Political fears

Geopolitical uncertainty just refuses to go away. In fact it is getting ever closer to home with the Netherlands going to the polls this week with an anti-immigration and anti-EU party polling strongly, Nicola Sturgeon indicating a desire to take Scotland to an independence vote again by the end of next year, and Theresa May’s finger hovering over the ‘go’ button on Brexit talks. Discussions with the EU over the UK’s exit will be formally triggered by the end of this month but the prospect of another Scottish referendum before EU talks are over is unpalatable for the government and Mrs May is expected to try to push any such vote out to 2019.

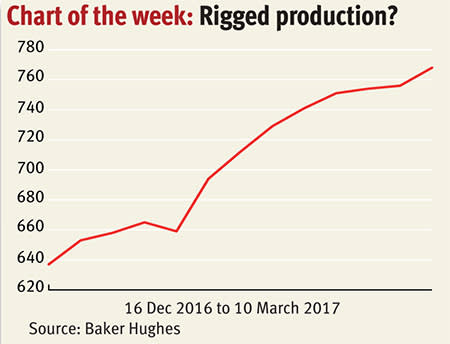

Oil slick

Price falls

The sustained fall in the oil price continued early this week as the Opec cartel boosted its estimates for 2017 production from non-Opec countries. Chief culprit behind the 400,000 barrels a day increase in non-Opec output to 57.7m is the renewed surge in production from US shale oil. The price of oil has dropped by more than 10 per cent over the past 10 days as marginal producers have stepped back into the market. They have negated the production freeze enacted by the Opec members, leaving global oil supplies and inventories at high levels.

Fed rising

More to come

As we went to press the Federal Reserve was pretty much nailed on to nudge US interest rates up by another 0.25 per cent, as the process of ‘normalisation’ of interest rates after the prolonged trough continues. With growth and inflation both on the rise in the US economy it is looking likely that further rises will be approved later in the year, possibly as soon as June, with the US economy finally judged to be strong enough to cope with slightly higher rates. But the road back to ‘normal’, if anyone remembers what that is, will likely be a long one.

Tonic time

Basket update

The UK consumer’s changing tastes are laid bare by changes to the products that go to make up the Office for National Statistics’ fictional basket of goods, used to measure inflation. The latest annual changes reflect the booming demand for gin, non-dairy milk and also bicycle helmets, while kids scooters replace swings in their affections. Ditched from the basket are goods such as menthol cigarettes, apple cider and mobile phone handsets, which have been replaced by smartphones.

Deal hungry

UK M&A boom

Political uncertainty is not putting the City’s rainmakers off pushing for mega deals among London’s quoted companies. Last week we saw Standard Life and Aberdeen announce merger plans and this week we have seen Amec Foster Wheeler agree a take-over deal from oil services rival Wood Group. Meanwhile, housebuilder Bovis Homes has knocked back speculative approaches from both rival housebuilder Redrow and peer Galliford Try, with the latter looking the more likely winner of any competitive action at the time of going to press. This takes the value of domestic deals suggested in the first 10 weeks of the year to $24.3bn, the highest level since the opening weeks of 2008.

Hogg gone

BoE shaken

The new deputy governor of the Bank of England, Charlotte Hogg, has been forced to resign from her post for falling short of a code of conduct she was instrumental in drawing up during her time as chief operating officer of the bank during the past four years. Ms Hogg said she had made “an honest mistake” when failing to tell the Bank during the period of her employment that her brother was employed as a senior executive at Barclays, a role that could potentially lead to a familial conflict of interest.

Protection call

Level the playing field

Unilever, which was the subject of a brief aborted takeover offer from smaller US rival Kraft Heinz last month, has called for UK companies to be offered greater protection by the rules that govern takeover situations. Referencing ‘national champions’ like itself, Unilever chief executive Paul Polman said the current rules, under which the government can only step in and block offers if they threaten security, financial stability or media plurality, are stacked in favour of bidders. In particular, the 28-day deadline within which a bid needs to be made disadvantages the target company in only giving it four weeks to frame a response to a company, which may have been working on a hostile bid for months or even years.

The prevalence of the shale oil industry in the US, where it is possible to ramp up production rapidly in times of need or high prices, has made the country something of a swing producer in global markets.

This can be seen by recent data from Baker Hughes which shows a rapid ramp up in the number of oil producing rigs in the US over the past three months, which have seen an increase of 20 per cent in rig numbers alone to 768 – a figure which is up 60 per cent on a year ago. This was prompted by a rise in the oil price as Opec members negotiated their own production freeze to try to support the oil price. While Opec’s freeze has taken effect, US production appears to have filled the void and inventory levels are on the rise again, prompting questions over how much ‘control’ the Opec cartel can have over the global market any more.