Concerns over a rival's expansion in capacity, the exposure of Victrex (VCT) to the oil and gas industry and consolidation in the US medical market have caused the company's shares to plummet in recent months. We think those fears have been overplayed, and they mask a quality, cash-rich company where prospects for growth still look good.

- Sell-off creates buying opportunity

- Leader in a flourishing market

- Demand for PEEK set to grow further

- Burgeoning cash flow to fund higher dividends

- Expansion by a key rival

- Some tricky end markets

Victrex is the world's leading producer of PEEK, which is a high-performance plastic that's lightweight and very resistant to extreme temperatures and dangerous chemicals. As such, there's no shortage of demand for it. Appetite is particularly strong where industries that are growing fast need PEEK to fulfil stringent regulatory requirements.

That's the case in automotive and aerospace, where PEEK is used to build lighter cars and planes capable of providing better fuel economy. The material has also played a key role in the consumer electronics rage, namely by transforming smartphones and gadgets into thinner, more heat-absorbent devices. Medical implant manufacturers have similarly seen the benefits, as PEEK is lighter, flexible and, unlike metal implants, can easily be viewed with imaging equipment.

Indeed, there are several positive factors in medical markets. These include ageing demographics, the development of new surgical techniques and growing healthcare demand in previously unpenetrated emerging regions. But, while sales in Asia have surged, demand in mature markets has temporarily softened due to consolidation in the US market for spinal implants. Yet Victrex's bosses say this issue has subsided, leaving the company well-placed to prosper from the launch of several new cutting-edge products that have just started to be marketed.

Another problem area has been oil and gas. PEEK's ability to resist heat and corrosive chemicals are ideal attributes for explorers drilling in increasingly harsh conditions, yet the collapsing oil price has resulted in painful project delays and cancellations. Some analysts believe that oil and gas prices are soon set to recover. But until that happens investors can take comfort knowing that this market accounts for less than a tenth of Victrex's revenue.

The other major issue that has weighed on sentiment since the beginning of the year is the news that Franco-Belgian rival Solvay (Fr:SOLB) had expanded its PEEK capacity. Investors were clearly worried that extra competition could undermine Victrex's pricing power and 40 per cent-plus profit margins. But maybe the markets overreacted. Victrex holds a huge competitive advantage over Solvay thanks to its three decades of experience, wider manufacturing capabilities and bigger production volumes. That should give it the economies of scale to make life painful for Solvay, even in rapidly growing markets.

As the aerospace sector faces a huge backlog of orders and consumer electronic customers deliver more than 1bn handset sales per year, PEEK has become more popular than ever. That ultimately means there could be space for new PEEK producers to trade profitably. If so, more manufacturers may switch to using PEEK now that there are at least two big reliable sources of supply, suggests Adam Collins, an analyst at stockbroker Liberum.

And there are plenty more customers to woo. Liberum points out that Victrex has penetrated under 10 per cent of its addressable market to date, despite marketing PEEK for over 30 years and growing sales volume at a compound annual rate of 7 per cent over the past decade. Victrex is excellently placed to take full advantage of these opportunities, having just recently finished a major capital expansion programme at its main production site in Lancashire.

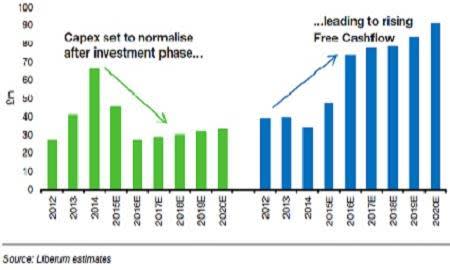

That also means capital expenditure is expected to fall drastically over the next few years, which should mean more cash generation. As the chart above shows, Liberum believes free cash flow of £50m in 2015 will rise annually to between £75m and £85m in the following four years. That has prompted City speculation that fat special dividends could easily be paid without undermining the company's healthy cash position. Victrex is no stranger to special dividends, having paid out 50p extra to shareholders in 2010 and 2014.

| VICTREX (VCT) | ||||

|---|---|---|---|---|

| ORD PRICE: | 1,767p | MARKET VALUE: | £1.51bn | |

| TOUCH: | 1,763-1,767p | 12-MONTH HIGH: | 2,147p | LOW: 1,505p |

| FORWARD DIVIDEND YIELD: | 2.9% | FORWARD PE RATIO: | 17 | |

| NET ASSET VALUE: | 382p | NET CASH: | £42.2m | |

| Year to 30 Sep | Turnover (£m) | Pre-tax profit (£m)* | Earnings per share (p)* | Dividend per share (p) |

|---|---|---|---|---|

| 2012 | 220 | 94.5 | 85.1 | 37.4 |

| 2013 | 222 | 94.6 | 86.0 | 43.0 |

| 2014 | 253 | 102.7 | 94.3 | 45.2 |

| 2015* | 264 | 106.0 | 98.6 | 48.5 |

| 2016* | 272 | 110.1 | 102.8 | 51.5 |

| % change | +3 | +4 | +4 | +6 |

Normal market size: 1,000 Matched bargain trading Beta: 0.9 *Numis Securities forecasts (diluted EPS) | ||||