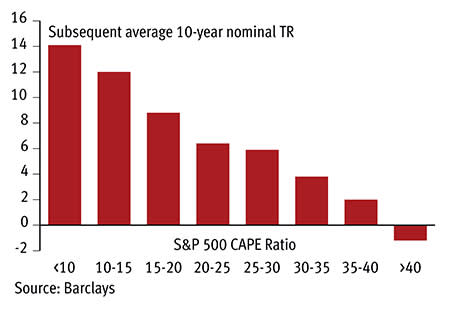

In his book, “Irrational Exuberance”, Professor Robert Shiller famously examines the relationship between human behaviour and asset valuation. The basic premise is that human beings’ natural focus on the short-term leads to overlooking longer trends and misunderstanding whether assets are fairly valued. The Cyclically Adjusted Price/Earnings or CAPE ratio that Professor Shiller developed with John Y. Campbell in the 1980s, aims to filter out some of the short-term emotion reflected in equity valuations by shifting emphasis from current earnings to the 10-year inflation-adjusted average.

The approach has been a very reliable predictor of long-term stock returns but has had its critics, who point out that staying out of the US or UK stock markets every time CAPE was above its long-term average would have led to investors foregoing some periods of considerable upside.

In its defence, Professor Shiller has stressed that CAPE should not be used as a market-timing device, at least not in the sense of deciding whether to be totally in or out of major stock markets. The idea is not to be 100 per cent out of developed equity markets if their CAPEs are high but to gradually increase the proportion of assets allocated towards these markets when the CAPE ratios are lower. This approach might eliminate the opportunity-cost risk of being out of important stock markets altogether but could still lead to often having a sub-optimal allocation towards major asset classes such as US equities.

As well as being used as a value indicator for whole markets, CAPE can be used to assess relative valuations across sectors within a stock market. Of course there are obvious flaws in this approach – the same valuation techniques are not necessarily appropriate for all sectors, which each have their own idiosyncrasies. However, the method has given rise to an interesting new ‘Smart Beta’ index strategy that involves staying invested in major stock markets and tracking sector CAPE ratios to pursue excess returns.

Smart Sector CAPE

Smart Beta is the marketing term applied by the exchange traded product industry for passive or semi-passively managed products that aim to surpass the ordinary positive beta returns (i.e. the upward movements) of the market benchmark. A plethora of new indices have looked to achieve outperformance by a combination of alternative weighting methodologies (e.g. equal-weighting the index constituents rather than weighting by market capitalisation) and heightened exposure to various return factors such as momentum or value.

The CAPE ratio is a prime example of a value investing strategy and since 2012 Professor Shiller has partnered with Barclays to create the Shiller Barclays CAPE Index family. The first group of indices took the US S&P 500 as their selection universe and used a number of CAPE-based methodologies to provide exposure to value factors in pursuit of positive beta. In August 2013, the partnership launched the first of a similar European family of indices, taking its selection universe as the MSCI Europe index.

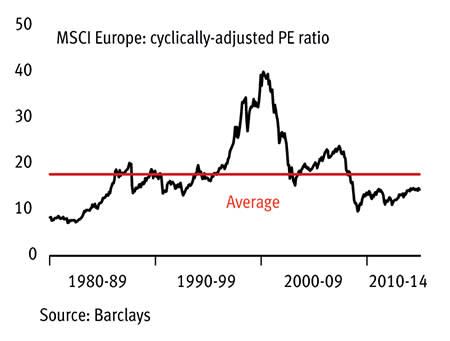

The methodology behind the Shiller Barclays CAPE Europe Sector Value index is to determine price and earnings for the 10 MSCI Europe sectors and then select the five most undervalued sectors based on a CAPE ratio. Recognising the point that different sectors have unique characteristics and are not typically considered fair value on the same multiples, the index compares each sector based on its current CAPE ratio relative to its 20-year rolling average CAPE.

To avoid the commonly cited ‘Value Trap’ danger for value investing strategies (essentially that an investment is cheap and remains so because of some fundamental reason that shows no sign of immediate resolution), the system removes the sector from the first stage selection that has the lowest 12-month price momentum. The four sectors selected are then equally weighted, with the index tracking total returns and re-balancing monthly. The index tracks the value of its selected sector indices rather than individual stocks.

The index has been live for 18 months and a simulated performance is available that goes back to December 2008. In that time the index has achieved total returns of 165.66 per cent which comfortably beats the 101.08 per cent total returns for the MSCI Europe.

Passive performance

However, it is ironic that a Shiller-inspired index should be marketed on the basis of such a short track record and the important question to ask is whether the out-performance is sustainable. We know that value strategies - buying low and selling high - work over the long-term but the portion of the index’s excess returns that can be put down to sector timing will require a longer period of scrutiny.

There are also questions as to CAPE’s usefulness in valuing sectors - it focuses on such a limited time horizon that structural changes affecting how performance in different industries is assessed may have been missed. While Professor Shiller’s research on the US market provides strong evidence for CAPE as a long-term indicator, the index methodology of buying in and out of European sectors based on the ratio surely requires a longer track record of success.

Putting these considerations to one side, so far the sector timing methodology has performed well, with seven out of the 10 MSCI Europe sectors having outperformed in periods when selected by the index compared to their total returns over the back-tested period. And for investors, the new factor index represents an opportunity to gain exposure to value in major European equities, a strategy that was hitherto wildly expensive and difficult to action. Ossiam, the exchange traded product arm of Natixis Global Asset Management, is launching an ETF that will track the Shiller Barclays CAPE Europe Sector Value index.

For Ossiam, meanwhile, it clearly makes sense to partner with powerful brands such as Shiller and Barclays to provide a unique take on the value tilt and differentiate their product. The marketing story is indeed a strong one, the methodology of the Shiller-Barclays index is based on the research of a world-leading theoretician and the index delivers exposure to value investments and international diversification of equity beta at a stroke. While reiterating the strong caveat that the sector-timing approach needs to be assessed over a far longer timeframe, returns have been in excess of not only the MSCI Europe but also similar value factor indices.

Whether or not the Shiller Barclays CAPE Europe Sector Value index can live up to its billing, the concept is undeniably highly innovative and ushers in an exciting new generation of smart beta products for investors eager to build factor and international exposure into their portfolios. As the passive revolution in the asset management industry gathers pace, we can expect to see many more similar “Smart Beta” products emerging. This will no doubt require an intelligent approach to portfolio management as different product exposures introduce new risk and reward scenarios. Using smart beta products to achieve optimal risk-adjusted returns will certainly provide investors some interesting but potentially rewarding challenges.