Millions of people have scoured Amazon (US:AMZN), Asos (ASC) and other online shops for Black Friday bargains and Christmas gifts in recent weeks. These e-commerce giants are clearly benefiting from the phenomenal growth in online sales of products and services, but they aren't the only ones: the boom has also been a boon for the payment, logistics and delivery businesses that transform these purchases into reality. Moreover, an entire sub-industry has sprung up of companies that help vendors establish digital storefronts, reach and engage customers around the world, and capitalise on this enormous market opportunity. The rapid growth of these 'e-commerce enablers' represents a lucrative opportunity for investors. Their main challenge, just like shoppers picking out presents or browsing for deals, is making the right choice.

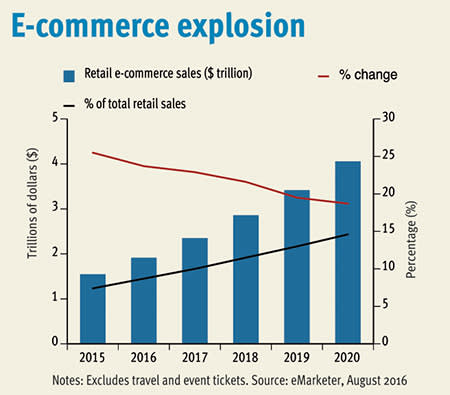

The speed, convenience and value offered by online shopping platforms has fuelled breathless growth in the e-commerce industry: worldwide revenues are on track to more than double to over $4 trillion (£3.2 trillion), or more than six times America's annual defence budget, between 2015 and 2020, according to eMarketer (see chart). Analysts at the market research group forecast annual growth of over 18 per cent during that period, and predict that e-commerce sales will balloon from 7.4 per cent to 14.6 per cent of total retail spending. They also expect two-thirds of sales to stem from Asia Pacific in 2020, up from about 52 per cent in 2015. Drivers of the region's growth include the burgeoning middle class in countries such as China, rising internet penetration and smartphone ownership, improving logistics and infrastructure, and the efforts of both foreign and domestic players to drum up demand.

Cogs and gears

Several companies play critical roles in the e-commerce industry. For example, fast and reliable payment is a cornerstone of efficient online trade. Surging volumes of e-commerce transactions have buoyed payment processors such as Worldpay (WPG) and SafeCharge (SCH), as well as cross-border payments specialist Earthport (EPO). Another important role is providing storage warehouses for stockpiling goods: Tritax Big Box Reit (BBOX) invests in very large distribution centres used by Amazon and Argos, while Segro (SGRO) lets out space to retailers such as DFS, and Hansteen (HSTN) leases storage depots to thousands of smaller vendors.

Logistics specialist Wincanton (WIN) goes a step further: it recently partnered with Majestic Wine to open a new national distribution centre to store, select, pack and deliver more than four million of the wine retailer's products. Similarly, Clipper Logistics (CLG) provides a range of e-commerce services including warehousing, transportation and returns management to customers such as Zara and John Lewis. And DS Smith (SMDS) is tapping into e-commerce growth by offering specialised packaging that promotes and protects products while making them easier to distribute.

Digital disruption

Many retailers are desperate to offset weakness in physical retail with e-commerce growth, meaning software companies have enjoyed brisk demand for ancillary products and services. SDL (SDL) helps clients such as Canon to sell to an international customer base by localising their websites and making it easier to interact with customers across different devices and media channels. Postal operator DHL has commissioned digital communications and transactions specialist Escher (ESCH) to modernise and connect at least 15,000 mobile devices, in a bid to bolster its presence in online delivery and speed up collection and distribution of parcels. And Fusionex (FXI) provides an intuitive 'big data' analysis platform that can help retailers track and garner insights from purchases, while Sanderson (SND) helps retailers, manufacturers and distributors set up and manage their e-commerce operations.

Other examples from the software space include dotDigital (DOTD), which helps customers link up to the Magento e-commerce platform and counts Paul Smith and Eurostar among its customers. Another is Accesso (ACSO), which helps leisure operators to sell admission tickets, merchandise and other items online, and recently launched a wearable device that functions as a contactless payment card, entry ticket and hotel room key. Moreover, Bango (BGO) provides a carrier-billing platform used by app store operators such as Amazon, while Eagle Eye (EYE) has helped Tesco, JD Sports and others to digitise their promotions, loyalty cards and rewards. Consultants are also cashing in on retailers' rush to establish retail storefronts. Events giant Ascential (ASCL) recently acquired One Click Retail, which provides e-commerce analytics to HP, Nestlé and Unilever. And global e-commerce consultancy Salmon - owned by advertising titan WPP (WPP) - recently snapped up Dutch peer Eperium, which counts Bunzl and Xerox among its clients.

Champ or chump?

The industry's giants haven't ignored the demand for e-commerce services. Amazon sells website hosting and data storage to millions of vendors, lists their products on its website and offers them access to its storage, packing and shipping services. Chinese peer Alibaba (US:BABA) has pursued similar initiatives and is also exploring new forms of e-commerce: it recently streamed a fashion show online and allowed viewers to pre-order items as they appeared on the catwalk, and used virtual reality to transport customers to overseas retail stores where they could select and purchase products.

Not every company has benefited from the e-commerce boom. Royal Mail (RMG), DX Group (DX.) and others face fierce competition from Amazon's fast-expanding logistics business, while retailers with large store footprints such as Game Digital (GMD) have struggled to compete with purely online vendors. Our recent cover feature on Amazon highlighted a range of companies and industries under threat. On the other hand, the greater risk of fraud for online retailers represents an opportunity for cyber security companies such as GB (GBG), which can verify the identities of more than 4bn people worldwide. Read our feature on investing in cyber security here.

IC VIEW:

The rising tide of e-commerce is lifting all manner of boats, making it a challenge for investors to choose the right vessels for their money. They should favour companies with strong track records, diversified, high-quality client bases and competitive advantages such as proprietary technology. Equally, they should give a wide berth to businesses that are struggling to adapt to digital trade and those that are most vulnerable to the e-commerce phenomenon. Given their structural growth story and stellar prospects, we think careful bets on e-commerce enablers have the potential to pay off handsomely.

Favourites

Amazon's relentless growth, incessant innovation and integral role in fostering global e-commerce make it a firm favourite. Recent contract wins and a shrinking debt pile leave Wincanton well placed to deliver, and the shares' low forward rating and sizeable yield add to the attractions. Fusionex, Accesso and dotDigital continue to outperform, but the market has largely priced in their stellar prospects. However, we see value in the shares of Tritax, DS Smith, Segro and Hansteen; all four businesses are trading strongly and should benefit from continued e-commerce growth.

Outsiders

The e-commerce boom has decimated traditional retailers and tested logistics groups, but newer businesses face their own set of challenges. Escher continues to sign postal operators around the world, but its shift to more lucrative and reliable subscription revenues has tempered top-line growth. Delays in closing licensing deals have also forced management to issue multiple profit warnings in recent years, weighing on investors' faith in the business. Meanwhile, SDL has narrowed its focus on language technology, streamlined its business and signed several big-name clients. But restructuring always carries risks, and the shares' punchy forward rating prices in the potential for a recovery here.