London house prices

The Nationwide Building Society says the average London property now changes hands for over £400,000, a rise of 25.8 per cent in the last 12 months. Does this make London property a better investment than equities?

It depends when you bought. Since the start of the century, London’s houses have beaten equities. Since 2005-06 the two have offered similar returns. But if you’d bought shares in the bear markets of 2002-03 or 2008-09 they would have beaten housing. Your correspondent sold a London flat in the spring of 2008 and shifted into equities and is feeling smug – for now.

The latest surge in London’s housing markets might look like a bubble. But from a longer-term perspective, prices aren’t high relative to shares. CD.

Source: Douglas & Gordon

But this chart suggests that the recent storming run for London housing may be about to abate. With supply of property onto the London market picking up and demand falling, there appears to be an inflection point coming where supply will meet demand.

European markets

European markets appear to have been the place to be invested in the first half of the year. Unlike the rather moribund performance of the FTSE 100, certain European markets have raced away although the blow up in Spanish tech company Gowex and Portuguese bank Espitiro Santo in the past few days will have dented Iberian equity performance in the days since this chart was prepared.

Cashed up

Source: eVestment

Despite the positive performance of equity markets in the past few years, the level of cash holdings among investors would appear to suggest a growing caution. After reaching a low in the final quarter of 2013, research from eVestment shows that cash holdings in both equity and fixed income strategies have been ticking upwards during the opening six months of 2014.

Waving, or drowning?

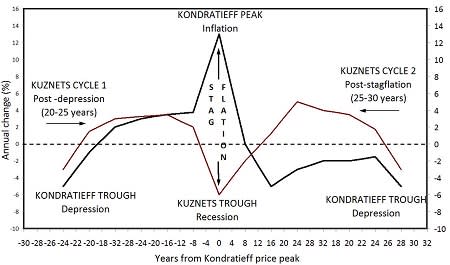

In companies editor Stephen Wilmot's Taking stock column this week he takes a closer look at the theories of 1920's Russian economist Nicolai Kondratieff and in particular the way in which he appears to have predicted great inflationary waves in the 20th century. Stephen considers whether Kondratief theory is indicating another great inflation in the coming years.

Platform preferences

Ever wondered just how homogenous the recommendation of popular investment platforms are? Well this table, put together by our personal finance team, indicates which funds are recommended the most by the top five investment platforms. For the full analysis of this, click here.