Nearly three-quarters of Games Workshop's (GAR) sales are generated overseas, which makes it a significant beneficiary of the current weakness in the pound. But the timing of the currency-related boost also coincides with a tangible uptick in trading, something chief executive Kevin Rountree says is built on a "considerable team effort across the business".

- High level of overseas earnings

- Attractive dividend yield

- Real improvement in underlying trading

- Analyst upgrades

- Unpredictable royalty income

- Spotty track record

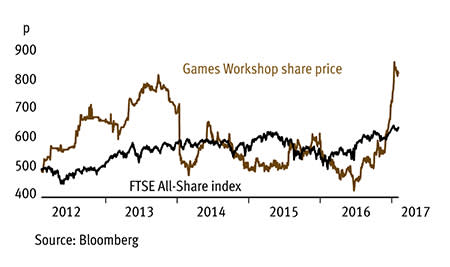

Last month's half-year results from the retailer of fantasy games and models were a cause for investor jubilation and prompted broker Peel Hunt to upgrade its forecasts for the full year by 17 per cent. Significantly, that upgrade followed a whopping 30 per cent mark-up on the back of a December trading update.

Given Games Workshop has a reputation for not being overly concerned about pandering to the City's taste for a smooth earnings trajectory, it's important that the basis of recent trading success looks likely to prove more than a flash in the pan. True, currency did play a significant part in boosting first-half sales by 28 per cent to £70.9m, but growth was 13 per cent even without this tailwind. What's more, progress has been made across all three of the group's main divisions and across all territories.

The standout performance in the first half was the 20 per cent constant-currency sales growth to £25.8m from Games Workshop's own retail estate - especially given that this division has struggled for some time. The division is showing growth across all territories, but particularly in the US where management has used some of the currency movement to reduce prices. There are encouraging signs that stores are benefiting from a focus on improved staff training and retention based on increased sales of starter packs. Also, the first two of "many" new products from the company's specialist design studio have sold well. And the company has started to make better use of social media to engage with customers and boost sales.

During the first half, the group opened 17 stores and closed eight, leaving the current store estate at 460. The trade division (35 per cent of first-half sales) is also doing well, with 60 new accounts added during the six months, while mail-order sales (17 per cent of sales) rose 8 per cent. Finally, the amount of royalties Games Workshop receives in relation to its licensed business rose from £1.5m to £3.3m.

Royalty revenue is inherently hard to predict and an expected fall back to more normal levels in 2018 is reflected in the forecast for that year in our table below. The company is also expected to benefit from a £1.4m gain this year (and similar benefits in the future) due to a change in how it depreciates assets. We're inclined to regard this as a positive reflection of the group having to adjust for the overly conservative nature of its accounts rather than management trying to pull a fast one.

| GAMES WORKSHOP (GAW) | ||||

|---|---|---|---|---|

| ORD PRICE: | 844p | MARKET VALUE: | £271m | |

| TOUCH: | 829-844p | 12-MONTHHIGH: | 885p | LOW: 420p |

| FORWARD DIVIDEND YIELD: | 5.9% | FORWARD PE RATIO: | 13 | |

| NET ASSET VALUE: | 183p* | NET CASH: | £15.9m | |

| Year to 31 May | Turnover (£m) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2014 | 124 | 16.9 | 36.0 | 20.0 |

| 2015 | 119 | 16.6 | 38.2 | 32.0 |

| 2016 | 118 | 16.9 | 41.9 | 40.0 |

| 2017** | 140 | 28.0 | 67.7 | 55.0 |

| 2018** | 147 | 26.0 | 62.9 | 50.0 |

| % change | +4 | -7 | -7 | -9 |

Normal market size: 500 Matched bargain trading Beta: 0.34 *Includes intangible assets of £14.3m, or 44.4p a share **Peel Hunt forecasts, adjusted PTP and EPS | ||||