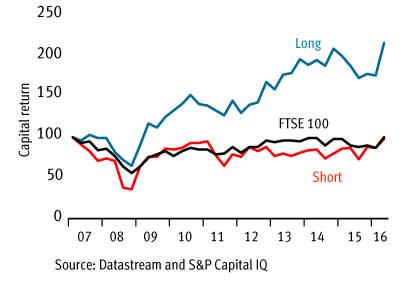

They say all good things come to those who wait, and for my blue-chip momentum screen this has certainly rung true over the past three months. Indeed, the last time I updated this most simple of screens, I bemoaned the fact that the blue-chip momentum 'longs' had underperformed the FTSE 100 index on both a one- and three-year basis. But how quickly things can change; over the past quarter the strategy has shot the lights out and the longs are now comfortably ahead of the index over both one and three years (see table) as well as longer time periods.

Long-term momentum performance:

| Capital return | Long | Short | FTSE 100 |

|---|---|---|---|

| Since inception | 116% | -1.8% | -0.2% |

| 5 years | 71% | 51% | 24% |

| 3 years | 20% | 28% | 3.6% |

| 1 year | 24% | 35% | 14% |

Source: Datastream/S&P CapitalIQ

The 10 long picks delivered a 22.5 per cent capital return over the three months, compared with an impressive 14.5 per cent from the market. What's more, all but two of the stocks selected by the screen three months ago outperformed the index. One could regard the result as a case of 'mean reversion' following a poor run. Faith in this statistical phenomenon formed a basis for the hopes I expressed in my last momentum update that a good outcome could be on the cards:

| From 16 June update: "There is a rich body of work pointing to the long-term outperformance of basic momentum strategies, so one would be hoping to see a reversion to outperformance from this screen at some point; hopefully it'll come in the coming three months." |

However, the performance of the 'shorts' (stocks that are selected to underperform the market) over recent years is another matter. While the shorts did underperform over the past three months, it is going to take much more of the same before this portion of the strategy can be regarded as behaving itself. Indeed, the shorts still show substantial outperformance compared with both the longs and the index over both one and three years (the opposite to what we're meant to be seeing). That said, since the screen's inception, the shorts are just about underperforming still (see graph below).

Source: Datastream/S&P CapitalIQ

A key reason for the poor performance of this momentum screen until the latest quarter was that the key themes the screen had latched on to at the end of one quarter (based on the best performing shares of the preceding period) were often being flipped on their heads during the subsequent three months. This was particularly painful for the shorts as a swift change in sentiment towards resources stocks earlier this year saw this portfolio of supposed losers notch up mega gains. However, the resources recovery has become quite an established trend now, and the success of the long portfolio was in no small part down to the fact that it contained a number of these plays (see table below). This theme persists in the portfolio the screen has chosen for the new quarter.

Another major reason for the long portfolio's success over the past three months was the strong representation of overseas earners (resources stocks included) among the 10-share portfolio. Such stocks rallied strongly following the outcome of the EU referendum, which was largely unexpected by the City, as sterling weakened, making overseas earnings more valuable when translated into pounds.

Stock-by-stock performance

| Capital return 15 Jun 2016 - 7 Sep 2016 | |||

|---|---|---|---|

| LONGS | SHORTS | ||

| Fresnillo | 41.1% | Sky | 1.1% |

| Anglo American | 31.7% | J Sainsbury | 5.2% |

| Ashtead | 33.9% | Standard Life | 19.9% |

| 3i | 21.8% | ITV | 4.0% |

| Johnson Matthey | 13.6% | Antofagasta | 20.1% |

| Royal Mail | 1.3% | Tesco | 13.1% |

| Standard Chartered | 25.5% | Next | 8.2% |

| BHP Billiton | 20.4% | Burberry | 23.9% |

| Shire | 18.6% | InterContinental Hotels | 28.0% |

| Randgold Resources Limited | 16.8% | Inmarsat | 11.6% |

| Average | 22.5% | - | 13.5% |

| FTSE 100 | 14.5% | - | 14.5% |

Source: S&P CapitalIQ

The nature of classic momentum investing means a very successful three months tends to limit the amount of turnover in a portfolio's holdings. That's because the screen works by simply selecting the 10 best performing shares of the last quarter, then holding them for three months before reshuffling the portfolio on the same lines. As last quarter's portfolio contained four of the top-10-performing blue-chip shares, only six new holdings have been introduced for the coming three months. The stock selection methodology is the same for the shorts, except the 10 worst performing shares are chosen rather than the 10 best.

