In light the plunge in the oil price, the oilfield services industry is now seen as a no-go area by some investors. But while excess supply in global crude markets will invariably foster change, as with previous cyclical downturns those oilfield services companies that boast technological advantages can be expected to recover lost ground more effectively than those reliant on volume trading.

- Proprietary technology offering

- Low rating versus peer group

- Attractive yield

- Strengthening balance sheet

- Industry budgets in decline

- Short visibility on sales

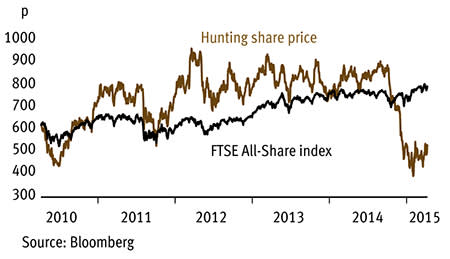

One of the IC's preferred sector picks, Hunting (HTNG), has traded at a substantial earnings premium to peers over the last cycle. But with the sector in the doldrums, Hunting has come back to the pack - but for how long? We think Hunting is a quality play that has been over-sold on a sector-wide correction and we see plenty of scope for its share price to bounce back from current levels. And for investors that get in now, the deal is sweetened by a near 4 per cent yield.

In a sense, it's perhaps unsurprising that the group's share price has suffered disproportionately from the decline in crude oil prices. Hunting is primarily a producer of oilfield equipment, as opposed to services, so the erosion of industry capital budgets was bound to have a negative impact on valuations. The group's market value fell by around two-fifths in the final quarter of 2014, and the shares are broadly flat in the first three months of this year. But Hunting beat market expectations with the release of its full-year figures last month. Net earnings increased 7 per cent on an adjusted basis. Shareholders can take encouragement from the performance of the group's well intervention and subsea businesses, while demand from the Middle East and southeast Asia continues to generate sales growth.

A sturdy balance sheet is a prerequisite for any business looking to see out a downturn and Hunting looks pretty sound on that front. The group's free cash flow was up by a quarter last year, while net debt fell by 36 per cent to $131m. Hunting was quick to cut its cloth in response to the oil-price decline, including redundancies along with hiring and salary freezes, affecting around 13 per cent of the global workforce.

Nevertheless, it could be argued that expectations that the dividend will be maintained not only highlights Hunting's balance sheet strength, but also points to confidence in long-term performance. The Cassandra's hold sway in terms of the oil price at the moment, but global demand is still forecast to rise by nearly a fifth over the next 20 years. To meet this growth, Hunting continued to invest in new manufacturing capacity during 2014, while major capital projects in the US and South Africa are due to be commissioned this year.

The decline in industry activity will inevitably affect profitability during this year and - perhaps more noticeably - in 2016. The US shale oil market remains a particular cause for concern. Hunting owes much of its success over the past few years to the industry-wide take-up of its horizontal drilling technology, but it is now well positioned in many of the oil industry's growth markets. A group strategy aimed at tapping into Asia's energy markets seems prescient in view of the oil-price falls.

Deutsche Bank predicts that group cash profits will fall by around a third this year to $136m (£91.9m), before rising to $146m in 2016. Hunting's free cash-flow yield is predicted to come in at 13 per cent. In short, although Hunting's contract backlog couldn't be described as long-dated, its dividend looks to be well-funded.

| HUNTING (HTG) | ||||

|---|---|---|---|---|

| ORD PRICE: | 493p | MARKET VALUE: | £804m | |

| TOUCH: | 493-494p | 12-MONTH HIGH: | 918p | LOW: 384p |

| FORWARD DIVIDEND YIELD: | 3.9% | FORWARD PE RATIO: | 27 | |

| NET ASSET VALUE: | 948¢* | NET DEBT: | 9% | |

| Year to 31 Dec | Turnover ($bn) | Pre-tax profit ($m) | Earnings per share (¢) | Dividend per share (¢) |

|---|---|---|---|---|

| 2012 | 1.31 | 133 | 67 | 28.5 |

| 2013 (restated) | 1.33 | 137 | 69 | 29.5 |

| 2014 | 1.43 | 109 | 46 | 31.0 |

| 2015** | 1.00 | 52.0 | 25 | 31.0 |

| 2016** | 0.96 | 65.0 | 30 | 31.0 |

| % change | -3 | +25 | +20 | - |

Normal market size: 5,000 Matched bargain trading Beta: 1.73 £1=$1.48 *Includes intangible assets of $665m, or 448¢ a share **Deutsche Bank forecasts | ||||