when she commenced work on the Rovuma Basin. In the near term, a potential farm-out agreement at Foum Assaka, where Fastnet is junior partner to Atlantic Margin specialist Kosmos Energy, would bolster Fastnet's working capital - a desirable outcome given that it has no intention of diluting its share capital.

Other companies worth considering

■ Botswana Diamonds (BOD) - prospective diamond miner with promising licences.

■ Iofina (IOF) - company establishing its iodine extraction technology and whose earnings are forecast to rocket over the next two years.

Blue sky picks

| Name | TIDM | Price (p) | Market value (£m) | Forecast PE (x) | Historic div yield (%) | 1-year change (%) | 5-year change (%) |

|---|---|---|---|---|---|---|---|

| Graphene Nanochem | GRPH | 60.75 | 70.8 | 0 | 10.45 | 62 | |

| Nanoco | NANO | 160.5 | 337.29 | 0 | 144.11 | 511.43 | |

| Hutchison China Meditech | HCM | 620 | 322.72 | 496.4 | 0 | 47.62 | 620.93 |

| Condor Gold | CNR | 130 | 49.24 | 0 | -21.21 | 1,081.82 | |

| Fastnet Oil & Gas | FAST | 17.38 | 47.6 | 0 | -22.78 | -47.74 | |

| Botswana Diamonds | BOD | 3 | 4.15 | 0 | -4 | X | |

| Iofina | IOF | 175.5 | 223.38 | 40.5 | 0 | 148.5 | 401.43 |

| Source: Thomson Datastream | |||||||