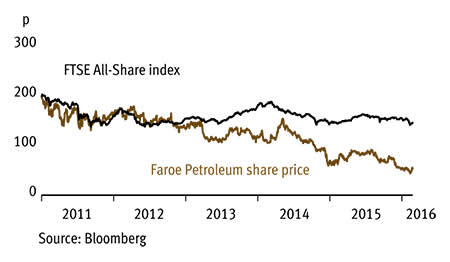

With the oil price having plummeted to around the $30 (£20.87) per barrel level, it is not hard to see the possibility of some major contrarian upside from shares in companies with exposure to the commodity should its price rebound. However, the sector presents substantial risks for even the most patient investor given the potential for many companies to require emergence fundraisings in order to survive. We think Faroe Petroleum (FPM), with net cash accounting for about 60 per cent of the current market cap and cash-generative North Sea operations, not only runs minimal risk of running into financial difficulties but should also be able to continue to investment in its business while oil prices are low and others are being forced to pull in their horns. This should leave it particularly well-placed if and when oil finally stages a sustained recovery from current depressed levels.

- Strong balance sheet

- Norway's offshore tax regime

- Step-up in 2P reserves

- Near-term drilling catalysts

- Weak oil price environment

- New Iranian barrels in the mix

While our recommendation to buy Faroe is not a direct call on the oil price - indeed, our best guess would be that the third quarter will be when a robust recovery is most likely to kick in - at some point the crude price should begin to retrace. But in the meantime Faroe looks well-placed to ride out the current malaise and benefit from any improvement in sentiment. And producers unencumbered by high debt levels should be set to profit over the long haul due to the industry-wide retrenchment - major industry projects equivalent to 20bn barrels have already been put on ice, or cancelled outright. While there's a Darwinian process at work in the oil industry, but we should remember that aggregate demand for energy is still rising rapidly, so even with new Iranian barrels in the mix, crude prices could rise sharply once it's assumed that the market is moving towards equilibrium.

Faroe was one of our Tips of the Year for 2009, but after a more than four-fold rise on our original buy call, the shares have slipped back to our original entry level. The good news is that much progress has been made since 2009, and Faroe provides a great play for investors that believe in the long-term economic viability of the Norwegian waters that are home to its producing and exploration assets. Norway's highly advantageous tax regime also gives Faroe a clear advantage over rivals located on the UK Continental Shelf.

Faroe's operational progress provides cause for optimism. At the half-year mark, Faroe increased the lower end of its 2015 production guidance to 9,000 barrels of oil equivalent per day (boepd), while operating costs fell to $22 per barrel. A subsequent independent technical report by LR Senergy effectively doubled the driller's proved and probable (2P) reserves to 60.6m barrels.

And there are potential share price catalysts in the offing. Faroe is moving ahead with three exploration wells in Norway this year: two near-field wells in the North Sea and one wildcat in the Barents Sea. Drilling has already commenced at the wildcat Kvalross prospect, although given the nature of the operation, the chances of success are limited. Nonetheless, the company has an impressive track record in discovering resources that are broadly in line with pre-drill risked resource estimates.

| FAROE PETROLEUM (FPM) | ||||

|---|---|---|---|---|

| ORD PRICE: | 52p | MARKET VALUE: | £141m | |

| TOUCH: | 52-53p | 12-MONTH HIGH: | 92p | LOW: 43p |

| FORWARD DIVIDEND YIELD: | nil | FORWARD PE RATIO: | na | |

| NET ASSET VALUE: | 87p | NET CASH: | £82m | |

| Year to 31 Dec | Turnover (£m) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2012 | 159 | -29.0 | -2.4 | nil |

| 2013 | 129 | 12.0 | 6.6 | nil |

| 2014 | 129 | -130 | -22.4 | nil |

| 2015* | 125 | -17.3 | -10.7 | nil |

| 2016* | 96.7 | -22.7 | -8.9 | nil |

| % change | -22 | - | - | - |

Normal market size: 10,000 Matched bargain trading Beta: 1.43 *Macquarie forecasts | ||||