Predictably, given the strong themes in the market following the Brexit vote, the longs are predominately resources plays and big overseas earners. Meanwhile, the shorts are mainly UK-focused, along with two airlines. The list of longs and shorts can be found in the tables below followed by some brief write-ups of the 10 longs.

Longs

| Name | TIDM | Price | Market cap | 3mth mom | NTM PE | DY* |

|---|---|---|---|---|---|---|

| Fresnillo | FRES | 1,640p | £12.1bn | 42% | 38 | 0.8% |

| Glencore | GLEN | 185p | £26.3bn | 36% | 34 | - |

| HSBC | HSBA | 578p | £114bn | 34% | 12 | 6.7% |

| Anglo American | AAL | 847p | £11.9bn | 33% | 15 | - |

| Ashtead | AHT | 1,233p | £6.2bn | 31% | 12 | 1.8% |

| Smiths Group | SMIN | 1,359p | £5.4bn | 28% | 17 | 3.0% |

| AstraZeneca | AZN | 4,819p | £61.0bn | 28% | 16 | 4.4% |

| Intercontinental Hotels | IHG | 3,169p | £6.2bn | 27% | 20 | 20.5% |

| CRH | CRH | 2,449p | £24.1bn | 27% | - | - |

| Standard Chartered | STAN | 640p | £21.0bn | 26.1% | 21 | - |

Shorts

| Name | TIDM | Price | Market cap | 3mth mom | NTM PE | DY* |

|---|---|---|---|---|---|---|

| easyJet | EZJ | 1,188p | £4.7bn | -18% | 11 | 4.6% |

| International Consolidated Airlines | IAG | 421p | £8.9bn | -14% | 6 | 4.0% |

| Berkeley | BKG | 2,658p | £3.6bn | -11% | 7 | 7.5% |

| Taylor Wimpey | TW. | 156p | £5.1bn | -11% | 9 | 7.0% |

| Travis Perkins | TPK | 1,609p | £4.0bn | -10% | 13 | 2.7% |

| British Land | BLND | 656p | £6.8bn | -9% | 18 | 4.5% |

| Lloyds Banking | LLOY | 59p | £42.2bn | -9% | 9 | 2.9% |

| Royal Bank of Scotland | RBS | 207p | £24.1bn | -8% | 13 | - |

| Barratt Developments | BDEV | 489p | £4.9bn | -7% | 10 | 6.3% |

| Persimmon | PSN | 1,816p | £5.6bn | -6.3% | 10 | 6.1% |

*includes special dividends

Source: S&P CapitalIQ

10 Top blue-chip momentum picks

Resources plays

Three resources stocks make it into the Longs this quarter: Fresnillo (FRES), Glencore (GLEN) and Anglo American (AAL). The common theme is that their earnings are very sensitive to the price of the metals and gems they sell and trade. All have benefited from rising prices and, just as importantly, improved sentiment towards the future trajectory of prices. However, this sector is still dealing with issues brought about by the commodity bust that preceded this year's nascent recovery.

Anglo is in the midst of a radical overhaul of its heavily indebted business, slashing staff, capital expenditure and its dividend while looking for buyers of assets it now deems non-core. Glencore has fought hard to keep its credit rating at a reasonable level, which is needed to underpin its trading activity. Like Anglo, excessive debt has seen Glencore look to cut costs and sell assets in order to shore up the balance sheet. Glencore's progress at the half-year stage looked impressive, and a further step in the right direction is recent news that the company has been confident enough to go to the debt market with a €1bn issue of seven-year bonds yielding less than 2 per cent. Fresnillo meanwhile has benefited from mining two of the hottest metals of 2016: gold and silver. The company has also benefited from cost cutting which has added to its recent performance surge.

