The growing complexities of running a businesses, combined with the increased availability of technology that can save time and boost efficiency, have left organisations clamouring for new ways of working. A large crop of companies has sprung up to satisfy their demands, providing everything from mobile devices and data management to workflow software and cyber security. The upshot is that investors have a variety of ways to bet on the ever-evolving future of the workplace.

Technology in motion

More and more businesses equip their workers with tablets and smartphones, enabling them to stay connected wherever they are. Growing numbers also allow employees to work remotely, meaning cosy cubicles and gossip by the water cooler could eventually become relics of the past. As part of its plan to become less reliant on iPhone sales, Apple (US:AAPL) has made a big push into the enterprise market in recent years. For instance, it has partnered with IBM (US:IBM) to get more iPads into the hands of workers. Meanwhile, Alphabet (US:GOOG) - previously Google - owns Android, the dominant smartphone operating system. Both companies look poised to profit as mobile devices become fixtures in the workplace, especially as Blackberry has fallen out of favour.

Linking up

Organisations are rapidly replacing landlines with online voice and messaging services. Many are also realising that it's often cheaper, safer and simpler to outsource management of computing and communication services to third parties. Robust demand for cloud services and online communication tools lifted enterprise sales by 2 per cent at mobile titan Vodafone (VOD) during the last financial year. Redcentric (RCN), which provides managed IT services to medium-sized organisations, is working to widen its margins by focusing on data storage, cloud applications and video conferencing. Hull and East Yorkshire telco KCom (KCOM) has focused on online communication and collaboration services, helping it win a landmark contract with HM Revenue & Customs, ATOC - the association of train operators - and private healthcare group Bupa.

Other options include Computacenter (CCC), a leading supplier of IT products and services; Softcat (SCT), a software reseller; and Alternative Networks (AN.), which specialises in providing data hosting, virtual desktops and wide-area networks to medium-sized organisations. Similarly, Gamma Communications (GAMA) is tackling the voice and data needs of businesses with cloud telephony and other services. And Iomart (IOM) has partnered with technology giants such as Amazon (US:AMZN) to offer both private and public data storage options.

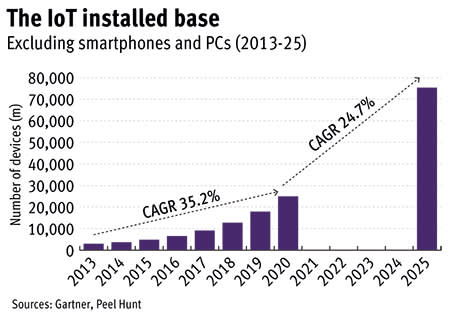

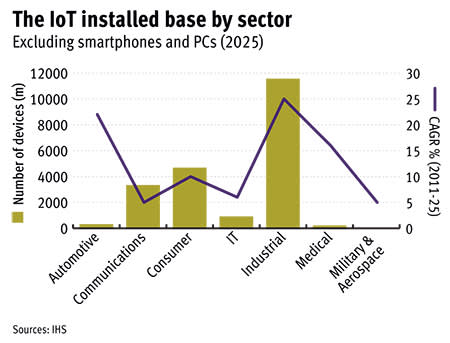

Telit Communications (TCM) stands out from the crowd. Soaring numbers of mobile devices have fuelled demand at the wireless connectivity specialist. For instance, software titan SAP recently licensed out its device management platform in order to resell it. And Telit just struck a deal with John Deere to implement its platform across its factories, allowing the industrial equipment group to collect and analyse real-time assembly information. The technology promises to boost production line efficiency, prevent unplanned downtime and improve efficiency throughout the supply chain.

