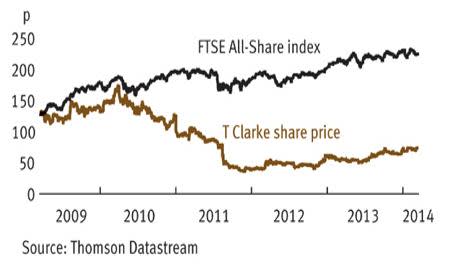

Seven years ago, fit-out specialist T Clarke (CTO) was riding the crest of a London office boom meant to last for years. Of course, it didn't. But now, with signs of life returning to the construction market, Clarke offers the prospect of significant cyclical upside. Indeed, recent results were better-than-expected, high-profile contracts are being won and a fat dividend further underpins the investment case.

- Better than expected results

- Steady flow of big contracts

- Cash rich

- Big dividend

- Customer dispute

- Thin margins

Despite fierce competition putting pressure on Clarke's margins, revenue still grew 12 per cent in 2013 to £217m and underlying pre-tax profit by 8 per cent to £2.6m. Analysts at N+1 Singer were looking for £210m and £2.4m, respectively. That's clear evidence that Clarke's repositioning as a nationwide building services contractor, and discipline in avoiding some of the suicidal bidding that's sent rivals under, is paying off.

Margin tells the real story. Sales in Clarke's southern heartland jumped by a third to £172m, and although margin grew just 20 basis-points to a still paper-thin 0.6 per cent, underlying operating profit doubled to £1m. Returns leapt 130 basis-points in the north of England to 5.7 per cent and more than doubled in Scotland to 1.5 per cent. Clarke always said revenue would come back first, followed by margins about six to 12 months later. And with group underlying operating margins at 1.5 per cent there's plenty left to play for based on the 2008 peak margin of 6.4 per cent.

Clarke's mechanical & electrical (M&E) contracting division made more than half of all sales – almost £120m in 2013. And if what chief executive Mark Lawrence is hearing from early-cycle beneficiaries such as architects is any indicator, London commercial property is set for a "mini boom".

A forward order book of £250m at year-end is already up by £20m, or 9 per cent on last year. Two-thirds of that is M&E. "The work we have done in recent years to shape our organisation and market offer began to deliver in 2013, and so in 2014 I expect that process to gather pace," says departing chairman Russell Race.

T CLARKE (CTO) | ||||

|---|---|---|---|---|

| ORD PRICE: | 74p | MARKET VALUE: | £31m | |

| TOUCH: | 72-74p | 12-MONTH HIGH: | 75p | LOW: 48p |

| FORWARD DIVIDEND YIELD: | 4.6% | FORWARD PE RATIO: | 13 | |

| NET ASSET VALUE: | 60p* | NET CASH: | £0.9m | |

| *Includes intangible assets of £23.4m, or 57p a share | ||||

| Year to 31 Dec | Turnover (£m) | Pre-tax profit (£m)** | Earnings per share (p)** | Dividend per share (p) |

|---|---|---|---|---|

| 2011 | 184 | 4.3 | 7.3 | 3 |

| 2012 | 194 | 2.4 | 4.3 | 3 |

| 2013 | 217 | 2.6 | 4.2 | 3 |

| 2014** | 221 | 2.8 | 4.8 | 3 |

| 2015** | 230 | 3.3 | 5.6 | 3.4 |

| % change | +4 | +18 | +17 | +13 |

Normal market size:5,000 Matched bargain trading Beta:0.2 **N+1 Singer forecasts, adjusted PTP and EPS figures | ||||

And why not? Clarke's so-called mission critical unit, which fits out data centres and upgrades power supplies, almost tripled sales last year to £33m. And demand from the big house-builders grew revenue from residential and hotel work by half to £25m. With little sign of an end to the housing boom, expect better things here.

Pitfalls, however, remain. Clarke completed a £24m project earlier this year, but the client refuses to pay up in full. That explains year-end cash of just £1m versus broker forecasts for £4.2m. Assuming the issue is resolved, N+1 Singer thinks Clarke will end 2014 with £5.1m net cash, although, there is also a £10.9m pension deficit to be considered.