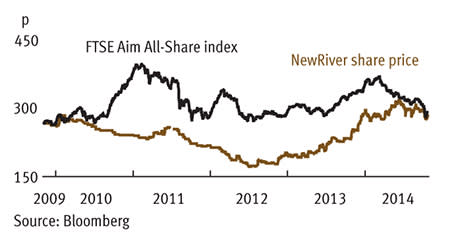

NewRiver Retail (NRR) was set up by real estate veteran David Lockhart in 2009, a time when finance was scarce and interest in regional retail assets was virtually non-existent. But five years on, his timing looks spot on.

- • Innovative deal making

- • Attractive dividend yield

- • Focus on a defensive niche

- • Discount to forecast NAV

- • Possible pressure on dividends

- • Big exposure to retail sector

In the year to the end of March, the group more than tripled its market capitalisation through a string of well-received fundraising exercises that provided the firepower for acquisitions. Most of these were made late in the year, so the uplift in annualised earnings will not show through until next year.

The business plan is simple but highly focused. The company concentrates on buying retail sites outside London where there is an opportunity to maximise returns through redevelopments that drive higher rents. Management is hands-on and Mr Lockhart says he doesn't recognise the business as comprising a landlord and tenants; but more of an owner/occupier relationship.

One of the most innovative deals secured recently was the purchase of 202 pubs from brewer Marston's. Marston's will pay rent on the pubs that it continues to run for up to four years, while some will be converted into convenience stores. Another of NewRiver's strengths is that these ventures are only conducted on a pre-let basis, thereby minimising the development risk. In this case, an agreement has been reached with the Co-operative Group to lease 63 new convenience stores for between £15 and £17.50 per sq ft. The appeal of convenience stores is the reliability of the income they generate from non-discretionary spending; we all have to eat after all. The leases will run for an initial 15-year period, with no break option and inflation-linked annual rental rises. No space has been ignored, either. Some pubs with large and under-used car parks will continue to function, but a convenience store will be built on what was the car park.

| NEWRIVER RETAIL (NRR) | ||||

|---|---|---|---|---|

| ORD PRICE: | 282p | MARKET VALUE: | £283m | |

| TOUCH: | 280-284p | 12-MONTH HIGH: | 320p | LOW: 231p |

| DIVIDEND YIELD: | 6.3% | TRADING PROPERTIES: | nil | |

| FORECAST DISCOUNT TO NAV: | 8% | |||

| INVESTMENT PROPERTIES: | £289m† | NET DEBT: | 39% | |

| Year to 31 Mar | Net asset value (p) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2012 | 254 | 4.0 | 15.3 | 15 |

| 2013 | 235 | 1.4 | 4.7 | 16 |

| 2014 | 241 | 23.1 | 38.0 | 16 |

| 2015* | 270 | 34.5 | 16.7 | 17 |

| 2016* | 304 | 41.0 | 20.0 | 18 |

| % change | +13 | +19 | +20 | +6 |

Normal market size: 2,000 Market makers: 7 Beta: 0.13 *Peel Hunt forecasts (profit forecasts for net operating income) †Includes investments in joint ventures | ||||

Other recent deals include a portfolio of three shopping centres for a total of £155m; part of which has been financed through disposals of £28.7m. This fast expansion saw the portfolio of properties grow by 21 per cent to £735m in the three months to September, pushing the total annualised rent roll up by the same percentage to £67.4m. A total of 65 lettings and lease renewals were secured in the second quarter, and new long-term leases are achieving rental income 14.4 per cent above previous estimated rental value.

Investors will also be attracted by the healthy dividend, which has the added attraction of being paid quarterly, starting from this month. While the growth profile makes the dividend look pretty secure, the likely payout for 2014-15 may not be entirely covered by adjusted net earnings.