Sourcing Software

New digital tools and computer applications have allowed organisations to boost their efficiency, comply with regulations and gain powerful insights into their consumers and markets. For instance, Idox (IDOX) provides planning, election management and compliance software to 92 per cent of local authorities in the UK, allowing them to save money and work more quickly. Meanwhile, K3 Business Technology (KBT) targets retailers, manufacturers and distributors with software products that can power everything from shop tills and tablets to payroll systems and marketing campaigns. Strong demand has led to contracts with European fashion retailers Tristyle and KLiNGEL, as well as recognition from Microsoft (US:MSFT) as an elite supplier of enterprise software. And Actual Experience (ACT) helps organisations to analyse every part of their supply chain in real time, and gauge customers' views on the quality of products and services. It recently inked a fiv-year deal with Vodafone, while US carrier Verizon and other global companies have agreed to distribute its services.

The proliferation of industrial automation, online commerce, mobile devices and social media has sent data volumes soaring. Several companies offer ways for organisations to gather and make sense of the overwhelming amount of information available. First Derivatives (FDP) has developed software that can analyse huge volumes of data in real time, allowing banks to track trades and insurers to comply with the latest regulations. It has also partnered with Utilismart to offer meter and sensor analytics to utilities, and ventured into new sectors such as digital marketing, retail and pharmaceuticals. Similarly, Fidessa (FDSA) provides financial trading and compliance software. And Fusionex (FXI) offers a user-friendly 'big data' platform that can spot security threats at a country's border or measure consumer sentiment around a particular product.

Older software companies have raced to adapt to the evolving workplace and embrace new technologies. Accounting and payroll software titan Sage (SGE) has focused its efforts on mobile, cloud, subscription and payment products. Its flagship software offering, Sage One, more than doubled its paid subscriber base to 173,000 last financial year as it launched in Australia, Brazil and Malaysia. Meanwhile, Micro Focus (MCRO) has enjoyed strong demand from organisations seeking to modernise ageing computing systems to allow them to interact with newer software and mobile devices. Aveva (AVV) has developed innovative engineering design and data systems, allowing organisations to create 3D models of large infrastructure assets before they build them. And brisk demand for Workday's human resources and financial management software has buoyed Kainos (KNOS), a consulting and software group that provides an automated testing tool for Workday to companies including Netflix and Shire.

Digital shields

Strong growth in e-commerce, internet-connected devices and cloud computing has been accompanied by the rising threat of digital crime. TalkTalk (TALK), LinkedIn (US:LNKD), Domino's Pizza (DOM) and other high-profile companies have been compromised in recent years. Organisations have rushed to protect themselves, drumming up demand at cyber security groups. For instance, Sophos (SOPH) provides both end-user and network security solutions to businesses, while NCC (NCC) offers cyber security software, risk consulting and safe data storage. Nike, Harrods and other big names use software from GB (GBG) to verify customers' identities, run background checks on employees and spot fraud and other criminal wrongdoing. And Eckoh (ECK) provides secure payment products and customer contact solutions, such as software that bars call centre staff from viewing customers' credit card information.

IC VIEW:

Organisations are navigating international conflicts, economic weakness in several countries and depressed trading in markets such as energy and financial services. Weathering those challenges will require them to slash costs, increase efficiency, embrace new technologies and insulate themselves from cyber attacks. Several companies look well placed to meet those needs; investors should get to work.

Favourites

Organisations are being forced to modernise their systems in order to remain competitive, which bodes well for Micro Focus. Its acquisitions of Attachmate and Serena have also strengthened its product range, and strong cash generation should allow it to reinstate its famed cash returns in the near future. Telit Communications is growing rapidly, winning big clients and gaining ground in the key US market. And Redcentric's focus on multi-year contracts has fuelled strong cash generation and provides excellent revenue visibility.

Outsiders

Aveva faces tough trading conditions in the energy and commodity markets as well as territories such as the US and Brazil. Moreover, investor sentiment hasn't recovered since its agreed reverse takeover by Schneider Electric fell through in November. Meanwhile, Eckoh's technology has plenty of promise, but the group's shares trade at a punchy 30 times forecast earnings for this financial year, pricing in its prospects.