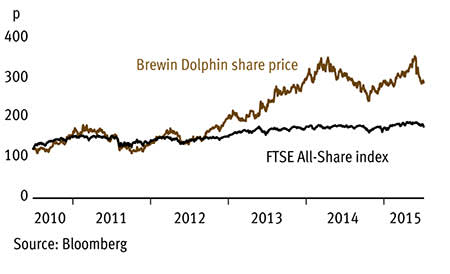

Brewin Dolphin (BRW) is completing its journey from stockbroker to full-blown wealth manager and emerging from a transformation of its back office. We don't believe its shares' rating, which is at a marked discount to peers and the historic average, reflects the benefits to shareholders of the recent changes, which include forecast compound annual EPS growth of 11 per cent over the next three years and expectations of a near 4 per cent yield this financial year rising to 4.6 per cent next year.

- Discount to sector

- Decent forward yield

- Completing restructure

- Assets and margins up

- Income slowed in H1

- Dealing fees down

Over recent years, Brewin has focused on increasing its discretionary fund management operation while exiting non-core businesses. The success of the strategy was evident in the first half when the company reported a 15 per cent year-on-year rise in discretionary funds under management to £26.2m. What's more, these funds now provide 83 per cent of the company's core income. Margins have been growing, too, with the adjusted pre-tax profit margin of 22.3 per cent at the end of the first-half comparing to 20.8 per cent a year earlier, and 17.1 per cent in 2013.

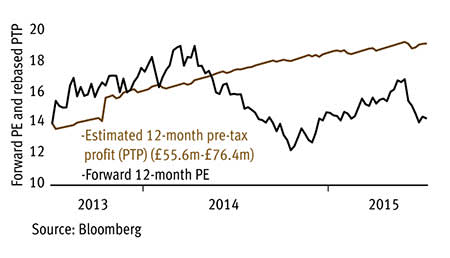

Forward earnings v profit forecasts

The sale of non-core assets also continues as Brewin moves away from its broking past. It sold its execution-only Stocktrade business to Alliance Trust Savings in May for £14m cash, which included a net gain of around £1m. The sale further streamlines its business around higher-value discretionary wealth management.

The company also has a growing pensions specialism that leaves it well placed to benefit from the trend towards people taking personal responsibility for their investment decisions. That trend started some years ago with the decline of defined benefit pension provision and has been accelerated by this year's regulatory change to remove the effective requirement for many to buy an annuity, and to reduce death tax charges. Personal wealth for higher-income earners is increasingly becoming a tax and inheritance issue, and wealth managers are set to benefit from people needing help to steer through retirement and pass their wealth on to the next generation. With £4bn of pensions business on its books, this is becoming a solid business line in its own right.

The company is also responding to the challenge to the sector from so-called 'discretionary direct' services. Its Brewin Direct service offers six non-advised investment portfolios with different levels of risk, which are aimed to cater for those with £10,000 to £200,000. These are people for whom investment advice is considered to no longer be practicable following the retail distribution review. Some managers are steering clear of the non-advised space for fear of the reputational risk, but they risk losing a new generation of clients, which Brewin and others can service via this type of model portfolio set-up.

At the same times as refocusing the business, Brewin, like the rest of the sector, has had to invest in its back office after a regulatory-driven review of the structures and the suitability of its services. The group has said this back-office transformation programme is entering its final stages which should free up management time and cash to invest in growth. But importantly, even while this behind-the-scenes work has been going on, the company has continued to grow its assets.

There have been some bumps in the road during Brewin's transformation and recent first-half results caused some disappointment after the group reported just 1 per cent growth in total income and revised down its revenue margin targets from 93 basis points to 89. However, we think any negative reaction does not do justice to the strategic progress being made by Brewin. Indeed, while management fees were well up in the first half, income was hit by a drop in commission revenue. This was partly market-related, as less dealing meant less deal-related income, and that situation has improved since the reported period, according to the company. The structural side of the drop was caused by clients moving away from commission-based charging structures to ‘fee-only’, asset-linked charging, which will be longer lasting and reflects Brewin’s reform of its discretionary fund management business to meet client demand. Importantly, though, by focusing on this area Brewin will improve its longer-term business prospects.

Brewin shares looks good value on a historical view and judged against brokers' growth expectation (see graph). The shares are currently valued at just 14 times Bloomberg consensus earnings expectation for the next 12 months, which is comfortably below both the average for the past three years of 15 times and the rating of shares in rivals such as Rathbone (RAT) and Brooks MacDonald (BRK), both on 17 times.

| BREWIN DOLPHIN (BRW) | ||||

|---|---|---|---|---|

| ORD PRICE: | 298p | MARKET VALUE: | £833m | |

| TOUCH: | 298-299p | 12-MONTH HIGH: | 361p | LOW: 237p |

| FORWARD DIVIDEND YIELD: | 4.6% | FORWARD PE RATIO: | 15 | |

| NET ASSET VALUE: | 79p** | NET CASH: | £115m | |

| Year to 28 Sep | Turnover (£m) | Pre-tax profit (£m)* | Earnings per share (p)* | Dividend per share (p) |

|---|---|---|---|---|

| 2012 | 270 | 42.9 | 12.2 | 7.2 |

| 2013 | 284 | 52.2 | 14.8 | 8.6 |

| 2014 | 291 | 60.2 | 16.5 | 9.9 |

| 2015* | 303 | 67.1 | 18.0 | 11.4 |

| 2016* | 313 | 76.5 | 20.0 | 13.7 |

| % change | +3 | +14 | +11 | +20 |

Normal market size: 2,000 Matched bargain trading Beta: 0.93 *Numis forecasts, adjusted PTP and EPS figures **Includes intangible assets of £90m, or 32p a share. | ||||