Britain is a nation of animal lovers and affection of our furry friends seems unlikely to wane. In fact, the pet care market is forecast to expand by more than 4 per cent a year between 2012 and 2017. This underpins the compelling growth story offered by Pets at Home (PETS), which operates both pet shops and veterinary surgeries. The group, which listed a year ago, is producing double-digit growth and enjoys an enviable market-leading position in a highly defensive sector - even when finances are stretched, consumers do not jeopardise the welfare of their beloved pets. Management is also embarking on an ambitious store rollout plan, while profits from the veterinary division will grow as clinics become more established. And the fragmented nature of the veterinary market provides major potential for expansion through acquisitions. Finally, the group is set to reap the benefits of cross-selling opportunities and cost savings between its retail and veterinary divisions.

- Defensive growth market

- Building scale in veterinary clinics

- Cross-selling opportunities

- Store rollout

- High rating

Pets at Home operates the UK's largest small animal veterinary business, with 308 surgeries under the Companion Care and Vets4Pets brands. The acquisition of Vets4Pets last year added scale to the business and has already delivered £1.8m of cost savings. As veterinary practices - and groom room salons - become more established, sales are rising fast and first-half like-for-like sales growth came in at 10 per cent. The beauty of this is that generating increased revenue from existing practices doesn't involve a significant rise in the cost base, leading to greater profitability. Indeed, first-half pet-services gross margins rose 546 basis points to 31.7 per cent.

What's more, the veterinary industry remains highly fragmented. Pets has an 8.5 per cent share of the market, and its biggest rival, CVS Group (CVSG), has an 8 per cent slice. The remainder is dominated by independents, so there's huge scope for consolidation. Accordingly, analysts at Liberum reckon that services revenue - which includes veterinary clinics and groom rooms - will achieve a compound average growth rate of 23 per cent in 2017 and that cash profit margins will rise by 10 basis points a year.

Meanwhile, the Pets at Home stores, which account for roughly 90 per cent of group revenues and now number 392, are having big success selling higher-margin own-brand products, which generate more than two-fifths of in-store sales. For instance, sales of Pets' Wainwrights pet food label jumped 55 per cent in the first half. Much of that was down to product development, such as grain-free dog food. This plays into a wider trend whereby pet owners are growing increasingly conscious of pet nutrition, so are more willing to splash out.

| PETS AT HOME (PETS) | ||||

|---|---|---|---|---|

| ORD PRICE: | 266p | MARKET VALUE: | £1.3bn | |

| TOUCH: | 266-267p | 12-MONTH HIGH: | 274p | LOW: 162p |

| FORWARD DIVIDEND YIELD: | 2.3% | FORWARD PE RATIO: | 18 | |

| NET ASSET VALUE: | 146p* | NET DEBT: | 32% | |

| Year to 27 Mar | Turnover (£m) | Pre-tax profit (£m)** | Earnings per share (p)** | Dividend per share (p) |

|---|---|---|---|---|

| 2012 | 544 | 25.6 | na | na |

| 2013 | 598 | 40.0 | na | na |

| 2014 | 665 | 52.2 | 0.5 | nil |

| 2015** | 729 | 87.6 | 13.7 | 5.5 |

| 2016** | 791 | 96.6 | 15.1 | 6 |

| % change | +8 | +10 | +10 | +9 |

Normal market size: 10,000 Matched bargain trading Beta: 1.07 *Includes intangible assets of £955m, or 191p a share **Liberum forecasts, adjusted PTP and EPS figures | ||||

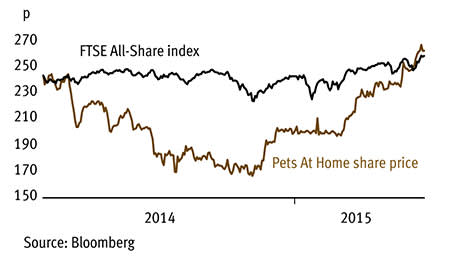

While a ratio of 19 times forward earnings may not shout 'bargain', the price nevertheless represents a marked discount to CVS, rated at 22 times. Moreover, Pets' forward price-earnings growth (PEG) ratio is less than 1. As a rule of thumb, anything sub-1 is considered to be good value.

And the real benefit within the Pets at Home operating model lies in the crossover between retail and veterinary. Pets is increasingly opening vet clinics and groom rooms within Pets at Home stores. Not only does this drive footfall and thereby cross-selling opportunities, but it generates higher sales from the existing retail space, thereby improving profitability. The plan is to grow the retail estate to 500 in the medium- term.