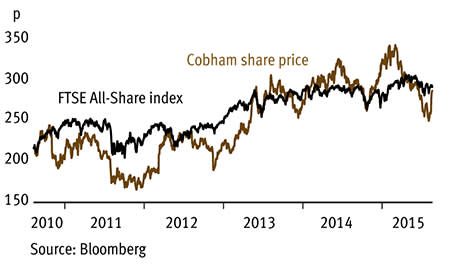

Having fallen 13 per cent since we downgraded them to a sell, shares in Cobham (COB) are starting to look attractive. Military spending cuts and chunky one-off costs from its biggest-ever acquisition have weighed on sentiment, yet first-half results for 2015 offer sufficient encouragement to suggest it's right to buy the shares for recovery.

- Aeroflex acquisition paying off

- Encouraging prospects across rest of the business

- Mid-teen operating margin to widen

- Strong cash conversion and decent dividend yield

- Under pressure to meet full-year guidance

- Hefty debt pile

Strip out the costs associated with integrating the $1.5bn (£869m) acquisition of New York-based wireless communications expert Aeroflex, and adjusted pre-tax profit rose 15 per cent to £135m in the first half. A 32 per cent surge in order intake and 26 per cent sales growth was mainly driven by Aeroflex, whose access to high-growth areas such as commercial space, avionics, defence, commercial wireless communications and medical markets already appears to be bringing benefits.

At 41 per cent of revenues, the Aeroflex deal was a huge one that represents a key part of management's strategy to dilute exposure to volatile defence spending. Already, £13m of efficiencies have been delivered from the acquisition, en route to total annual synergies of about £75m, which will cost around £140m to implement.

Elsewhere, organic revenue growth of 0.3 per cent - while hardly mouth-watering - indicates that the rest of Cobham is finally moving in the right direction. Bulls will sweat that the group requires low-to-mid single-digit sales growth in the second half to meet management's full-year guidance and is counting on the stabilisation of oil and gas markets to achieve this. Overall, though, prospects do look encouraging.

For example, defence operations are starting to benefit from a slight pick-up in US military spending. Moreover, plenty of comfort can be taken from the fact that Cobham's focus on niche technology used for communication, aerial refuelling and safety appears to be in line with the Department of Defense's priorities. Within the latest US National Military Strategy document published in June, key Pentagon requests match the capabilities that Cobham can offer.

Outside the US, growth in Asia and Middle Eastern markets has been offset by flat defence budgets in Europe. Fortunately, that has started to change as governments react to regional security threats, such as Russia's annexation of Crimea. Extra aircraft orders, meanwhile, should cement growing custom from other regions. That includes South Korea and Australia's eagerness to buy Airbus A330 MRTT aircraft - Cobham supplies its hose and drogue aerial refuelling system.

Following a prolonged downturn in demand for land and marine solutions, the group's core commercial operations could see a marked pick-up, too. The specialist aerospace segment's move into communication devices looks smart as demand for increased bandwidth is on the rise. With the launch of Inmarsat's Global Xpress satellite constellation due soon, Cobham's high-performance SATCOM products should also be in demand.

Exposure to this array of structural drivers should protect the group's profits margins in the mid teens. True, margins have recently been hit by the integration of Aeroflex Test Systems and falling SATCOM revenue affected by weak oil and gas markets. Yet Cobham's cost-cutting drive, diverse technological offerings and long-term programmes mean broker Liberum expects operating margins to widen 0.7 percentage points to 16.2 per cent in 2015.

Rising profit could also help cut Cobham's debt, which has surged since the Aeroflex acquisition, as will the sale of surplus-to-requirement assets. Cobham's bid to focus on segments that hold scale and market-leading positions was the rationale behind it recently selling its aerospace design business to Meggitt for $200m. Meanwhile, $80m was pocketed from the disposal of Inmet and Weinschel, two businesses acquired with Aeroflex.

Debt reduction will also be helped by converting accounting profit into cash. In the first half - and despite capital spending more than doubling to £58m - Cobham's ratio of cash conversion was 13 percentage points higher than the previous first half at 77 per cent. That ultimately prompted management to maintain the group's long history of dividend growth.

| COBHAM (COB) | ||||

|---|---|---|---|---|

| ORD PRICE: | 287p | MARKET VALUE: | £3.27bn | |

| TOUCH: | 286-287p | 12-MONT HIGH: | 349p | LOW: 251p |

| FORWARD DIVIDEND YIELD: | 4.2% | FORWARD PE RATIO: | 12 | |

| NET ASSET VALUE: | 87p* | NET DEBT: | 125% | |

| Year to 31 Dec | Turnover (£bn) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2012 | 1.75 | 301 | 22.5 | 8.8 |

| 2013 | 1.79 | 288 | 21.5 | 9.7 |

| 2014 | 1.85 | 257 | 18.4 | 10.7 |

| 2015† | 2.24 | 313 | 21.6 | 11.3 |

| 2016† | 2.35 | 339 | 23.3 | 12.0 |

| % change | +5 | +8 | +8 | +6 |

Normal market size: 5,000 Matched bargain trading Beta: 0.7 *Includes intangible assets of £1.8bn, or 162p a share †Liberum forecasts (all profit and EPS data are underlying figures) | ||||