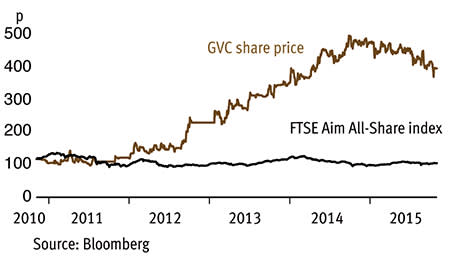

It is right for investors to err on the side of caution when a company whose shares they own goes on the hunt for an acquisition. But such wariness seems to have gone too far in the case of gambling company GVC (GVC), whose share price has dropped some 13 per cent since its bosses first addressed the speculation in May about its intentions to buy rival Bwin.Party Digital Entertainment (BPTY).

- Dividend likely to resume in 2017

- Bwin deal will propel the shares into FTSE 250

- Good track record with mergers

- Finance director buying the shares

- High financing costs for deal

- Likely to face higher taxation

The likely reason for this is that the stock is an income darling, with a dividend yield approaching 10 per cent on 2015's likely payout (see table). Yet deep in its statement about its bid for Bwin - GVC was up against rival 888 (888) - the company announced it would axe its dividend in 2016 while it digested its target and the share price fell accordingly.

But GVC has a precedent for this. It did the same when it acquired Sportingbet and was able to reinstate the dividend more quickly than anticipated. True, there will inevitably be costs to integrating Bwin - part of the reason for pausing payouts is likely to be funding the 12.5 per cent coupon attached to the debt it needed to finance the deal. But Karl Burns, an analyst at stockbroker Panmure Gordon, says he expects GVC to be able to refinance the debt once the Bwin deal is complete, saving roughly €20m (£14.3m) in annual interest payments - and that will help with the resumption of dividends.

Beyond this, the purchase, which doesn't have obvious competition hurdles to overcome given the complimentary geographic exposures, will mean shares in the enlarged company will eventually take Bwin's spot in the FTSE 250 index. This alone should help propel the share price, given that tracker funds will have to buy it. Currently, GVC's shares are quoted on Aim.

As the deal is likely to be given the green light, attention turns to the ability of management to integrate an acquisition and GVC's bosses have a good track record. Besides, Bwin's own bosses chose GVC as its preferred bidder. True, that could well be because GVC offered the higher price. That said, Bwin's chief executive, Norbert Teufelberger, is set to be on the board of the enlarged GVC, so he will still have an influence on the brand that he has helped build since joining Bwin in 1999.

GVC's financial position is also positive. At its half-year results, the company had €13.6m net cash so it has the firepower to spend on integrating Bwin. Also, management at Bwin has been wielding the cost-cutting axe lately - its own half-year numbers showed it had swung from an operating loss of €100m in the first half of 2014 to a €5m profit thanks mainly to efficiencies and disposals. In terms of milestones for the deal, the UK Listing Authority is set to hand over its final documents to the company this month, which should mean completion in the first quarter of next year. Management's confidence is perhaps reflected in the decision of GVC's finance director, Richard Cooper, to buy more than 13,000 shares at 413p in recent weeks.

Granted, there is a worry that GVC's tax bill will rise. Its online gambling websites operate in an increasing number of markets, which is good because it diversifies revenue. But the trend in gambling is for extra taxation to accompany state regulation - it's the quid pro quo for legalising gambling in the first place.

| GVC (GVC) | ||||

|---|---|---|---|---|

| ORD PRICE: | 400p | MARKET VALUE: | £245m | |

| TOUCH: | 397-400p | 12-MONTH HIGH: | 499p | LOW: 371p |

| FORWARD DIVIDEND YIELD: | See text | FORWARD PE RATIO: | 12 | |

| NET ASSET VALUE: | 160p | NET CASH: | €13.6m | |

| Year to 31 Dec | Turnover (€m) | Pre-tax profit (€m) | Earnings per share (¢) | Dividend per share (¢) |

|---|---|---|---|---|

| 2012 | 60 | 10.8 | 29.3 | 22.0 |

| 2013 | 170 | 13.0 | 22.5 | 48.5 |

| 2014 | 225 | 41.3 | 66.4 | 55.5 |

| 2015* | 250 | 46.5 | 73.6 | 56.0 |

| 2016* | 858 | 141.7 | 46.4 | see text |

| % change | +242 | +205 | -37 | na |

Normal market size: 3,000 Market makers: 3 Beta: -0.07 *Panmure Gordon forecasts; £1=€1.399 | ||||