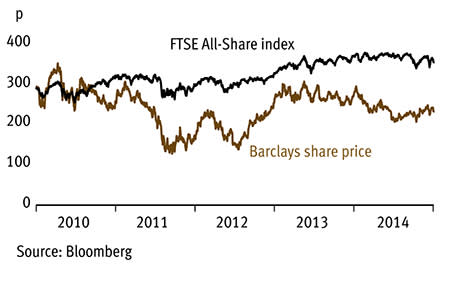

Admittedly, shares in Barclays (BARC) haven't exactly soared since chief executive Antony Jenkins announced a "bold simplification" of the bank in May. But judging the significance of that plan by the muted share price reaction so far would be a mistake. That's because, by focusing on the lender's better performing operations, Barclays has scope to radically bolster its return on equity and success here should leave the shares - currently trading at a notable discount to forecast net tangible assets (NTA) - looking churlishly cheap.

- Significant restructuring potential

- Effectively cutting costs

- Economic recovery should deliver a boost

- Shares cheaply rated for the sector

- Ongoing misconduct issues

- Weak investment banking conditions

Mr Jenkins' recovery plan - which involves hiving off non-core assets and dramatically scaling back the investment bank - is certainly radical. The objective is to focus Barclays on its decently-performing UK retail and corporate operations, as well as the African business. Plans to hack back the investment bank are especially ambitious and headcount there should fall by 7,000. Given that investment bank pre-tax profit in the nine months to end-September slumped 38 per cent year on year, amid low levels of market volatility, action here can't come too soon. Barclays has also established a non-core bank where around £115bn of assets (weighted for risk) will be placed with the intention of running them down to about £50bn by end-2016. Some 80 per cent of those assets come from the investment bank.

It's still early days, but restructuring is making progress. For instance, in September Barclays announced the sale of its struggling Spanish business to CaixaBank (ES:CABK) for £630m and completed the sale of its United Arab Emirates retail banking arm. Such measures are helping the tally of non-core assets to fall - risk-weighted assets in the third quarter fell £6bn from the second quarter's total.

There's good cost-cutting progress, too. Third-quarter figures, for example, revealed that total operating costs had fallen 7 per cent in the year to end-September, with total group headcount down by 7,800 in that period. Moreover - and at the time of May's restructuring announcement - the cost base target for 2014 and 2015 was lowered by £0.5bn in both years to £17bn and £16.3bn, respectively, and management expects core costs to fall to under £14.5bn for 2016.

BARCLAYS (BARC) | ||||

|---|---|---|---|---|

| ORD PRICE: | 237.6p | MARKET VALUE: | £39.2bn | |

| TOUCH: | 237.55-237.65p | 12-MONTH HIGH/LOW: | 298p | 202p |

| FWD DIVIDEND YIELD: | 3.8% | FWD PE RATIO: | 13 | |

| NET ASSET VALUE: | 361p | |||

| Year to 31 Dec | Pre-tax profit (£bn) | Earnings per share (p) | Dividend per share (p) |

|---|---|---|---|

| 2011 | 5.77 | 22.9 | 6 |

| 2012 | 0.80 | -4.8 | 6.5 |

| 2013 | 2.87 | 3.8 | 6.5 |

| 2014* | 4.23 | 9.8 | 7 |

| 2015* | 6.39 | 18.8 | 9 |

| % change | +51 | +92 | +29 |

*Investec Securities estimates Normal market size: 7,500 Matched bargain trading Beta:1.46 | |||

With the bank's core businesses already performing well - with a 10.5 per cent return on equity at the third-quarter stage - success with restructuring should be profound. Indeed, the non-core operations cut that return figure back to 6.3 per cent. But upside potential doesn't only reflect restructuring. Growing credit demand and improving credit quality - as the UK's economy continues to recover - will also help. And evidence for that economically-driven recovery is already apparent. Barclays' bad debt charge for the nine months to end-September, for instance, tumbled almost a third year on year - so a rapidly diminishing proportion of profits are being consumed by bad debts. Indeed, broker Investec Securities expects reported earnings to soar almost ninefold in the four years to end-2017.

Improving earnings, and less risk-weighted assets, is also bolstering the bank's capital cushion. It passed both Europe-wide stress-testing and the Bank of England's version rather more convincingly than rivals Lloyds (LLOY) and RBS (RBS) and Barclays reported a healthy Basel III equity tier one capital ratio (comparing its highest-quality capital with risk-weighted assets) of 10.2 per cent at the third-quarter stage.

Misconduct issues, however, continue to drag on sentiment. At the third-quarter stage, for example, a £500m provision was set aside relating to the ongoing investigation into foreign exchange market-rigging and the bank's PPI mis-selling provision was hiked by another £170m, bringing the total there to £1.2bn. The group is also being sued over its 'dark pool' trading operations - which allow blocks of shares to be traded while keeping prices private. Barclays was the first to be hit with a Libor-rigging fine - for £290m - back in 2012, too.