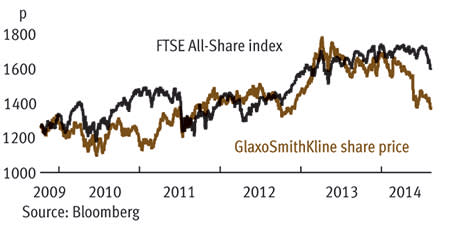

Blue-chip income staple GlaxoSmithKline (GSK) has had a torrid year hit by trading disappointments and a Chinese bribery scandal. However, with its shares having fallen 15 per cent since the start of 2014, we think the fortunes of the UK’s biggest pharma business could be about to change, helped by a canny "asset swap" deal , new-drug sales and a recent settlement on Chinese bribery charges. What's more, there's a near 6 per cent yield for investors to enjoy whilst waiting for things to improve.

- Generous dividend

- Novartis deal

- New products

- New chairman

- Bribery scandal

- Poor recent trading

One of the major drags on sentiment towards GSK this year has been the bribery scandal. Now, the group hopes to move on. It was fined a record £297m, a figure Chinese investigators say is equal to the bribes GSK paid medical professionals to boost sales of its products. But this was better than many expected and the shares actually rose modestly on the back of the news. True, GSK cannot be said to be totally out of the woods yet as other countries are now keen to look into its dealings. Investigations still loom in Poland, Iraq, the UK and the US. But there is no indication of further fines as yet. If anything, GSK and its chief executive Andrew Witty have an opportunity to pioneer new standards of corporate governance for the industry.

Attempts to clean up the corporate brand should also be helped by changes at the board level. Andrew Witty will still be at the helm as the group’s chief executive, but Royal Bank of Scotland (RBS) chairman Sir Philip Hampton is due to take the chair at the drugs giant when he leaves the banking behemoth after next year’s general election. He will replace Sir Christopher Gent, who plans to retire at the end of 2015. And Sir Philip has experience with scandal in his current role. He previously described RBS’s £390m Libor fine as ‘a sad day’ saying ‘a small group of people’ had ‘exposed the organisation to considerable reputational damage’. He added ‘a pocket of individuals’ at RBS had ‘lost touch with basic principles of right and wrong’ – sentiments echoed by Mr Witty at GSK.

But the bribery issue has only been one part of GSK's problems this year. In the second quarter the company saw a 4 per cent drop in core sales, at constant currency, which disappointed investors. What's more, there was a 12 per cent drop in EPS, which meant consensus forecasts were broadly missed and cuts to full-year EPS forecasts were made across the board.

Sales of new products – specifically Tivicay (for HIV) and respiratory products Anoro and Breo – to replace the flagging performance of older drugs are now likely to prove critical to boosting sentiment on this front. Some concern was even mounted over the sustainability of the dividend following recent poor trading, but the market seems to have got over these fears now and the consensus view is that a token full-year increase may actually be on the cards.

Importantly, GSK recognises its weaknesses and is trying to put things right. Earlier this year it took part in a high-profile “asset swap” deal with Swiss rival Novartis (NOVN). Although overshadowed by the Chinese investigation, the deal significantly altered the shape of GSK’s underlying business model – in our view, for the better. What’s more, the transaction means £4bn, worth about 80p per share, of net proceeds will be returned to GSK shareholders.

The deal involves GSK selling its oncology unit to Novartis for $16bn, and then buying the Swiss group's vaccine unit for up to $7bn. GSK's newly enlarged vaccines business would be stronger thanks to the addition of meningitis treatments from Novartis, and the business will benefit from increased access to emerging markets. Separately, the two will develop a co-owned consumer healthcare division in a joint venture controlled by GSK, which will own a 64 per cent majority share. In terms of future earnings potential, Deutsche Bank estimates the deal will add 2 to 3 per cent to earnings in the first and second years, and 5 per cent or more from 2017 onwards as £1bn of targeted cost savings come through.

| GLAXOSMITHKLINE (GSK) | ||||

|---|---|---|---|---|

| ORD PRICE: | 1,356p | MARKET VALUE: | £ 65.8bn | |

| TOUCH: | 1,355-1,356p | 12-MONTH HIGH: | 1,706p | LOW: 1,355p |

| DIVIDEND YIELD: | 5.9% | PE RATIO: | 14 | |

| NET ASSET VALUE: | 126p* | NET DEBT: | 211% | |

| Year to 31 Dec | Turnover (£bn) | Pre-tax profit (£bn)** | Earnings per share (p)** | Dividend per share (p) |

|---|---|---|---|---|

| 2011 | 27.4 | 7.6 | 112.9 | 70 |

| 2012 | 26.4 | 6.6 | 109.6 | 74 |

| 2013 | 25.6 | 5.1 | 106.5 | 78 |

| 2014** | 23.3 | 4.3 | 93.9 | 80 |

| 2015** | 25.7 | 4.5 | 97.3 | 80 |

| % change | +10 | +5 | +4 | - |

Normal market size: 1,000 Matched bargain trading Beta:0.70 *Includes intangible assets of £12.1bn, or 249p a share **Deutsche Bank forecasts, adjusted PTP and EPS figures | ||||