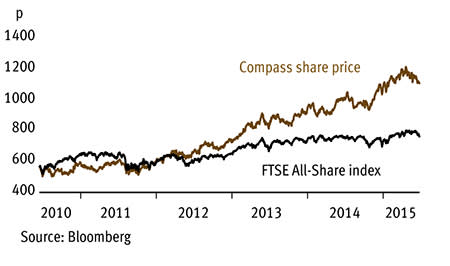

Catering giant Compass (CPG) has long been regarded worthy of 'core-holding' status, but finding suitable entry points for new investors into quality stocks is tricky. Recent share price weakness for Compass reflects market concerns over a slower second half and trading in emerging markets. However, long-term growth prospects based on increased outsourcing of food services remain unchanged, and Compass's highly cash-generative business model is still highly attractive. So we think investors should see this as a chance to buy on weakness.

- Weak share price

- Strong half-year results

- Share buybacks to continue

- Resilient business model

- Emerging markets weakness

- Moderate second half expected

Compass reported a bumper set of first-half figures in May. At the halfway stage, underlying sales, excluding a negative currency impact, were up 5.7 per cent and like-for-like sales rose a respectable 2.7 per cent. A strong six months in North America and high levels of new business boosted margins and lifted group operating profit by 6.5 per cent to £688m. There were even signs of a modest recovery in Europe and Japan (which Compass reports on as a single region) as constant-currency revenue crept up 1 per cent and underlying profit grew 3 per cent to £205m.

North America - which accounts for just over half of group revenue - is the star performer. Underlying revenue there grew 8.2 per cent in the first half as retention rates held up and new contracts were signed. There was also some improvement in like-for-like volumes and operating profit grew by £38m (at constant currency) to £398m. Margins also rose about five basis points to 8.5 per cent.

However, there are concerns over the tough time Compass is having in Australia, Brazil and Turkey. A depressed oil price has prompted revenue declines in Compass's offshore and remote business, as fewer exploration sites means low demand for catering services for large on-site crews. In the first half, margins slipped 10 basis points to 7 per cent. In response, Compass has been forced to cut headcount in Australia, Brazil and its Turkish food business by 10 per cent. This, along with the prospect a return to more 'normal' contract retention rates in North America, has prompted Numis Securities to trim its forecasts for the second half of the financial year. Instead of 5.4 per cent, the broker expects organic revenue to grow by 5.1 per cent in the year to September 2015.

However, it's worth remembering Compass actually outperformed its own guidance of 5.5 per cent growth during the first half, and group operating margins still grew overall, up 10 basis points to 7.5 per cent. It's well-known that Compass has regularly erred on the conservative side when issuing its full-year guidance.

True, the bearish stance on emerging markets is not to be underestimated, with Goldman Sachs forecasting another 4 per cent drop in emerging markets currencies against the US dollar over the next year. But Compass is a geographically diverse business, and its exposure to fast-growing and emerging regions accounts for only 15 per cent of operating profit. Similarly, a growth rate of more than 5 per cent this year shouldn't be sniffed at - this is just an example of a quality stock being held to exaggerated standards by the market. In the first half, Compass still won significant levels of new business across its fast-growing and emerging division, so much so that even accounting for the turnover trouble in Australia, Turkey and Brazil, underlying revenue still grew by 7.7 per cent.

While Compass combats the oil price and currency deflation its shareholders could still do well. The group has utilised approximately £340m of its £500m share buyback programme so far this year, and closing net debt at the halfway stage represented just 1.5 times cash profit. Bosses are keen to maintain that ratio, but said they won't rule out future buybacks or other special one-off returns to shareholders. Last year, in May 2014, it paused the buyback programme to announce a special dividend worth 56p a share. That equated to nearly £1bn returned to shareholders during the 2014-15 financial year.

| COMPASS (CPG) | ||||

|---|---|---|---|---|

| ORD PRICE: | 1,115p | MARKET VALUE: | £18.5bn | |

| TOUCH: | 1,114-1,115p | 12-MONTH HIGH: | 1,223p | LOW: 925p |

| FORWARD DIVIDEND YIELD: | 2.6% | FORWARD PE RATIO: | 19 | |

| NET ASSET VALUE: | 113p* | NET DEBT: | 141% | |

| Year to 30 Sep | Turnover (£bn) | Pre-tax profit (£bn) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2012 | 16.9 | 1.09 | 42.6 | 21.3 |

| 2013 | 17.6 | 1.19 | 47.7 | 24.0 |

| 2014 | 17.1 | 1.16 | 48.7 | 24.8 |

| 2015** | 17.9 | 1.22 | 54.7 | 26.8 |

| 2016** | 18.5 | 1.27 | 59.0 | 28.9 |

| % change | +3 | +4 | +8 | +8 |

Normal market size: 2,000 Matched bargain trading Beta: 0.92 *Includes intangible assets of £4.71bn, or 284p a share **Numis Securities forecasts | ||||