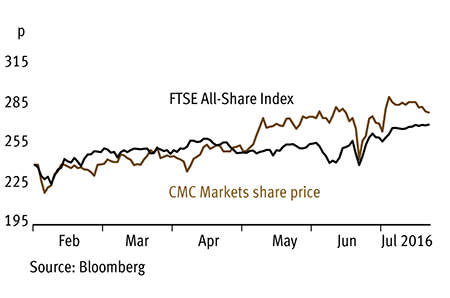

Nervous stock markets have hammered the share price of many UK-listed financial services companies during the past 12 months, whose price movements are often highly correlated to their underlying market. Yet shares in CMC Markets (CMCX) have risen by a fifth since the company's flotation on the London market in February, which provided enough momentum to push the stock into the FTSE 250 index in June's quarterly review. As a provider of spread betting, contracts for difference (CFDs) and foreign-exchange trading, CMC has capitalised on investors' desire to hedge their exposure - and make money from - market swings. With such fluctuations showing no signs of abating post-referendum and the group pushing into the institutional market, we reckon there is every reason to believe CMC's solid profits growth will continue.

- Active client numbers growing

- Geographically diversified

- Widening profit margins

- Shares rated below chief rival

- Sales per client pressurised

- Margins lag chief rival

CMC may not be as big a household name as its closest competitor, IG Group (IGG), but its clients trade in around 10,000 financial instruments in more than 70 countries. The bulk of CMC's business comes from trading in spread betting and CFDs, its platform allowing its predominately retail client base to deal in shares, indices, foreign currencies and commodities.

The group operates across three broad geographical areas: the UK, Europe and Canada/Asia Pacific. While revenue growth is strongest in the UK - up almost a third last year - management has been pushing overseas expansion, last year opening up offices in Austria and Poland. Generating 70 per cent of its sales outside the UK, CMC is more geographically diversified than IG, which generates around half its sales in the UK. Importantly, CMC's client numbers have been growing across all regions. Overall active client numbers - those who have taken a position within the past 12 months - increased 14 per cent to 57,300 last year, while a further 7,500 signed up during the three months to the end of June. This should be good news because management has started going after big-money clients.

The development of its Next Generation trading platform has been instrumental in ramping up client numbers. Management spent £60m on developing the new platform, which launched in 2010. The platform was developed in a modular format so that each of the different areas of the business - such as trading platforms, client-relationship management, and payments, pricing and risk - can be isolated and upgraded for a moderate cost. In Europe, the final batch of clients was migrated from the legacy platform to Next Generation last year.

CMC has now opened up its new platform to institutional investors, big-money customers who can trade their own clients' money. Products include fully branded and unbranded options, as well as allowing institutional investors to electronically access the trading platform via an electronic link. CMC typically rebates an element of the dealing spread between punters to each institutional customer. The aim is to lower its own cost of acquiring new business, since each institution does much of the marketing to its own clients.

Admittedly, the profit margins being achieved by CMC Markets are lagging those of IG Group. Last year CMC achieved a net income operating margin of 25.2 per cent, while the latter posted a 33.7 per cent margin in the 12 months to May 2016. However, CMC's margins have grown steadily during the past three years, while its rivals have been more inconsistent. In 2014, CMC's net income margin was 19.7 per cent, rising to 24.3 per cent in 2015. However, IG margins fell from 36.1 per cent in 2014 to 31.2 per cent the following year, before recovering again.

While both CMC's share price and the demand for its services have proved resilient so far, the operation comes with its own risks. The value of client trades was lower in the quarter leading up to the EU referendum, resulting in a moderate drop in revenue per active client compared with the same period a year earlier.

CMC MARKETS (CMCX) | ||||

|---|---|---|---|---|

| ORD PRICE: | 280p | MARKET VALUE: | £806m | |

| TOUCH: | 278-280p | 12-MONTH HIGH: | 293p | LOW: 195p |

| DIVIDEND YIELD: | 3.6% | PE RATIO: | 14 | |

| NET ASSET VALUE: | 61p | NET CASH: | £75.8m | |

| Year to 31 Mar | Turnover (£m) | Pre-tax profit (£m) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|---|

| 2014 | 122 | 32.2 | 8.4 | 4.3 |

| 2015 | 144 | 51.9 | 14.6 | 5.7 |

| 2016 | 169 | 62.3 | 18.0 | 8.9 |

| 2017* | 184 | 66.6 | 18.9 | 9.4 |

| 2018* | 195 | 72.1 | 20.4 | 10.2 |

| % change | +6 | +8 | +8 | +9 |

Normal market size: 1,500 Matched bargain trading *Numis Securities forecasts, adjusted profit and EPS figures | ||||