Half-year results for Pan African Resources (PAF) contained some strong numbers when they landed a week ago, but for a number of reasons sentiment is understandably subdued. For one thing, operational difficulties at the gold producer's mines meant production fell 10 per cent in the six months to December. To compound this, the Alternative Investment Market (Aim)-listed group was forced to suspend underground mining operations at its Evander mine just two days before the half-year results, after management identified "critical infrastructure issues".

- Strong dividend

- Super low PE rating

- Low-cost production growth

- Play on sterling weakness

- Evander mine suspension

- Gold price uncertainty

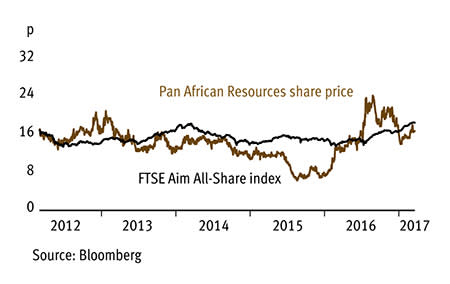

Against these challenges, Pan African would do well to hit its revised guidance for 195,000 ounces (oz) of gold while maintaining first-half all-in sustaining costs of $1,014 (£814). However, even if it fails to do so, we think now is the time to reiterate our 2015 buy call, which has delivered a 66 per cent total return to date. Put simply, the company looks too cheap considering its prospects, and should continue to reward patient shareholders with an excellent yield.

Chief among those prospects is a plan for a new source of gold output. In December, the board sanctioned the 1.73m oz Elikhulu project, after a definitive feasibility study showed that a mine capable of producing 56,000 oz a year could be up and running by late 2018. Although the total project outlay will be around £103m, the pay-off is set to be one of the lowest all-in sustaining costs in the market at $523 an oz. Much of the financing for the deal is in place, thanks to an existing revolving credit facility which can extend to £65.1m, and an undertaking from Rand Merchant Bank to provide a ZAR1bn (£61.8m) five-year loan, which Pan African will be able to repay from Elikhulu's cash flows. All of this assumes a long-term gold price of $1,180 an ounce, a level gold has only been below in a handful of months since 2010.

That was the case for much of December, as global investors piled out of gold and into equities. Fortunately for Pan African, the overall first-half average sales price stood at $1,257, which helped to take the sting out of higher costs. These were caused by a shaft accident at Evander and a combination of local community unrest and government-enforced safety stoppages at the larger Barberton mine, which resulted in 14 days of lost production.

Pan African's immediate priorities are therefore to improve community relations at Barberton, and get Evander shipshape. Re-opening of underground operations at Evander, expected by mid-April, should also provide some reassurance on net operating cash flows, 40 per cent of these cash flows, adjusted for maintenance capital expenditure and scheduled debt repayment, are set aside for dividends. Even if this takes a hit from lower production, next year's payout is forecast to be more than twice covered by expected earnings, suggesting a degree of comfort.

| PAN AFRICAN RESOURCES (PAF) | ||||

|---|---|---|---|---|

| ORD PRICE: | 17p | MARKET VALUE: | £330m | |

| TOUCH: | 16.8-17p | 12-MONTH HIGH: | 25p | LOW: 12p |

| FORWARD DIVIDEND YIELD: | 6.0% | FORWARD PE RATIO: | 6 | |

| NET ASSET VALUE: | 8.95p | NET DEBT: | 17% | |

| Year to 30 Jun | Turnover (£m) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2014 | 154 | 34.0 | 1.5 | 0.82 |

| 2015 | 141 | 16.0 | 0.6 | 0.54 |

| 2016 | 168 | 45.9 | 2.1 | 0.88 |

| 2017* | 196 | 52.0 | 2.4 | 0.98 |

| 2018* | 201 | 58.7 | 2.6 | 1.02 |

| % change | +3 | +13 | +11 | +4 |

Normal market size: 20,000 Matched bargain trading Beta: 0.39 *Edison forecasts. | ||||