The debate over executive pay has never been far from the front pages in recent years, but it has come to the forefront during this year's AGM season. A range of high-profile companies are facing pressure from shareholders over the pay packages offered to those in the top jobs. The Enterprise and Regulatory Reform Act 2013, introduced by the coalition government, requires companies to seek shareholder approval for their forward-looking remuneration policy at least once every three years. The result of such votes are binding and could have a significant impact on the chief executive's compensation if they are not passed.

This year is more important than most. Tom Gosling, partner at consultancy PwC and author of numerous reports on executive pay, noted that as the three-year mark since the policy was introduced passes this AGM season, nearly two-thirds of companies will have votes on their remuneration policies.

Pearson (PSON) came under fire after chief executive John Fallon received a 20 per cent pay rise while shares in the company performed poorly. A spokesperson for Pearson said: "The board put a great deal of time and focus into the remuneration process, exercising significant discretion, to make sure we came to a fair conclusion. We acknowledge our shareholders' feedback and will continue to engage with them to ensure our approach to remuneration reflects the best long-term interests of the company.”

Shareholders in Crest Nicholson (CRST) also voted 58 per cent against the housebuilder's 2016 remuneration report in March. This followed shareholder concern over the reduction in profit targets at which executives' long-term incentive payouts kick in. The housebuilder said that while it expected the rate of profit growth to remain robust it would not be at levels seen in recent years. This is due to factors including tough comparators and additional investment in land.

Political pressure weighs heavily

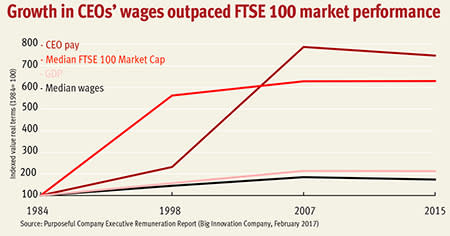

Executive pay has become a core issue in modern British politics, with both Theresa May and Jeremy Corbyn speaking about the need for action. Last November the government released a green paper on corporate governance reform, which floated the idea of making some or all elements of executives' pay packages subject to annual binding votes. Mr Corbyn has spoken in favour of pay ratios limiting remuneration to a multiple of the salary of less senior employees.

Despite political support for action, research cited in PwC's 'Executive pay in a world of truthiness' report claimed "most analysis of pay and performance ignores basic adjustment for company size and fails to take account of the impact of previously awarded equity". Allowing for these two factors, performance explains 80 per cent of the variance in total chief executive pay in the UK, its authors said. The report also cited high levels of support from shareholders, with only 2 to 3 per cent of companies either losing a vote or getting more than 20 per cent opposition.

However, Catherine Howarth, chief executive of responsible investment charity ShareAction, said support for remuneration packages was often voted through by asset managers on behalf of large institutional investors, despite being "quite poorly aligned with shareholders' long-term interest". She added: "Small investors have incredibly little power."

ShareAction has been calling for shareholders to vote against the remuneration policies of oil giants Royal Dutch Shell (RDSA) and BP (BP), arguing that the strategic priorities of both companies are not consistent with climate change scenarios limiting global warming to 2°C, the goal of the Paris Agreement. Shell could not be reached for comment, but a spokesperson for BP said: "We have worked closely with our major shareholders to develop a new remuneration policy that will be presented at the 2017 AGM. We are pleased to see that the three largest proxy advisers have all reacted positively to the new policy and remuneration report and have recommended voting in favour to their shareholder clients."