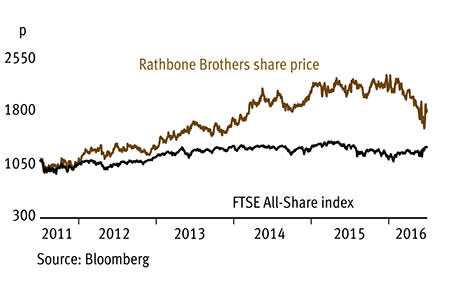

With almost all its income generated via discretionary wealth management and with sector-beating profit margins, Rathbone Brothers (RAT) is a top-quality player in the wealth management industry. Rathbone has also grown the distribution network for its services, expanding overseas and, despite volatile financial markets, has continued to win new business and outperform the FTSE 100 index and WMA Balanced Index. Following the uncertainty unleashed by the Brexit vote, shares in the wealth manager now trade around their three-year low and on an earnings multiple several points lower than their level early in the year. We believe this provides a good opportunity to buy shares in a quality act.

- Shift towards more stable fee income

- Sector-beating profit margins

- Structural industry growth

- Unjustified fall in rating

- Stock market volatility

- Falling commission income

Rathbone revised its tariffs for investment management services at the start of last year. New clients are now charged according to a fee-only pricing structure, rather than a mixture of fees and commission. Fees are based on a tiered scale applied to the value of a client's funds at the end of each quarter, whereas commission was charged on the execution of a transaction. That means fee income is typically more stable than commission since it relies less on the volume of transactions done.

Fee income now accounts for a much larger proportion of the group's total revenue. Net investment management fee income has grown by more than a third during the past three years and was up by almost a fifth to £144m during 2015 alone. Meanwhile, with the additional hindrance of poor stock markets, net commission income fell marginally to £43m last year - much the same as 2013's figure. What's more, around 92 per cent of Rathbone's business is now discretionary wealth management, which also usually provides a 'stickier' revenue stream.

Weak stock markets have hit investor sentiment towards all wealth managers during the past 12 months. Despite this, Rathbone's investment management business generated like-for-like net inflows of £700m in 2015 and brought in another £700m via its acquisition of the private client operation of Deutsche Asset & Wealth Management. A further £100m in new business during the first quarter of 2016 took total assets under management to £29.3bn, despite a £210m hit to the book value of investments. Rathbone's unit trust business - which caters to retail investors - also grew assets under management by around £100m to £3.2bn during the first quarter of the year.

Management is now broadening its avenues of distribution. At present, around two-thirds of discretionary business comes via its existing investment managers and referrals from existing clients. However, management is pushing further into the intermediary market in order to gain new business. Last year it set up a combined sales and business development team to promote its discretionary wealth management business among UK independent financial advisers (IFAs) and other intermediaries. Targeting IFAs is paying off - Rathbone attracted 10 new partnerships last year. The next step is to target lawyers and accountancy firms. The purchase of the remaining 81 per cent stake in financial planning company Vision in December should also help Rathbone gain greater access to the intermediary market.

The decline in commission may cause some pressure on profit margins in the short term. This prompted analysts at stockbroker Numis to downgrade their EPS forecasts in May, only for them to revise forecasts up again when stock markets revived. Numis even expects the wealth management industry to grow by 10-11 per cent a year for the next 30 years. Rathbone's margins are far better than its competitors', with wealth managers typically achieving margins of 20 per cent or more.

RATHBONE BROTHERS (RAT) | ||||

|---|---|---|---|---|

| ORD PRICE: | 1,842p | MARKET VALUE: | £890m | |

| TOUCH: | 1,835-1,842p | 12-MONTHHIGH: | 2,373p | LOW: 1,577p |

| DIVIDEND YIELD: | 3.4% | PE RATIO: | 14 | |

| NET ASSET VALUE: | 624p* | |||

| Year to 31 Dec | Turnover (£m) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2013 | 176 | 50.5 | 86 | 49 |

| 2014 | 201 | 61.5 | 102 | 52 |

| 2015 | 229 | 70.4 | 116 | 55 |

| 2016† | 245 | 71.6 | 117 | 59 |

| 2017† | 275 | 82.5 | 135 | 64 |

| % change | +12 | +15 | +15 | +8 |

Normal market size: 100 Matched bargain trading Beta: 0.3 *Includes intangible assets of £171m, or 356p a share † Numis Securities forecasts, adjusted PTP and EPS figures | ||||