August proved to be a period of two halves when it came to the Growth and Income portfolios. In the first, I reduced equity exposure when on tight discounts and added to the commercial property and fixed interest sectors.

During the second, following my knee osteotomy, I took advantage of the setback in equity markets and on 'Black Monday' added to my Chinese and Far Eastern holdings. The timing proved fortuitous. Furthermore, both periods of activity had the effect of generating more income.

Given the extent of portfolio activity relative to column space, I hope readers will forgive me if I cover the first half in this column, and then cover the second half in next month's column - when I will continue to suggest investors should buy Chinese and Far Eastern equities on bad days.

The importance of diversification and rebalancing

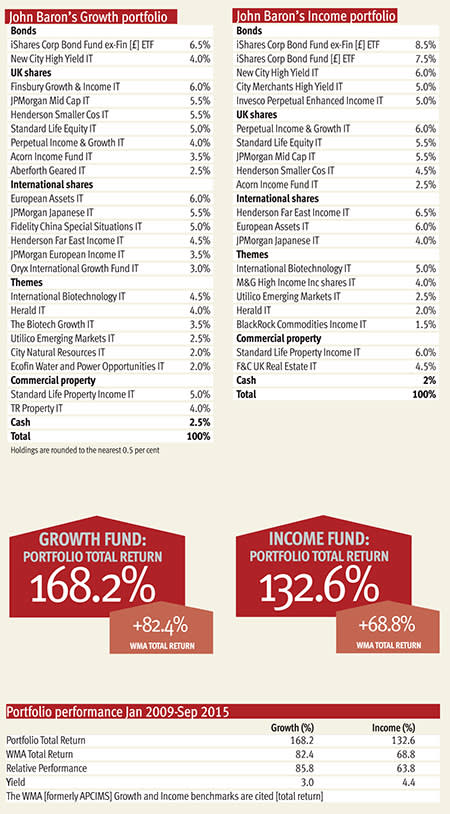

In part because both portfolios are having a strong year relative to both cash and benchmarks, I decided the time had come to rebalance portfolios somewhat by switching some equity exposure, after a strong run, into both bonds and particularly commercial property given its strong fundamentals. Visitors to my website will see this theme continues in my other portfolios.

Regular readers will know I am a strong believer in diversification as a means of reducing equity portfolio risk. Both portfolios achieve this by investing in the lesser-correlated assets of bonds, commercial property and commodities. Diversification becomes more important with time as the need to protect past gains and produce more income typically increases with age.

However, the full benefits of diversification can only be realised if the discipline of rebalancing is adhered to. The concept is simple. If a 60/40 equity/bond split is adopted and then equities perform well, the result could be a 70/30 split. Evidence suggests it pays to rebalance – back to the 60/40 split – provided the portfolio's risk profile and investment objectives remain unchanged.

This is particularly true when markets fall. During the 2007-09 downturn, a portfolio starting with a 60/40 split would have lost 37 per cent if left unbalanced, compared with a loss of 30 per cent if rebalanced annually.

Longer-term examples confirm the discipline's merits. Forbes has shown that $10,000 invested by way of a 60/40 split in the US in 1985, and rebalanced annually, would have been worth $97,000 in 2010. By comparison, the same unbalanced portfolio would have been worth $89,000.

Unbalanced portfolios can by stealth seriously increase the risk profile of an unguarded investor's portfolio. The discipline helps to reduce complacency. But, to avoid over-dealing, I suggest an annual review and when portfolios have drifted from the initial asset disposition.

Portfolio changes

Accordingly, during the first half of August, in the Growth portfolio I top-sliced JPMorgan Mid Cap (JMF) after a very strong run and a narrowing of its discount to a multi-year low. With the proceeds, I added to existing holdings of Standard Life Property Income (SLI) and New City High Yield (NCYF).

Within the Income portfolio, I replaced the holding of Temple Bar (TMPL) with a new holding of F&C UK Real Estate Investment (FCRE). I also added to the existing holding of Henderson Far East Income (HFEL) on its initial pull-back.

Having already highlighted the attractions of both NCYF and HFEL within the last year, I thought it may be helpful to focus on SLI.

Standard Life Property Income

When first introducing SLI into both portfolios in December 2011, I believed commercial property was merely in the foothills of what would prove to be a long and profitable upswing. At the time, SLI was standing on a 15 per cent discount and offered an 8.7 per cent yield. Those foothills are now behind us, but there is still some way to climb.

The relentless search for sustainable yield at a time when government bonds in particular appear to offer little value, the present property cycle's lack of investment and therefore shortage of supply, an improving economy which is feeding through to rental growth, and a debt scenario suggesting a very gradual increase in interest rates, all bode well for the sector.

There is a further reason to be positive. The world's two biggest index providers, the MSCI and the S&P Dow Jones Indexes, have for decades classified all companies into just 10 sectors. But next year this will become 11, as real estate will be split from financial services to form its own sector - worth around 2.5 per cent of the total value of the S&P.

This is significant. Indices help frame investment decisions and therefore influence financial flows. ETFs and other passive funds will have to follow. Active fund managers will need to revisit the sector's merits. Money will continue to move into the sector - the real estate sector has arrived!

In catching up recently with Jason Baggely of SLI, the focus continues to be on acquiring good quality and modern properties. Tenants tend to pay-up for such properties given this cycle's lack of investment and therefore shortage of alternative accommodation, and the cost and disruption of moving.

This approach has enabled SLI to successfully focus on the more unfashionable and higher yielding shorter leases, compared to the industry average, which were deemed higher risk courtesy of their duration. There was also less competition for such leases from larger institutions which preferred longer leases in part because of the nature of their open-ended structures.

Now that the market has caught up, SLI is moving out along the duration curve. To compensate, it is focussing more on acquiring smaller lots which offer better value and yields as there is less competition from the larger institutions. Furthermore, its early focus on the higher-yielding industrial sector outside the South-East continues to pay dividends, especially as the recovery picks up.

In short, despite now standing on a 7 per cent premium, a respected fund manager at the top of his game, a 5.5 per cent yield which is covered by the portfolio and supported by strong revenue reserves, and a loan facility fixed at 3.7 per cent until 2018, all suggest SLI will continue to capitalise on the sector's bright prospects.

The second half

In next month's column I will explain why, on so-called 'Black Monday' (24 August), I added to the existing holding of Fidelity China Special Situations (FCSS) in the Growth portfolio and to the existing holdings of Henderson Far East Income (HFEL) in both.

In addition, I will highlight FCRE's attractions having also added to the Income portfolio's new position during the second half of August.