Unsurprisingly, the percentage losses stomached by the fallers significantly exceeded the gains of the risers in all three indices. Nonetheless, early beneficiaries of the EU referendum result include companies with limited reliance on the EU, significant overseas earnings that stand to benefit from the sterling's depreciation, or exposure to gold and other precious metals that are seen as safe havens during a crisis. Other 'winners' are companies that sell essential products and services - meaning they're largely insulated from a market downturn - and those exposed to emerging markets. The 'losers' have been companies that do most of their trade with European partners or sell discretionary goods such as cars and sofas.

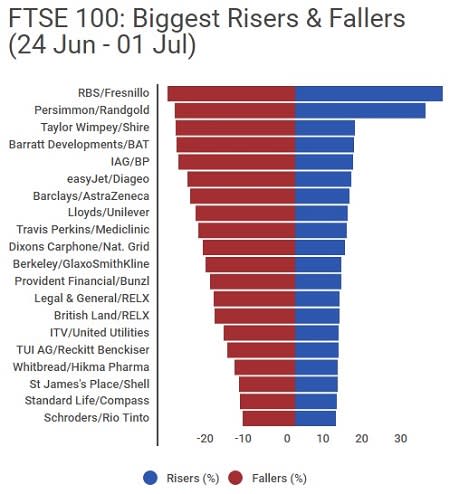

In the FTSE 100, miners such as Fresnillo (FRES) and Randgold Resources (RRS) have secured the largest gains, while international pharmaceutical companies such as AstraZeneca (AZN) and GlaxoSmithKline (GSK) have benefited too. Sellers of consumer goods including British American Tobacco (BATS) and Unilever (ULVR) have also registered gains, as consumers are likely to continue buying Lucky Strike cigarettes and Dove soap even in times of austerity.

Meanwhile, some of the biggest fallers were housebuilders Persimmon (PSN) and Taylor Wimpey (TW.), reflecting investors' concerns about the housing market and what severing ties to Europe and a possible economic downturn could mean for construction and foreign investment. Macroeconomic fears also meant Barclays (BARC), Standard Life (SL.) and other financial services groups suffered some of the heaviest valuation reductions.

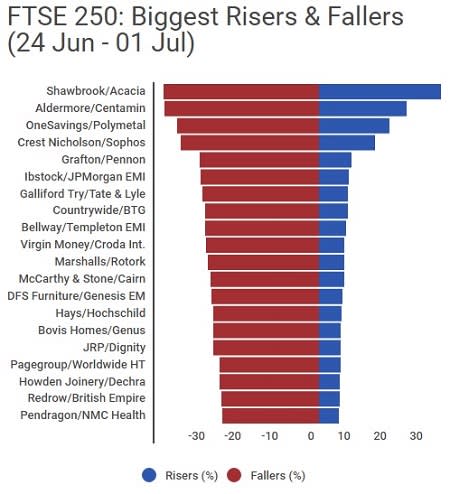

It's a similar story in the FTSE 250. The biggest risers include miners such as Centamin (CEY) and Polymetal International (POLY). Utilities specialist Pennon (PNN) and ingredients group Tate & Lyle (TATE) also enjoyed an uplift, as there will always be demand for food and running water. Moreover, JP Morgan EMI, Templeton EMI and other funds focused on emerging markets banked gains.

Unsurprisingly, the greatest fallers were banks such as Shawbrook (SHAW) and Aldermore (ALD), property developer Crest Nicholson (CRST) and Grafton (GFTU), a supplier of building materials. Shares in DFS Furniture (DFS) also slumped, presumably over fears that cash-strapped consumers could delay buying a new sofa.

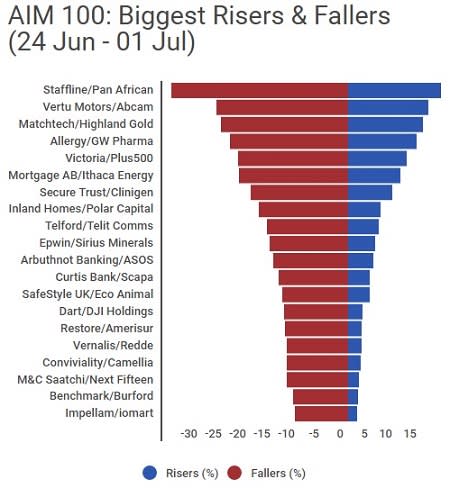

The same trends can be seen in the AIM 100. Pan African Resources (PAF) and Highland Gold (HGM) benefited from the flight to gold and precious metals, while international pharmaceuticals groups Abcam (ABC) and Clinigen (CLIN) rose on investors' desire to hedge their exposure to Europe. Meanwhile, shares in Vertu Motors (VTU) and Victoria (VCP) fell sharply, likely over concerns that consumers will delay buying new cars and carpets if the economic outlook worsens.