With paper and packaging prices rising and supply tightening following a wave of mergers in the sector, the major capital expenditure plans of Johannesburg and London-listed Mondi (MNDI) should prove to be highly profitable. What's more, analysts think strong cash generation could also fund a special dividend further down the line.

- Potential for a special dividend

- Solid track record

- Investment to boost market-leading ROCE

- Tightening supply and rising demand spur price rises

- Favourable commodity prices

- Vulnerable to commodity price swings

- Currency volatility

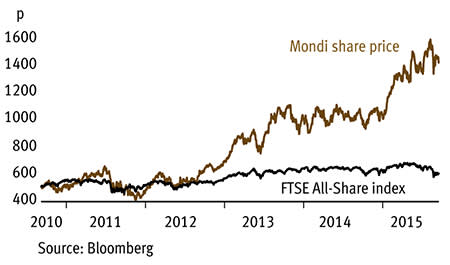

Despite a sluggish European economy, packaging giant Mondi posted higher sales from four of its five operations in the six months to the end of June and underlying operating profit surged 30 per cent to €490m (£345m). That impressive performance means Mondi has now delivered 20 per cent compound annual EPS growth since listing in 2007. Normally, you'd have to pay a premium for such success and encouraging prospects, yet the recent equity market sell-off has left Mondi's shares trading on an attractive forward price-earnings (PE) multiple of just 13 times.

That looks particularly cheap considering the major capital expenditure programme currently under way. Through disciplined capital allocation and exiting struggling operations, Mondi has more than doubled its return on capital employed since 2009 to a market-leading 19 per cent. With that in mind, confirmation that the group plans to spend about €500m over the next few years to boost mill efficiency and capacity is welcome news.

The latest projects include providing an additional 100,000 tonnes a year of softwood pulp, which is used to make resilient wrapping paper, and an extra 80,000 annual tonnes of kraftliner, a 100 per cent recyclable solution for packaging premium goods. Those two upgrades are expected to be complete by the third quarter of 2016, while management also reports that "good progress" has been made revamping a wood yard in South Africa and modernising kraft paper operations.

These investments are made even more exciting by recent consolidation in the packaging sector. As the likes of Ball (US: LBB) and Rexam (REX), and RockTenn (US: RKT) and MeadWestvaco (US: MWV) merge, capacity has been cut and prices have subsequently risen. Aside from completed capital projects, which added €35m to operating profit in the first half, Mondi benefited from selling higher volumes of packaging at higher prices. Those increases are expected to continue throughout 2015, thanks to solid demand and tightening supply.

Mondi isn't talking about small price hikes either. The group hopes to increase recycled containerboard prices by €30 a tonne and uncoated fine paper by up to 12 per cent. Analysts at Investec reckon high pulp prices and lower industry-wide capacity should assist with the latter objective. And the broker expects every 1 per cent increase in uncoated fine paper prices to boost operating profit by 1 per cent.

Despite growing its own wood in Russia and generating its own energy in South Africa, Mondi is still vulnerable to commodity price swings. Management usually implements price increases to compensate for any unfavourable movements, although for now costs of the raw materials it consumes look very favourable. For example, an easing of supply interruptions in Europe means polymer, which represents about half of consumer packaging costs, is now cheaper. The low oil price is another boon, as the group's many plants use a lot of energy.

These positive factors are boosting the amount of cash that Mondi generates. Despite the higher-than-normal first-half working capital needed to improve its service offering and bed in the acquisition of a US industrial bags business, cash generated from operations climbed 23 per cent to €583m.

Broker Jefferies forecasts operating cash flow of £1.21bn for the full year, rising a further 11 per cent in 2016 to £1.34bn. That optimism is shared by other analysts, most of whom expect the group's growing war chest to fund a special dividend and acquisition activity.

| MONDI (MNDI) | ||||

|---|---|---|---|---|

| ORD PRICE: | 1,469p | MARKET VALUE: | £7.1bn | |

| TOUCH: | 1,468-1,470p | 12M HIGH / LOW: | 1,614p | 919p |

| FORWARD DIVIDEND YIELD: | 2.9% | FORWARD PE RATIO: | 13 | |

| NET ASSET VALUE: | 780¢ | NET DEBT: | 56% | |

| Year to 31 Dec | Turnover (€bn) | Pre-tax profit (€m)* | Earnings per share (¢)* | Dividend per share (¢) |

|---|---|---|---|---|

| 2012 | 5.79 | 459 | 69.2 | 28 |

| 2013 | 6.48 | 586 | 95.0 | 36 |

| 2014 | 6.40 | 671 | 107.3 | 42 |

| 2015** | 6.84 | 853 | 134.3 | 53 |

| 2016** | 6.99 | 966 | 150.0 | 59 |

| % change | +2 | +13 | +12 | +11 |

Normal market size: 1,500 Matched bargain trading Beta:1.30 £1=€1.37 *UBS forecasts, adjusted PTP and EPS figures | ||||