Historically, big pharmaceutical companies have been enticing investments, providing earnings growth alongside generous dividends. However, in recent years investor sentiment has drifted as a string of pricing scandals have put margins under pressure while many best selling drugs have seen increased competition due to the loss of patent-protected exclusivity and the emergence of many fleet-footed biotechnology companies. UK giant AstraZeneca (AZN) has typified such woes, culminating in the loss of exclusivity of its multi-billion pound cholesterol drug Crestor in May 2016. But the panic caused by last month’s Brexit vote has provided reasons to take a fresh look at the defensive attractions of big pharma. Especially in the case of Astra, we like what we see.

- High, well-covered dividend yield

- Big pipeline of drugs in key therapeutic areas

- Good long-term growth prospects

- Defensive end markets

- Poor short-term earnings outlook

- Loss of IP on 'blockbuster' Crestor

After some tough years, we feel Astra back on the front foot. In 2014, chief executive Pascal Soriot set out an ambitious target to return to earnings growth by 2017 and achieve the same level of revenue as 2013 - the year before the group started to see a major patent drop off. As this date creeps closer he maintains that Astra is on track to deliver.

The last three years have seen significant efforts to replace revenue lost from big selling drugs. Research and development (R&D) spending over that time has been a whopping $16bn which has been largely channelled into the six areas management have identified as key growth platforms. While progress has not been entirely smooth, the investment is starting to deliver.

Cardiology drug Brillinta has been gathering strong momentum, particularly in the US where it has now been identified by the American College of Cardiology and the American Heart Association as the preferred drug for treatment of acute coronary syndrome. The respiratory franchise, which has long been a key asset for Astra, is also growing, with drug Symbicort expected to reach $816m of revenue in the current financial year. It is also good to see the revamp of the group's oncology division, which has been missing for many years. New oncology has recently been added as the sixth growth platform and should benefit from the launches of drugs Tagrisso - for lung cancer - and Lynparza, currently approved for gastric cancer with data from trials into breast and ovarian cancer expected within the next few months.

Growth through R&D has been supplemented by acquisitions and partnering. In 2015 the group completed the $2.7bn acquisition of ZS Pharmaceuticals, spent $4bn on a large stake in Acerta Pharma - in order to gain access to its oncology prospects - and earlier this year acquired the respiratory division of Takeda Pharmaceuticals for $575m. While the high prices paid for these companies has led to some criticism, they have had a huge effect in bulking up the pipeline as all have assets either approved or in the late stages of development. Rumours have also surfaced that Astra has been eyeing another company - Medivation. The US-based cancer specialist has got a top selling prostate cancer pill on the market and an impressive pipeline, but has already been bid for by French pharma giant Sanofi. It has been suggested that Astra may be willing to pay $10bn.

Given the long-anticipated Crestor patent expiry, the short-term outlook is not great, but Astra has never made any secret of the fact that 2016 was going to be tough. Set-backs in the diabetes franchise and more recently with Brillinta missing the clinical endpoint in a trial testing its use in stroke patients have also dampened spirits and highlighted the extent to which Astra's future is still dependant on the success of new drugs. It has also not been a good sign that the group has lost a few of its top research scientists to small innovative biotechs, while the move of the scientific hub from Manchester to Cambridge has fallen behind schedule.

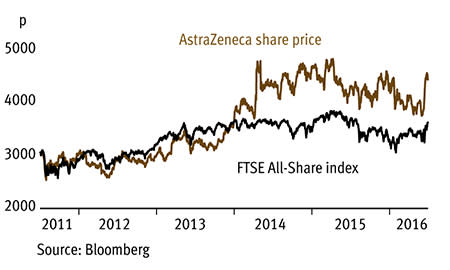

However, we believe that the long-term profile of Astra is very promising and its attributes have been thrown into sharper focus by current economic and political turbulence. The prospective yields stands at nearly 5 per cent and forecast earnings and free cash flow suggest there should be decent cover for the payout this year. There should be scope for dividend growth as new treatments come through. While Astra's share price has been rising following the Brexit vote, the next-12-month's PE rating remains in the bottom quarter of the two-year range and at a discount to the sector and its closest rival GlaxoSmithKline (GSK).

ASTRAZENECA (AZN) | ||||

|---|---|---|---|---|

| ORD PRICE: | 4,471.5p | MARKET VALUE: | £56.5bn | |

| TOUCH: | 4471-4472p | 12-MONTH HIGH: | 4,634p | 3,680p |

| FORWARD DIVIDEND YIELD: | 4.9% | FORWARD PE RATIO: | 9 | |

| NET ASSET VALUE: | 1,166ȼ* | NET DEBT: | 70% | |

| Year to 30 Jun | Turnover ($bn) | Pre-tax profit ($bn) | Earnings per share (ȼ) | Dividend per share (ȼ) |

|---|---|---|---|---|

| 2013 | 25.7 | 7.9 | 505 | 280 |

| 2014 | 26.6 | 6.4 | 428 | 280 |

| 2015 | 23.6 | 6.4 | 426 | 280 |

| 2016** | 21.8 | 8.1 | 537 | 280 |

| 2017** | 20.8 | 7.3 | 480 | 280 |

| % change | -4 | -10 | -11 | - |

Normal market size: 500 Matched bargain trading Beta: 0.89 *Includes intangible assets of $41.6bn, or 3,291ȼ a share **Liberum forecasts, adjusted PTP and EPS £1=$1.29 | ||||