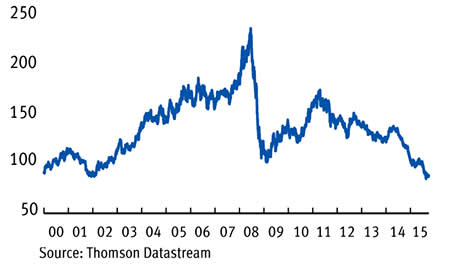

Commodities stocks have quite simply been the pits this year. In August, the Bloomberg Commodity Index fell to its lowest level since the turn of the century. The FTSE 350 Mining index is down 40 per cent in the nine months to October 2015, trailing an abysmal 2014. Investors could be forgiven for thinking that anything being dug out of the ground quickly turns to investment dust. Apart from the gold-sheltered Centamin (CEY) and Polymetal (POLY), all of the FTSE 350 index's constituents have lost serious ground in the past year; none more so than the debt-laden Glencore (GLEN). And mining stocks around the world have been similarly punished.

Why the fall? In short, insatiable Chinese demand has dropped at a time of peak supply, in turn reversing the once seemingly unstoppable rise in base metal prices. Likewise, those looking for a safe haven have had little cheer. Gold has not cost $1,500 (£990) an ounce since early 2013, thanks to lower-than-expected Chinese stockpiling and a strengthening dollar. But there are many metals, precious stones and other materials that are either less traded, less susceptible to industrial demand, or whose prices are chiefly determined by other trends.

Electric dreams

Take lithium, for example. Last month, Tesla Motors (US:TSLA) - a strong contender for the title of world's most eagerly watched company - opened its first European manufacturing plant in the Netherlands. The electric-car-maker hopes the facility will be able to produce 1,000 cars a week at full capacity, and chief executive Elon Musk wants to identify further production sites from the beginning of next year. To do this, and to fulfil the growing orders to its US sites, Tesla needs an enormous amount of lithium for the batteries in its cars. By the company's own calculations, its $5bn Gigafactory, now under construction in Nevada, will be producing more lithium ion batteries each year by 2020 than were produced globally in 2013. Global lithium demand from Tesla and other electric carmakers will surge over the next decade.

Bloomberg Commodity Index

Fortunately for UK investors, there is an interesting way to play this story. Bacanora Minerals (BCN), a Mexico-based lithium miner with an indicated resource of 1.05m tonnes of battery-grade lithium carbonate, and a further 4.8m tonnes of inferred resources, is one of just a handful of companies contracted to supply Tesla with the commodity. As part of the five-year deal, Tesla will buy lithium carbonate below the market price, currently at $6,000 (£3,925) a tonne. But 10 per cent annual growth in demand for lithium carbonate over the next decade, coupled with tight global supply, should push prices higher, in turn increasing the total value of Bacanora's indicated and inferred resources. At $6,000 a tonne, this currently equates to $23bn after drilling costs. That's a healthy premium to the miner's current £75m market capitalisation. The company's most recent accounts had C$11.6m net cash, although to build its processing plant, the company will need to raise $114m in debt and equity next year. Tesla is expected to participate in that capital-raising.

Yorkshire grit

Lithium is a good example of a commodity tied to consumption - in this case, growing sales of electric vehicles - rather than base metal-intensive industrialisation. Growing consumption of a different kind is central to the investment case in another UK-listed company, whose mineral deposits are being touted as the fertiliser of the future. Sirius Minerals (SXX) is well-known to many retail investors, following a decade-long and ultimately successful planning application.

The company owns the licence to develop its Yorkshire Potash project, the UK's largest and highest-grade deposit of polyhalite, a four-in-one macronutrient which Sirius says will be an important solution to the demand for greater crop yield and food output. A comprehensive agronomy study in 130 countries suggests there are big end markets for the product, although the company's success hangs on its ability to differentiate the added benefits of polyhalite in an already crowded potash market.

But with production still some way off, the current state of global potash prices has limited bearing on Sirius's current value. In the meantime - and while the company presses ahead with a major debt and equity fundraising and multiyear investment programme - demand for greater agricultural output will only increase. As we've stated previously, we think the potential commercialisation of the vast Yorkshire polyhalite deposit presents much less of an obstacle than the funding of the project itself - the low-fuss alternative would be a full asset buyout.

Building aggregate returns

IC buy tip Breedon Aggregates (BREE) is another UK-based alternative mining play, but one where the investment case hinges on the particulars of the national construction market. Breedon, which runs 53 quarries, plus 26 asphalt and 59 ready-mixed concrete plants, is the largest independent aggregates business in the country and is in an excellent position to acquire smaller peers in a fragmented industry. Barriers to entry are also enormous, with licences to open a new quarry virtually unattainable, meaning Breedon should benefit directly from strengthening infrastructure spending and the boom in demand for its industrial inputs. And unlike base metals, aggregates are relatively easy to mine.

Marble is another high-margin mining product worth examining. For Aim-traded Fox Marble Holdings (FOX), one cubic metre of the mid-range natural stone found in its mines in Kosovo and Macedonia might cost €65 (£48) to extract, and sell for €350 on the market in its raw form. But, once processed and sliced into thin slabs (at relatively low cost), the same piece of marble can fetch €2,250. Global demand for marble is increasing, and Fox is confident it has buyers for the 1,000 tonnes of marble it expects to be extracting in each of its four operational quarries by the year-end. Unfortunately, interim results revealed weak sales owing to delays at the Sivec and Malesheva quarries. And a fire at equipment supplier Prometec in July destroyed two major pieces of machinery destined for Fox's factory in Macedonia, which set back higher-margin marble processing by several months. Although this has resulted in a fall in the share price in recent months, the quality of Fox's high-margin products gives us confidence that sales will rebound.

A clear alternative

Precious stones of a different kind are also worth considering. Diamonds - which "normally take a small hit early on and are often last to recover from a downturn in the commodities cycle", according to WH Ireland mining analyst Dr Paul Smith - are nonetheless more closely tied to consumption patterns than industrial demand. A heavy markdown in the share price of Petra Diamonds (PDL) this year could be an excellent buying opportunity, particularly given the miner's refreshed focus on more lucrative undiluted kimberlite blocks.

Management - which recently bought £1.3m of shares - believes this will reduce costs in the coming months, providing further upside to earnings growth. And with rough diamond demand and prices expected to grow by more than 5 per cent a year between now and 2020 according to industry projections, a recent high-grade discovery at DiamondCorp's (DCP) Lace mine in South Africa (see below), may also be worth investors' attention.

The IC's preferred option in this space, however, has to be Gemfields (GEM). Against a backdrop of faltering commodity markets, Gemfields' sales growth shows no signs of abating, as consumers are increasingly shifting their attentions towards high-quality, ethically-sourced coloured gemstones. Strong auction performances, coupled with a maiden resource estimate at the highly promising Montepuez ruby mine in Mozambique, convinces us that Gemfields is a star performer in a niche market.

IC VIEW: As mining analysts sweat over the price trajectories of copper, coal and iron ore, it is possible to partially offset cyclical industrial demand by focusing on alternative, non-correlated mining products; or companies whose fortunes are being shaped by rapid technological change - Bacanora Minerals provides a case in point. Although Tesla's Gigafactory is on course to produce its first lithium-ion cells by next spring, Bacanora is effectively getting in on the ground floor, with an initial agreement that secures minimum purchase quantities over a five-year period. An investment in Bacanora highlights why it's still possible to identify potential growth levers in an industry where investor confidence is at a premium.