Born out of a merger between Just Retirement and Partnership Assurance last year, JRP (JRP) has set out its stall as a life assurer focused on quality rather than just quantity of new business. And while many predicted that the introduction of so-called pension freedoms in 2015 would lead to a savage drop off in individual annuity sales - one of JRP's key markets - there are encouraging signs that retirees still want these products even at a time of ultra-low rates. What's more, the withdrawal from the market of large insurers, such as Prudential (PRU), and rising "open market" sales means there are more potential customers up for grabs. Meanwhile, the life assurer's prudent approach to writing policies helped it double its new business margins last year. At the same time the group is diversifying geographically and by product line. Despite the growth opportunities on offer, individual-annuity worries, which we think increasingly look overstated, mean the insurer's shares trade at a discount to its peers.

- Diversification potential

- Growing annuity sales

- Trading at a discount to peers

- Benefiting from higher mortgage spreads

- Slim dividend yield

- Concentration in individual annuities

JRP operates in three business areas: defined benefit pension scheme derisking (also known as 'bulk annuities'), individual annuities and lifetime mortgages. Since the merger in April the first of these has been the fastest growing area of the group. Management's focus is on the buy-in area of the market, which derisks pensions already being paid. This involves JRP making regular payments to a pension scheme for an agreed number of members' benefits, and also drawing on its expertise in medically-underwritten annuities to take on the longevity risk of members living longer than anticipated.

There was a surge in derisking sales during the latter half of 2015 ahead of the introduction of Solvency II in January last year. This meant sales were down by about a quarter during 2016 to £943m. However, when compared with more normal levels during 2014, sales were up more than a third. What’s more, momentum grew as the year went on, with sales during the second half totalling £779m - almost five times what they were during the first six months.

Unlike many of the larger life assurers, JRP still has a chunk of its revenue coming from individual annuities. This was viewed as a negative by some investors following the introduction of the pensions freedom changes in 2015. However, we reckon concerns that annuity sales would fall off a cliff are overdone. Sales of individual annuities, or as JRP calls them 'guaranteed income for life', increased by 2 per cent last year.

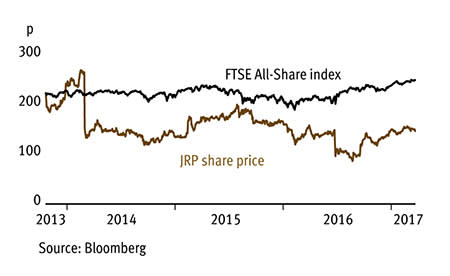

Management attributes this to growth in the open market, meaning more retirees are shopping around for annuities. The open market accounted for 50 per cent of individual annuity sales during the first three quarters of last year, compared with 41 per cent in 2015, and the market as whole is recovering following a dip following the pension-freedom changes (see chart). There is also more potential business up for grabs due to larger insurers redirecting their focus away from individual annuities and towards asset management. However, even large insurers such as Aviva (AV.) have recently enjoyed an increase in individual annuity sales.

Another area JRP is diversifying further into is lifetime mortgages, better known as 'equity release'. These assets provide a good match for the assurer's liabilities, particularly its derisking products where liabilities are longer in duration than individual annuities due to the fact benefits are linked to inflation. The equity release market grew 30 per cent during 2016. Admittedly, JRP's sales of these products fell back 6 per cent during this time to £559m. However, this was because the group took its foot off the gas during the final quarter to ensure it stayed within its target ratio of equity release sales to new retirement income liabilities. A reduction in risk-free rates meant JRP wrote new business at much higher mortgage spreads, which contributed to the group's new business margins more than doubling to 6.8 per cent.

JRP (JRP) | ||||

|---|---|---|---|---|

| ORD PRICE: | 150p | MARKET VALUE: | £1.4bn | |

| TOUCH: | 149.6-150p | 12-MONTH HIGH: | 161p | LOW: 85p |

| FORWARD DIVIDEND YIELD: | 2% | FORWARD PE RATIO: | 12 | |

| NET ASSET VALUE: | 173p | SOLVENCY II RATIO: | 151% | |

| Year to 31 Dec | Total sales (£bn) | Operating profit (£m) | Earnings per share (p)** | Dividend per share (p)** |

|---|---|---|---|---|

| 2015 | 2.71 | 104 | 8.9 | 3.3 |

| 2016 | 2.41 | 164 | 14.0 | 3.5 |

| 2017** | 2.73 | 153 | 13.1 | 3.6 |

| 2018** | 3.19 | 182 | 15.6 | 3.8 |

| % change | +17 | +19 | +19 | +7 |

Normal market size: 5,000 Matched bargain trading Beta: 0.13 **Panmure Gordon forecasts, adjusted PTP and EPS figures | ||||