Last month’s column (‘Taking profits’, 9 September 2016) promised to explain why profits had been taken in the portfolios’ bond holdings and why the reduced exposure is more focused on the higher end of the yield curve. This represents a major change in the portfolios’ bond policy – with both having long benefited from our overweight position.

Reducing bond exposure

Regular readers will be well aware of our caution about economic policy. Central bankers are fast approaching the limit of their capabilities in promoting growth. Policies perhaps once considered radical – persistently low interest rates, quantitative easing (QE), negative interest rates – have now become the norm. A slowdown and financial crisis caused by high debt was always going to present unique challenges.

Our long-held view that interest rates were going to remain low for longer than consensus forecasts suggested has meant our portfolios have benefited from our overweight position in bonds. We have long viewed with scepticism market talk about ‘bond bubbles’ – the economic backdrop, together with a regulatory framework that encouraged the large financial institutions to buy bonds, suggested the market was well supported.

But there comes a point when the balance of probabilities as to perceived outcomes has to be reassessed. As policy-makers increase their efforts to stimulate growth, whether successful or not, the perception will gradually gain ground that inflation will rise as a result.

If economic growth remains elusive, governments could intervene more directly and undertake various ‘helicopter cash’ initiatives. If this happens, the bond market’s perception may not be wholly positive as inflation expectations may rise. If it doesn’t, it may worry about the possibility of such initiatives if growth continues to disappoint. Either way, bonds could react badly.

But there are other reasons to take profits. As an investment journey progresses, bonds play an essential role in assisting with portfolio diversification in order to protect past gains. However, in allocating weightings, the relative value of other asset types, also less correlated to equities, should be considered. Some of these currently look relatively attractive – including commercial property, commodities and renewable energy.

Furthermore, these other asset types offer higher yields and, importantly, the prospect of dividend increases over time. The correlation of such assets with equities may be somewhat closer than bonds, but this can be compensated for by ensuring a higher weighting in cash.

Meanwhile, the portfolios’ reduced bond exposure is now more focused on the higher end of the yield curve, which has recently underperformed the ‘high-grade’ alternatives. This is understandable, but may change given the scenario suggested above. The perception and perhaps reality of lower default risk increases the attractiveness of high-yielding corporate debt, while such debt may react better to the early stages of any tick-up in inflation.

One can seldom time such changes in policy perfectly – forecasts of bursting bond bubbles have long been common. However, the balance of probability suggests this is a good time to take profits – having enjoyed a good run in our overweight positions to-date. Bonds will continue to feature in those portfolios where diversification and yield are important but, given the alternatives on offer, taking profits is seldom the stepping stone to ruin.

Portfolio changes

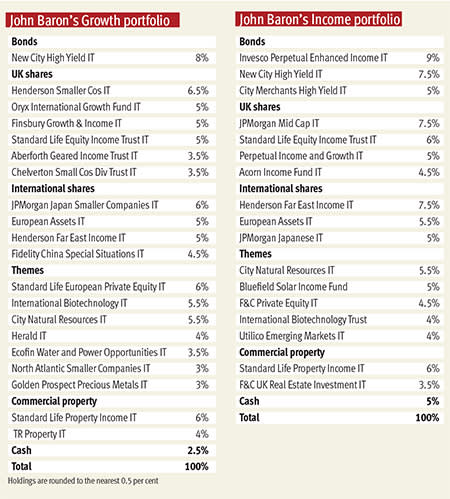

During September, as part of the bond policy shift initiated in August, both portfolios sold their entire holdings in iShares Corporate Bond Fund ex-Fin ETF (ISXF). While the portfolios’ overall cash positions have been increased, some of the proceeds were used to top up existing higher-yielding bond holdings – these being New City High Yield (NCYF) in the Growth portfolio, and Invesco Perpetual Enhanced Income (IPE) in the Income.

Some of the remaining proceeds of the ISXF sale were also used to increase equity positions. A common purchase for both portfolios was International Biotechnology Trust (IBT) – adding to an existing holding in the Growth portfolio, and re-introducing it to the Income. Recent corporate news and a conversation with the manager suggest strong support – the website johnbaronportfolios.co.uk has more details.

Within the Growth portfolio, Standard Life European Private Equity (SEP) was topped up. Meanwhile, within the Income portfolio, the sale of M&G High Income Inc shares (MGHI), as it heads towards its wind-up, also helped to fund further purchases of Standard Life Equity Income Trust (SLET), Acorn Income Fund (AIF) and Bluefield Solar Income Fund (BSIF) – the latter to assist with diversification.

Golden Prospect Precious Metals

Last month’s column also promised to explain why the Growth portfolio increased its exposure to precious metals during August courtesy of Golden Prospect Precious Metals (GPM). This was part of the shift away from bonds, and into alternative assets to assist with diversification.

GPM’s metal exposure is approximately two-thirds gold and one-third silver. It is run by Keith Watson and Robert Crayfourd, and has enjoyed a strong run in the year to date as sentiment towards gold has improved. With growing concern about the efficacy of central bank policies in stimulating growth and the knock-on effect such policies may be having on respective currencies, gold has performed well.

Meanwhile, silver has industrial uses and is often seen as the more volatile of the two metals. Perhaps because of concerns about the economic outlook, it has not performed as well as gold of late. Indeed, the gold/silver rate is well above its five-year average – suggesting silver is cheap in relative terms.

The gold and silver mining companies still appear attractively priced relative to the underlying metals. These companies have been restructuring and this is ongoing – they are leaner and fitter than they have been for a long time. As such, they are generating a lot of cash. Speaking with Mr Crayfourd, GPM looks to companies producing 15 per cent free cash flow and double-digit earnings growth, which is attractive. Dividends may be on the rise.

Many insiders believe the recent market environment for precious metals is more positive than it has been during the past three years. Mr Crayfourd certainly shares this optimism and believes mining companies can still perform well even if the metal prices stay around current levels. GPM’s focus on smaller companies should also bode well given that further value can be found.

All in all, GPM looks attractive. A well-established and experienced management team, a near-20 per cent discount when bought, a sector benefiting from restructuring and exposure to commodities, which are increasingly seen as insurance in an uncertain world, all suggest patient investors will be rewarded. The recent correction in mining shares during August – a month not typically kind to gold shares – suggests now may also be a good entry point.

John Baron waives his fee for this column in lieu of donations by Investors Chronicle to charities of his choice. As these are live portfolios, he has interests in all of the investments mentioned.