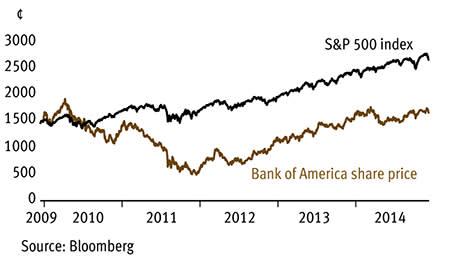

Bank of America's (US: BAC) recovery story looks impressive. Go back to the financial crisis and the lender - weakened by the acquisition of Merrill Lynch - found itself in need of a $45bn (£29bn) bailout from the US government. But, unlike those UK banks that needed bailout cash, Bank of America was sufficiently back on its feet by end-2009 to repay US taxpayers. Its recovery since has continued to gain momentum amid an improving US economy, leaving the shares - trading only a shade above analysts' end-2014 forecast for net tangible assets (NTA) - looking too cheap.

- Benefiting from US economic recovery

- Successfully cutting costs

- Comfortably capitalised

- Shares cheaply rated for the sector

- Slender dividend yield

- Hit by painful redress-related costs

Evidence for Bank of America's recovery was on display with the lender's third-quarter figures. Significantly, and against the backdrop of a US economy that the IMF expects to grow over 3 per cent in 2015, it reported a hefty improvement in credit quality. Indeed, its net charge-off ratio - essentially, bad debts as a proportion of average loans - fell from 0.73 per cent in 2013's third quarter to just 0.46 per cent a year later. Management described that charge as the "lowest in a decade", demonstrating that the loan book's return to health is well under way.

And while economic recovery has yet to start strongly feeding credit demand - leaving loan book growth muted for now - costs are falling. Third-quarter underlying non-interest costs fell 7 per cent year-on-year, which helped drive the net interest margin up seven basis points quarter-on-quarter to 2.29 per cent. Lower costs and falling bad debt provisions are helping to grow the capital cushion, too. Bank of America's Basel III core equity tier one ratio (comparing its highest-quality capital with risk-weighted assets) reached almost 10 per cent at the third quarter stage, leaving it roughly as well capitalised as its large US bank peer group.

BANK OF AMERICA (US:BAC) | ||||

|---|---|---|---|---|

| ORD PRICE: | 1,738¢ | MARKET VALUE: | $183bn | |

| TOUCH: | 1,735-1,758¢ | 12-MONTH HIGH/LOW: | 1,803¢ | 1,437¢ |

| FWD DIVIDEND YIELD: | 1.7% | FWD PE RATIO: | 11 | |

| NET ASSET VALUE: | 2,270¢ | |||

| Year to 31 Dec | Pre-tax profit ($bn) | Adj. earnings per share (¢) | Dividend per share (¢) |

|---|---|---|---|

| 2011 | -0.2 | 7 | 4 |

| 2012 | 3.1 | 27 | 4 |

| 2013 | 16.2 | 91 | 4 |

| 2014* | 8.6 | 47 | 12 |

| 2015* | 26.6 | 154 | 29 |

| % change | +209 | +228 | +142 |

*JP Morgan forecasts Normal market size: na Matched bargain trading Beta:1.25 £1=$1.57 | |||

That said, low financial market volatility is hitting the investment banking operation. Third-quarter investment banking fees, for example, fell 17 per cent quarter-on-quarter and chief executive Brian Moynihan said this month that he's expecting a further slide in trading-related revenue in the current quarter. Still, Bank of America is hardly alone in struggling against weak investment banking conditions.

Bank of America has also been hit hard with misconduct-related costs. Most significant amongst these are redress costs from having mis-sold mortgage-backed securities prior to the financial crisis and, earlier this year, the lender agreed a huge $16.65bn settlement with US federal and state authorities. But America's other big banks have been hit similarly hard and, crucially, there are good reasons to think that this particular round of settlements could bring the era of mega-settlements at the US lenders to an end.

An end-2014 prospective dividend yield of under 1 per cent is hardly impressive, either. But, after receiving the Fed's approval in August, the payout should improve significantly in coming years.