Last IC view:

Anglo American, Sell, 862p, 4 Aug 2016

Glencore, Hold, 183p, 24 Aug 2016

Fresnillo, Hold, 1,930p, 2 Aug 2016

Overseas-focused banks

With interest rates falling into negative territory in much of the developed world, and (barring the jitters of recent days) expectations of rates in the US remaining 'lower for longer', there has been a revived interest in emerging markets assisted by the recovery in commodity prices. This has benefited banks with exposure to these markets. Previously, such banks had been suffering due to fears about emerging market economic weakness and currency falls; sources of concern for the earnings and debt quality.

Standard Chartered (STAN) produced interim results during the past three months that included some encouraging second-quarter numbers and reported a stable CET1 capital ratio of 13.1 per cent, meaning the balance sheet looks fairly robust. That said, Standard Chartered decided not to pay a first-half dividend, provided a cautious outlook statement and management said the bank would not manage to meet the target of raising return on equity to 8 per cent by 2018. HSBC (HSBA) also produced a torrid set of interim figures during the three months, however this big dollar earner did nevertheless offer shareholders some tangible rewards. These included a commitment to sustain the dividend at current levels for the foreseeable future and, following the sale of a Brazilian business, a share buyback of up to $2.5bn.

Last IC view:

Standard Chartered, Sell, 616p, 4 Aug 2016

Ashtead

Most of equipment hire group Ashtead's (AHT) business is done in the US, so its shares have benefited from currency movements over the past three months. However, the company's stock has also performed well because it continues to avoid the travails of rivals in both the US and UK. Indeed, a recent first-quarter update reported record margins, and cash generation is expected to start to improve as the company reins in spending on growth as it gets into a later phase of the current business cycle.

Last IC view: Hold, 1,325p, 8 Sep 2016

Smiths Group

Engineering conglomerate Smiths Group (SMIN) benefited from a positive year-end trading update during the three months. Trading has been especially good at the detection business, which is benefiting from increased spending on preventing terror attacks. The detection business should also be boosted by this year's $710m deal to acquire California-based Morpho Detection. However, bigger factors influencing the shares' recent strong performance are likely to be Smiths' exposure to the recovery in the oil price through its John Crane business (the benefit being for sentiment rather than profits at this stage) and the effect of sterling weakness on its overseas earnings. Full-year results this month could prove significant as Smiths has long been seen as a potential break-up play and the City will be hoping to hear how management plans to get more value from its diverse operations.

Last IC view: Hold, 1,322p, 10 Aug 2016

AstraZeneca

In the face of political uncertainty and weakening sterling, big pharma is a predictable first point of call for UK investors. Little surprise then that AstraZeneca (AZN) was a top-performing blue-chip over the past three months. The company has also made progress with its strategy of streamlining the business during the quarter by agreeing the sale of its antibiotics business to Pfizer for up to $1bn. And while profits have fallen this year as blockbuster drug Crestor goes off patent, investors seem impressed with the pipeline of new drugs in development and the potential for Astra to generate enough cash to support its dividend, which is paid in dollars.

Last IC view: Buy, 5,033p, 26 Aug 2016

InterContinental Hotels

InterContinental (IHG) released a mixed set of half-year results last month, although they were positive on the whole. Pockets of weak trading in London, Paris, the Middle East and oil-sensitive parts of the US were offset by stronger trading elsewhere. Meanwhile, the pipeline of new hotels InterContinental is being signed up to manage looks encouraging. However, there's no doubting that the heavy exposure to the dollar has been a major influence on the strong share price performance over the past three months.

Last IC view: Sell, 3,064p, 11 Aug 2016

CRH

After spending almost €8bn on acquisitions and investment in 2015, CRH (CRH) is busy integrating newly bought businesses and paying down the debt used to fund the deals. First-half results at the end of August were very encouraging, with cash profits more than doubling and management has kept a tight rein on costs. Margins widened for the group in both North America and Europe, and the company expects the US construction market to continue to grow for the next five years while Europe should continue its gradual recovery. CRH remains in expansion mode, with management guiding that there should be scope for €1bn-€1.5bn of acquisitions next year based on its expectations for debt reduction in 2016.

Last IC view: Buy, 2,541p, 30 Aug 2016