Another tweet from presidential hopeful Hillary Clinton was enough to unsettle pharma share prices. The Democrat candidate took to social media to repeat her policy to clamp down on "prescription drug price-gouging", this time spurred into action by US group Mylan (US:MYL). The company has, over the past five years, raised the price of its EpiPen anaphylactic shock treatment by more than 400 per cent.

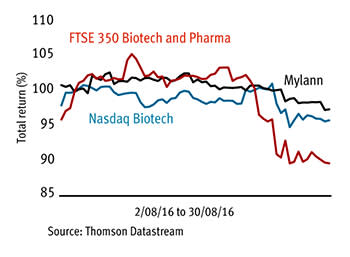

The EpiPen - which administers about $1-worth of adrenalin but is now being sold at $600 (£458.37) per two-pack - is widely used by children who suffer from severe allergies and Mylan shareholders have not reacted well to the price hike, sending the shares down 13 per cent in the past two weeks. The Nasdaq biotech index fell the fastest it has done all year, down 4 per cent last Wednesday, while many UK pharma stocks, including behemoths GlaxoSmithKline (GSK), AstraZeneca (AZN) and Shire (SHP), also slipped amid concerns they too could be caught up in pricing changes.

How Mylan compares

This is the second time in as many years that a tweet by Mrs Clinton has wiped value off pharma and biotech markets both sides of the pond. Last summer, the price inflation at Canadian company Valeant (CA:VRX) saw her launch new policies to clamp down on the huge margins made by drugs companies. Now, as the Democratic presidential candidate inches closer to the White House, it would appear her ideas are beginning to carry more weight. Mylan has been forced to re-evaluate its pricing of the EpiPen and has decided to launch an un-branded (generic) version "within weeks", which will go on sale for half the cost of the branded product.

Pricing problems in the US are, in part, the result of a poorly managed regulatory environment. The US Food and Drug Administration which is responsible for approvals, is said to have a large backlog of generic products which Mrs Clinton aims to clear to create a more competitive environment for speciality drugs. Although UK companies have their pricing controlled by a government scheme (an initiative missing stateside), there have been concerns that increased competition and a clamp-down on prices in the world's largest pharma market could cause problems for UK groups.

Pharma stocks, including GSK, have fallen amid price concerns

However, sector specialists are not too worried and believe innovative companies that spend efficiently on research and development should be well insulated against any changes to US pricing structures. New policies will aim to prevent companies such as Mylan and Valeant - neither of which are engaged in drug development but are largely spending their money on marketing and executive salaries - from exploiting the gaps in regulation, and this should be a good thing for the industry.

Of course, the likelihood of new pricing regulations primarily depends on whether Mrs Clinton becomes president and how many Democrats make up the Senate. But regardless, changes are unlikely to be radical. The US is unrivalled in the pharma and biotech space and it is unlikely that a new government will want to put big changes in place that could sacrifice the strength of the market.