If you’ve walked past an Argos in recent months you might have noticed that some of the stores have a distinctly different feel. Sleek tablets replace the well-thumbed paper catalogues and small blue pens of the past. Even the colour scheme is different. Homebase, too, is getting make-over. It’s all part of a multi-year plan to turn parent company Home Retail Group (HOME) into a leading digital retailer fit for the blossoming world of e-commerce. So far, the group has made good progress with its plans, reflected in last year’s stellar financial performance. But it’s still early days, and we believe Home Retail has further to go. By adapting to the way people shop through heavy investment in digital technology, customer service, store refits and new product lines, Home Retail Group is securing its long-term growth. Cash rich, it’s well positioned to continue to fund these major capital investment programmes too. And, the large fixed-cost base means that if it can get the sales mix right and higher volumes flowing through, profitability should recover.

- Cash rich

- Self-help measures

- E-commerce and m-commerce ready

- Housing market strength

- Margin recovery

- Departing CEO

- Tough comparatives

Digital technology is rapidly changing the way we shop, with consumers now expecting a smorgasbord of buying channels, wide product choice, competitive pricing, and flexible delivery options. Home Retail Group is embracing this new world with gusto and has the cash to finance its ambitions. Argos has already benefited from investment in e-commerce. Last year internet sales totalled 44 per cent of divisional revenue. But there's more work to be done: this year, Argos plans to redesign the online checkout system and accommodate flexible payment and credit options. It will introduce real-time stock availability by location and allow narrow time-slot delivery, thanks to the roll-out of the innovative 'hub and spoke' distribution model. New, sleek concept stores are to be trialled in a further 25 locations, helped by voice-driven picking system. Higher-margin aspirational lines, including Emma Bridgewater homeware, Oxo kitchenware and Baby Björn are widening Argos' appeal. By 2015, it plans to add 15,000 new lines.

It’s a similar story at Homebase. There, multi-channel sales grew 53 per cent in the last financial year, reaching 7 per cent of sales. Homebase is upgrading its web portals, offering free wifi in store and branching out into higher quality brands, including Odina fitted kitchens and Laura Ashley. Store refits are driving higher sales and so far, customer feedback has been positive. Better delivery options are coming on stream too. This year, Homebase is piloting home delivery with time slots for larger ‘two man’ delivery items. Unlike rival B&Q, owned by Kingfisher (KGF), Homebase has even been able to shrink its bloated store estate, closing 13 outlets last year. A further 65 leases are up for renewal soon.

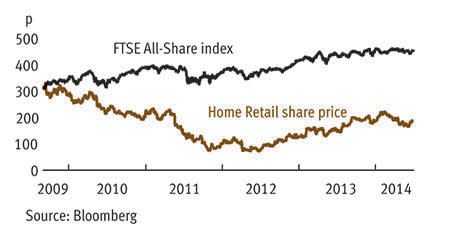

But if last year's stellar performance is testament to the success of these changes, it does mean that both Argos and Homebase face tough comparatives this year. Homebase in particular is lapping a very strong seasonal performance in the second quarter of 2013. The sector is also experiencing a de-rating cycle, while the end of former chief executive Terry Duddy's seven-year tenure as boss has destabilised the stock. Still, though, we're confident in his replacement, John Walden, who ran Argos for two years. Moreover, investors can take solace in the fact that the shares appear to be rebounding and that weaker sales growth this year has already been well-flagged.

Importantly, sales of homeware, and furniture in particular, were unusually strong in July, according to the British Retail Consortium. This bodes well for the group, given that homeware is a higher-margin category. In fact, Homebase and Argos should be able to boost margins in the medium-term through cost efficiency, sales growth and product mix. Higher house prices should also help. Based on S&P CapitalIQ data, the current 1.9 per cent operating margin compares with a five-year peak of 5.1 per cent, so there's certainly scope for improvement. What's more, if profitability is boosted, there is plenty of potential for valuation upside with the current enterprise-value-to-sales ratio of just 0.2 representing less than half the 0.43 five-year high. Meanwhile the a price-to-book-value multiple of just 0.54 compares with the five-year peak of 1.

| HOME RETAIL GROUP (HOME) | ||||

|---|---|---|---|---|

| ORD PRICE: | 185p | MARKET VALUE: | £1.5bn | |

| TOUCH: | 185-186p | 12-MONTH HIGH: | 225p | LOW: 141p |

| FORWARD DIVIDEND YIELD: | 2.2% | FORWARD PE RATIO: | 14 | |

| NET ASSET VALUE: | 329p* | NET CASH: | £331m | |

| Year to 1 Mar | Turnover (£bn) | Adj Pre-tax profit (£m) | Adj Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2012 | 5.49 | 102 | 8.7 | 4.7 |

| 2013 | 5.48 | 91 | 7.7 | 3 |

| 2014 | 5.66 | 115 | 11.2 | 3.3 |

| 2015** | 5.84 | 135 | 12.4 | 3.63 |

| 2016** | 5.97 | 151 | 13.1 | 4 |

| % change | +2 | +12 | +6 | +10 |

Normal market size: 10,000 Matched bargain trading: Yes Beta: 1.33 *Includes intangible assets of £1.7bn, or 214p a share **Bank of America Merrill Lynch forecasts, adjusted PTP and EPS figures | ||||