For investors desiring a strong festive tipple, Enterprise Inns (ETI) may fit the bill. The pub group became synonymous with pre-credit-crunch excess after loading up with vast amounts of debt secured against income-producing assets (pubs) before discovering the income from those assets was less stable than hoped. The consequence has been a hangover that has lasted almost a decade and net debt that, despite extensive efforts, remains stubbornly high at 7.5 times the company's cash profit and more than four times its market capitalisation, meanwhile underlying interest cover stands at just 1.8 times.

- Improved trading

- Refinanced some debt

- Investment in estate

- Share buybacks

- Huge debt

- Market open rents

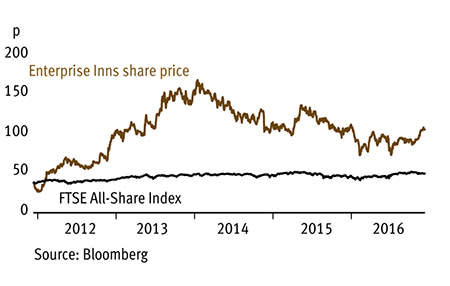

Given the scale of Enterprise's debt, the shares are massively sensitive to any improvement or deterioration in trading, which makes them very high risk but also potentially very high reward. Having spent some weeks since the recent full-year results studying the numbers, we think there are enough positive developments to now move the shares to a speculative buy.

News from Enterprise's pub estate last year was positive across the board. The group reported that rent reviews and a drop in business failures had lifted like-for-like sales from its 4,470 leased and tenanted pubs by 2.1 per cent. What's more, there was growth across all regions, including the north for the first time in several years. And the tenanted model should help shield Enterprise from industry cost pressures in the current financial year, while the introduction of market open rents doesn't seem to be causing too many issues yet.

The group also broke another long-running negative trend by reporting that the value of the estate at £3.6bn had actually increased last year. This has been helped by the group's development of a portfolio of 291 commercial properties, which it plans to grow to between 400 and 450.

Net debt fell by £120m during the year. Enterprise refinanced £250m-worth of bonds at a lower, although still lofty, interest rate (6.375 per cent from 6.5 per cent) and extended the maturity from 2018 to 2022. The group is also £80m ahead of the "amortisation" schedule on its huge £1.1bn 2032 'class A' securitisation debt, which provides some comfort as scheduled payments ratchet up from £74m last year to £85m in 2019.

Another encouraging sign from the securitisation is that noteholders agreed to give Enterprise permission to pursue its promising strategy of converting more tenanted pubs into own-managed pubs. It plans to take the number from 99 at the September year-end to 800 by September 2020. The strong payback from this strategy contributed to the group generating an overall return on investment of 22 per cent (up from 19 per cent) from the £74m invested during the year. As well as using excess cash to invest in the business, the company has shown its confidence by spending £14m of £25m earmarked for share buybacks, which is another encouraging sign of management's confidence in the business and its balance sheet.

| ENTERPRISE INNS (ETI) | ||||

|---|---|---|---|---|

| ORD PRICE: | 107p | MARKET VALUE: | £525m | |

| TOUCH: | 107-107.3p | 12-MONTH HIGH: | 114p | LOW: 70p |

| FORWARD DIVIDEND YIELD: | nil | FORWARD PE RATIO: | 5.5 | |

| NET ASSET VALUE: | 295p* | NET DEBT: | £2.2bn | |

| Year to 30 Sep | Turnover (£m) | Pre-tax profit (£m)** | Earnings per share (p)** | Dividend per share (p) |

|---|---|---|---|---|

| 2014 | 632 | 121 | 18.6 | nil |

| 2015 | 625 | 122 | 19.4 | nil |

| 2016 | 632 | 122 | 19.2 | nil |

| 2017* | 609 | 122 | 19.3 | nil |

| 2018* | 600 | 123 | 19.4 | nil |

| % change | -2 | +0 | +1 | - |

Normal market size: 5,000 Matched bargain trading Beta: 0.59 **Barclays forecasts, adjusted PTP and EPS figures *Includes intangible assets of £330m, or 67p a share | ||||