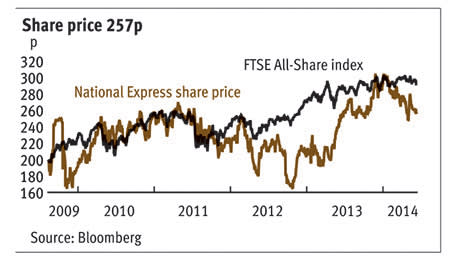

Multiple franchise awards have breathed life back into the transport sector, particularly the allocation of the high-profile Thameslink contract to Go-Ahead (GOG). More quietly, National Express (NEX) is hanging on to its foothold in the UK rail sector, too. It retained its c2c Essex Thameside franchise with a new 15-year operating contract in June. But while this secures the group's long-term future in British rail, as well as £4bn in future revenues, the minimal contribution rail makes to overall revenues - just 8 per cent in the first half - means National Express's shares have drifted over the last 12 months while those of peers have romped ahead (see table). Given the attraction of National Express's highly-cash generative business and the virtues of its shares as a long-term income play, we think the valuation discrepancy that has emerged is unlikely to persist for long.

- Retention of c2c

- Good US performance

- Bidding for international contracts

- Cheap compared with peers

- Regulation

- Spanish competition

National Express vs peers

| Name | TIDM | Price | Mkt cap | 1-yr price change | Fwd NTM PE | DY |

|---|---|---|---|---|---|---|

| Go-Ahead | GOG | 2,185p | £0.9bn | 42% | 14 | 3.7% |

| FirstGroup | FGP | 122p | £1.5bn | 17% | 13 | - |

| Stagecoach | SGC | 355p | £2.0bn | 7% | 14 | 2.7% |

| National Express | NEX | 257p | £1.3bn | 1% | 12 | 3.9% |

Source: S&P Capital IQ

As well as c2c,National Express does have the potential to deliver positive surprises from its rail operation; it has two franchise bids on the table including one currently under evaluation for ScotRail. But it's no secret that the company's strengths lie in its bus business where it has far-reaching ambitions for international growth. For example, it is currently the preferred bidder for a 2015 10-year bus contract in Bahrain via a 50:50 joint venture, where contracts usually come without revenue risk.

Its largest international profit generator is its North American business, which accounted for 36 per cent of both profit and revenue in the first half. A performance improvement programme for the division's school bus operation offers good potential here. In the first half National Express added 100 school buses to its 20,000 fleet via new or converted contracts. But perhaps more significantly, it let 10 low-margin contracts go, but swiftly replaced the lost business with higher-margin wins. That said, unusually cold weather in the US lost the group 1,000 school days, which put a $6m dent in profits despite a solid underlying performance.

But it's Spain, which accounted for a third of first-half profits, where there is most room for improvement. Although National Express's Spanish subsidiary business Alsa is doing well in neighbouring territories such as Morocco, the Spanish intercity coach market is suffering from growing competition across eight key transport corridors. And it doesn't help that operators across five of these corridors have to compete with an aggressively-priced regional rail industry. So far this year, regional rail operators in Spain have pushed fares down by an average 27 per cent as heavy discounting grips the industry.

But Alsa has a plan. A real-time fare analysis system allows prices to be cut so they're cheaper than the comparable rail journey, journey times have been noticeably reduced and significant variations to its 'value' and 'premium' services were made. Finally, a marketing plan is under way. Alsa is a well-respected brand and now customers will know it's low-cost, too. Crucially, passenger volumes are growing by 2 per cent and revenue is now only 5 per cent behind year on year.

The US weather hit and a £4.6m currency headwind in the first half means growth expectations for the current year are muted, but nevertheless compound annual EPS growth of 4 per cent is expected over the next three years. Importantly, strong cash generation should continue to underpin an attractive yield, which is twice covered by earnings. Indeed, in the first half National Express generated £80m of free cash flow and is on track to hit its full-year target of £150m. What's more, debt fell by £17m in the first half of 2014 to £729m, and is down £80m over the past 12 months.

NATIONAL EXPRESS (NEX) | ||||

|---|---|---|---|---|

| ORD PRICE: | 257p | MARKET VALUE: | £1.3bn | |

| TOUCH: | 257-258p | 12-MONTH HIGH: | 308p | LOW: 245p |

| DIVIDEND YIELD: | 4.1% | PE RATIO: | 11 | |

| NET ASSET VALUE: | 162p* | NET DEBT: | 87% | |

| Year to 31 Dec | Turnover (£bn) | Pre-tax profit (£m)** | Earnings per share (p)** | Dividend per share (p) |

|---|---|---|---|---|

| 2011 | 2.24 | 180 | 26.9 | 9.5 |

| 2012 | 1.83 | 164 | 25.4 | 9.8 |

| 2013 | 1.89 | 144 | 21.4 | 10.0 |

| 2014** | 1.84 | 144 | 21.7 | 10.3 |

| 2015** | 1.79 | 151 | 22.6 | 10.6 |

| % change | -3 | +5 | +4 | +3 |

Normal market size: 7,500 Matched bargain trading SETS Beta: 0.91 *Includes intangible assets of £1.18bn, or 230p a share **Investec forecasts, adjusted PTP and EPS figures | ||||