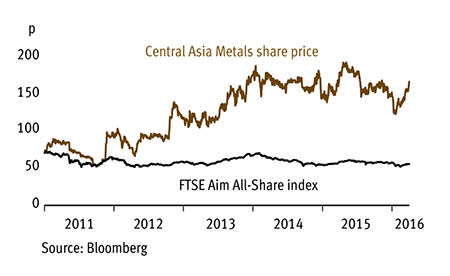

Aim-traded miners that pay a dividend are in the minority. Within that small subset, copper producer Central Asia Metals (CAML) should be singled out for having paid back the entire $60m (£42.5m) it raised from shareholders in its 2010 flotation. That's all the more impressive considering the drop in the price of copper since the company first started recovering the metal from its main plant in 2012. This commitment to shareholder returns, together with a strong balance sheet and an improving outlook for copper, should be good for Central Asia Metals' share price.

- Low-cost business model

- Excellent shareholder returns

- Net cash balance

- Copper price may have bottomed out

- Dividend set to dip short term

- Can't escape commodity price risk

The company's main asset is its low-cost plant in Kazakhstan, which recovers copper from dumps accumulated from the Kounrad open-pit mine between 1936 and 2005. These so-called 'waste' dumps comprise oxides and low-grade sulphides of copper, which, thanks to leaching and a process known as solvent extraction-electrowinning (SX-EW), can now be turned into a product that meets the London Metal Exchange's requirements for A-grade copper.

Last year, the miner completed an expansion of its SW-EW plant, increasing copper production capacity to 15,000 tonnes a year, 50 per cent higher than its output in 2012. That development - funded from its existing cash - should cut full-year cash costs to between 65¢ and 70¢ per pound when 2015 results are reported on 11 April. That puts Central Asia Metals at the foot of the global cost curve and, despite last year's $13m outlay on the SW-EW plant, December's cash balance stood at $42m.

Despite its cost advantages, the company's shares are a pure-play on the copper price - and recent history has been cruel. The metal has spent the past two years on a downward trajectory from $3 to $2 per pound, or $5,000 a metric tonne, due to the drop in demand for steel in China. Broadly, the consensus is that the copper price has bottomed out. That said, stockpiling, the slow unwinding of major projects and a supply surplus should keep prices below $3 until 2017.

The medium-term fundamentals are much better, however. Analysts at Canaccord Genuity estimate that at current prices perhaps a quarter of total global production is unprofitable, which could add to the production cuts already made. Meanwhile, few new projects are coming on stream. That situation has attractions for mega miners with sound finances - Rio Tinto (RIO) and BHP Billiton (BLT) are both expected to acquire copper assets*. Copper is also the only base metal that features in Anglo American’s (AAL) revamped strategy.

*This article was updated on 1 April 2016. Previously it read: "That situation has attractions for mega miners with sound finances - Anglo American (AAL), Rio Tinto (RIO), and BHP Billiton (BLT) are all expected to acquire copper assets."

CENTRAL ASIA METALS (CAML) | ||||

|---|---|---|---|---|

| ORD PRICE: | 168p | MARKET VALUE: | £188m | |

| TOUCH: | 164-168p | 12-MONTH HIGH: | 198p | LOW: 121p |

| FORWARD DIVIDEND YIELD: | 3.6% | FORWARD PE RATIO: | 16 | |

| NET ASSET VALUE: | 113p* | NET CASH: | $42m | |

| Year to 31 Dec | Turnover ($m) | Pre-tax profit ($m) | Earnings per share (¢) | Dividend per share (p) |

|---|---|---|---|---|

| 2012 | 30.7 | 14.8 | 11.0 | 10.7 |

| 2013 | 54.1 | 55.4 | 54.9 | 9.0 |

| 2014 | 76.6 | 70.3 | 56.3 | 12.5 |

| 2015* | 63.6 | 20.6 | 20.0 | 7.0 |

| 2016* | 65.3 | 24.1 | 15.0 | 6.0 |

| % change | +3 | +17 | -25 | -14 |

Normal market size: 2,000 Matched bargain trading Beta: 0.5 £1=$1.426 *Includes intangible assets of $78.3m, or 49p a share †Marten & Co forecasts | ||||