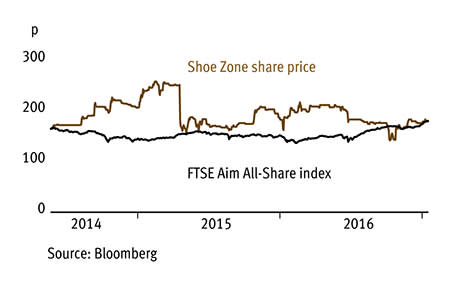

Shoe Zone (SHOE) has delivered a profit increase and a further special dividend for 2016 despite a difficult trading backdrop, which suggests the value shoe retailer's self-help strategy focused on its property estate, product, inventory, costs and cash management is working. The coming year looks likely to be another one marred by the external challenges of weaker consumer demand and cost pressures linked to sterling weakness and the new living wage. But other growth initiatives such as the group's new out-of-town 'big box' format stores and accelerating online sales should start to gain more traction. And while investors should not expect too much on the growth front, the shares current forward yield stands in excess of 10 per cent if a maintained special dividend is included, making the stock an enticing income play.

- Falling rent costs

- Special dividend

- 'Big box' rollout

- Value offer

- Cost inflation

- Uncertain consumer outlook

Shoe Zone reported pre-tax profit of £10.3m in 2016, slightly ahead of the prior year and in line with analysts' expectations. Revenue was down 4 per cent, but this was flagged in the pre-close statement and largely reflected the continued exit from unprofitable stores. Gross margins rose 50 basis points thanks to better sourcing activity in local currencies, pricing and stock management, while operating costs also fell as expected, reflecting ongoing store closures and lower-rent lease renewals.

Indeed, Shoe Zone is using the travails of the high street to its advantage by pushing rents down. During 2016 it managed to negotiate rents down 17 per cent on average on the leases it renewed. And the short length of leases on its 510-store estate (only 13 per cent of its £79m, end-2015 property-lease commitments extended beyond five years) should provide it with further opportunities to squeeze hard-pressed landlords in 2017.

The group's net cash should be seen in light of ongoing rental commitments, which in many ways are similar to debt held against freehold properties. Sharepad puts an estimated value on Shoe Zone's lease liabilities of £169m based on annual rents.

Shoe Zone's short leases, which give it more flexibility to close unprofitable stores, makes it a safer bet amid the decline on the UK high street. But the company is also focusing on more promising parts of the retail market. It has turned its attention to the online arena, and its marketplaces on Amazon and eBay have allowed global expansion without the usual expense required to enter overseas markets. But the company is careful about the extent of low-price products it sells via the sites relative to the costs incurred, specifically regarding postage and commission fees. The company's three trial 'big box' stores have also produced encouraging results and this out-of-town format looks set to become more of a focus.

As for the wider consumer climate, we thing retailers offering a value proposition, such as Shoe Zone, look better placed than their mid-market peers. What's more, customers that trade down tend to be 'sticky', which should help Shoe Zone given the expectation of rising costs associated with sterling's decline and wage increases.

| SHOE ZONE (SHOE) | ||||

|---|---|---|---|---|

| ORD PRICE: | 180p | MARKET VALUE: | £90m | |

| TOUCH: | 175-185p | 12-MONTH HIGH: | 219p | LOW: 137p |

| FORWARD DIVIDEND YIELD: | 6% | FORWARD PE RATIO: | 10 | |

| NET ASSET VALUE: | 33p | NET CASH: | £15m | |

| Year to 1 Oct | Turnover (£m) | Pre-tax profit (£m)* | Earnings per share (p)* | Dividend per share (p)* |

|---|---|---|---|---|

| 2014 | 173 | 11.4 | 17.9 | 3.6 |

| 2015 | 167 | 10.1 | 16.2 | 9.7 |

| 2016 | 160 | 10.3 | 17.1 | 10.3 |

| 2017* | 158 | 10.5 | 17.3 | 10.5 |

| 2018* | 161 | 10.7 | 17.7 | 10.8 |

| % change | +2 | +2 | +2 | +3 |

Normal market size: 1,500 Matched bargain trading Beta: 0.2 *Numis forecasts, adjusted PTP and EPS figures, excludes special dividends of 6p in 2015 and 8p in 2016 | ||||