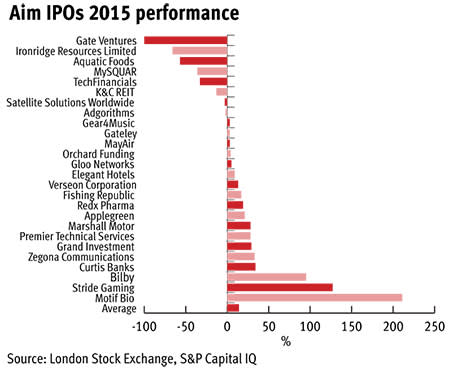

As we often remind readers, Aim is a market for stock-pickers. But were you to invest in any of 2015’s Aim debutants on the issue price, you would have made an average return of 14 per cent. And as the chart below shows, just 8 of the 26 new entrants are down on their initial listing price, (although this group includes the now-suspended Gate Ventures, whose shareholders were wiped out following a stratospheric and bizarre rise in the stock).

But strip out the Chinese businesses (Gate and Aquatic Foods) and other non-UK registered companies (Ironridge, MySQUAR, TechFinancials, Grand Group Investments, Adgorithms, Applegreen and Verseon), and the group is up 35 per cent, thanks in part to major re-ratings for Motif Bio (+211%), Stride Gaming (+127%) and Bilby (+95%). Whether these companies can maintain their early momentum is of course another question, but the data at least serves as a reminder that there is serious value to be found on the junior market. Or at least the presence of expectant investors prepared to bid up the value of newly listed companies.