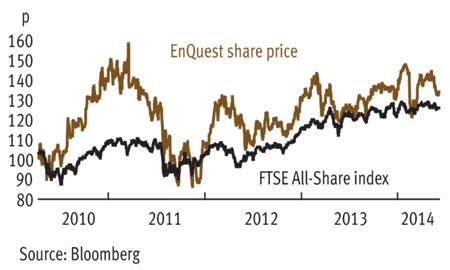

In the 12 months since we recommended EnQuest (ENQ) as a speculative buy option, the share price of the North Sea independent has oscillated within a relatively narrow range (-11p/+16p) either side of the current share price of 132p. The relative stability (or stagnation) of the share price - depending on your point of view - is partly attributable to repeat production delays on the Alma/Galia project. But oil from the 34m barrel development is now imminent, which will help to shore-up near-term sentiment, particularly if output is cranked-up in fairly short order. However, even beyond the immediate quest to bump-up EnQuest's daily production volumes by another 13,000 barrels, the driller's strategic focus on exploiting maturing assets and underdeveloped fields in the UK North Sea places it in an ideal position to benefit from likely regulatory reforms, and we recommend buying in anticipation.

- Prospective tax concessions

- Organic reserve increases

- Private equity interests in North Sea

- Successful note issue

- Alma/Galia delays

- Rising production costs

We think that Westminster has been deliberately downplaying the potential of the UK Continental Shelf (UKCS) ahead of September's referendum on Scottish independence. The Department of Energy has certainly been far more subdued than it was at the time of the February publication of Sir Ian Wood's preliminary findings on the future of offshore oil & gas in the UK. According to the report, the UK economy could generate £200bn over the next 20 years through the recovery of only 3-4bn barrels of North Sea oil and gas. Many analysts believe that the potential is much greater, although energy companies will need to be offered increased tax incentives to stay the course in the North Sea.

The whole North Sea industry would be buoyed by further fiscal concessions on decommissioning relief and/or tax breaks for unsuccessful drilling programmes. But any benefits would be felt particularly keenly by EnQuest, as it is the largest independent UK oil producer in the region. So are there any indications that HM Treasury is willing to go that extra mile? We have witnessed a rise in interest from private equity sources over recent months. It has been flagged that the likes of Blue Water, Blackstone and KKR are to invest in shell companies that will buy unwanted mature fields in the UKCS, while BG Group (BG.) recently sold its interest in the Central Area Transmission System (Cats) gas pipeline for £562m to another private equity concern - Antin Infrastructure Partners. We feel the increased involvement of private equity buyers in the UK North Sea - particularly in relation to marginal assets - suggest they anticipate an improving fiscal environment for E&P plays in the region. Admittedly, our stance on future tax concessions is still little more than conjecture, but if the UK government is genuinely committed to fully exploiting the North Sea's energy resources, it will need to forego some short-term revenues in favour of a long-haul strategy.

Leaving aside the prospect of increased North Sea incentives, EnQuest has turned in a solid operating performance in the early part of this year. Initial production forecasts were trimmed due to the delays at Alma/Galia, but 2014 output through to the end of April averaged 25,597 barrels of oil equivalent per day (boepd). This was at the upper end of guidance and represents an uplift of 25 per cent on the corresponding period last year. For the full year, EnQuest reiterated mid-point guidance of 27,500 boepd. That's reasonably conservative, but management is understandably circumspect given the re-jigged timetable at Alma/Galia.

And this growth in production was achieved despite unfavourable weather conditions in the North Sea during the final quarter of 2013, together with unplanned third party maintenance shutdowns. Given EnQuest's ability to generate increased value from its maturing assets, it provides a suitable template for Sir Ian Wood’s recommendations; the majority of the increase in proven and probable reserves through 2013 was through upgrades to existing producing fields. James Thompson of JPMorgan Cazenove believes it highlights the driller's "strong operational qualities".

There are share price catalysts in prospect over coming months through appraisal drilling at the Kraken development, together with results of the 28th North Sea licensing round. Investment capital isn't an issue following a successful $650m (£381m) note issue during the first quarter. And there was generally favourable analyst reaction to last month’s deal to acquire interests in the Seligi oil field and Malaysian production sharing contracts from ExxonMobil Exploration and Production Malaysia Inc.

| ENQUEST (ENQ) | ||||

|---|---|---|---|---|

| ORD PRICE: | 132p | MARKET VALUE: | £1.1bn | |

| TOUCH: | 132-132p | 12-MONTH HIGH: | 148p | LOW: 120p |

| FORWARD DIVIDEND YIELD: | nil | FORWARD PE RATIO: | 8 | |

| NET ASSET VALUE: | 185¢ | NET CASH: | 26% | |

| Year to 31 Dec | Turnover ($bn) | Pre-tax profit ($m) | Earnings per share (¢) | Dividend per share (¢) |

|---|---|---|---|---|

| 2011 | 0.9 | 363 | 7.6 | nil |

| 2012 | 0.9 | 403 | 46.2 | nil |

| 2013 | 1.0 | 331 | 24.4 | nil |

| 2014* | 1.2 | 471 | 27.0 | nil |

| 2015* | 1.4 | 481 | 27.0 | nil |

| % change | +11 | +2 | - | - |

Normal market size: 15,000 Matched bargain trading Beta: 1.1 *JPMorgan forecasts £1 = $1.71 | ||||