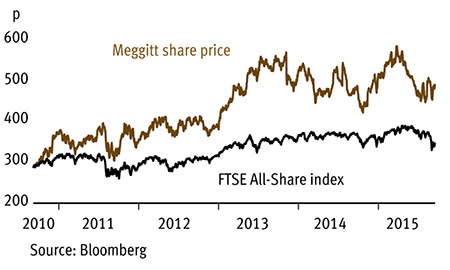

Warren Buffett's recent $37bn (£24bn) purchase of aerospace parts supplier Precision Castparts highlights the allure of UK peer Meggitt (MGGT). And directors have recently been buying shares, too, as the components and sub-systems manufacturer boosts investment to capitalise on strong end markets. With last month's first-half results emphasising Meggitt's attractions and bid speculation growing, we think the shares look too cheap on 13 times forecast earnings.

- Buffett buying US rival

- Directors buying shares

- Takeover speculation

- Strong end markets

- Decent dividend yield

- Elevated investment spend

- Tepid energy markets

Most of Meggitt's recent success is thanks to strong demand from the civil aerospace market, which accounts for over half of all sales. Part of the engineer's strategy is to supply equipment free of charge to new aircraft before making a killing from parts and repair work. With available seat kilometres - a good proxy for air traffic and a key driver of demand for spares and repairs on large and regional aircraft - growing around the 6 per cent mark, Meggitt is excellently placed to continue growing high-margin aftermarket revenues. Meanwhile, order backlogs at Airbus and Boeing have hit record levels.

To enhance this potential, and beat off competition, a big investment programme has been implemented to help the engineer become the supplier of choice. This six-phase programme designed to provide a "gold-standard" service has so far seen the quality of products improve by 86 per cent, while boosting the number of deliveries made on time by 10 per cent. Such investments, coupled with the capital required to cater to 15 significant new programmes coming into service, have naturally added to capital spending in the short term.

But while total research and development spend currently represents about a tenth of revenues, it is an outlay that should help the group capitalise on the sector's growth potential, which means it should be more than compensated for by more profitable aftermarket work further down the line. And management expects "elevated" expenditure to revert back to a more standard 7 per cent of total sales towards the end of 2016.

Volatile oil and gas markets also have benefited the aerospace business by reducing airline operating costs and ticket prices. On the flip side, though, the weak oil price has been bad news for the 10 per cent of group sales that are generated from providing valves, condition-monitoring equipment and printed-circuit heat exchanges to the energy sector.

Fortunately, the downturn in the energy sector has been offset by an improving outlook for the group's bigger defence operations, which account for just over a third of sales. Recent contract wins, including a $25m deal with the Canadian armed forces and a $42m deal to build an ammunition handling system for the British Army's new 'Scout' armoured vehicles, illustrate the pick up in demand.

About half of Meggitt's defence revenues come from the world's biggest defence market, the US. As part of a fiscal austerity programme, the US has held back on military spending in recent years, but recently President Obama has pledged to increase development spending by 13 per cent next year. While the budget hasn't been passed yet, rising geopolitical tensions hint that substantial rises could soon be in store.

| MEGGITT (MGGT) | ||||

|---|---|---|---|---|

| ORD PRICE: | 490p | MARKET VALUE: | £3.8bn | |

| TOUCH: | 490-490.5p | 12-MONTH HIGH: | 594p | LOW: 422p |

| FORWARD DIVIDEND YIELD: | 3.4% | FORWARD PE RATIO: | 12 | |

| NET ASSET VALUE: | 267p* | NET DEBT: | 34% | |

| Year to 31 Dec | Turnover (£bn) | Pre-tax profit (£m)** | Earnings per share (p)** | Dividend per share (p) |

|---|---|---|---|---|

| 2012 | 1.61 | 366 | 36.5 | 11.8 |

| 2013 | 1.64 | 378 | 36.9 | 12.8 |

| 2014 | 1.55 | 329 | 31.9 | 13.8 |

| 2015** | 1.70 | 359 | 36.7 | 15.1 |

| 2016** | 1.81 | 400 | 40.5 | 16.6 |

| % change | +6 | +11 | +10 | +10 |

Normal market size: 3,000 Matched bargain trading Beta: 1.07 *Includes intangible assets of £2.8bn, or 360p a share **Investec Securities forecasts, adjusted EPS and PTP figures | ||||