The return to the dividend coal-face by large mining companies will propel payouts in 2017 to a record high, with a helping hand from the US dollar.

Oil and gas dividends are expected to account for 21 per cent of the total £92bn estimated payout for this year, according to IHS Markit, which expects a 66 per cent dividend increase across the commodities sector thanks to the resumption of payments by Glencore (GLEN) and the increase from BHP Billiton (BLT).

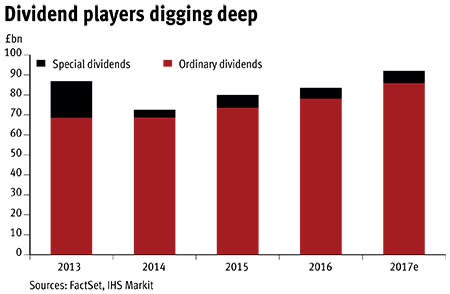

Markit said it expects FTSE 350 ordinary dividends to hit £86bn - a rise of 10 per cent on 2016 - but that special payouts should push this to the higher £92bn figure.

The weakness of sterling against the dollar is also an important factor, given that 45 per cent of the predicted payments are paid using the greenback, including by BP (BP.), Royal Dutch Shell (RDSA) and HSBC (HSBA). Markit noted BP and Shell account for 22 per cent of total FTSE 350 dividends and it believed both were safe in the near term given the recent rise in the oil price and supply cuts. It did, however, highlight Shell's debt-to-equity ratio of 29 per cent was higher than peers and its divestment plan had been slower than intended.

And in banking, Standard Chartered (STAN) is expected to resume its dividend while Lloyds Banking (LLOY) is being tipped to up its shareholder payout given its strong capital ratio, meaning "another special dividend cannot be ruled out", according to Markit.

Other sectors, including tobacco and insurance, should also see rises as will the gambling stocks due to an expected dividend per share increase of 22 per cent from both Paddy Power Betfair (PPB) and Ladbrokes Coral (LCL) and the return to the roster by GVC (GVC), which suspended payouts while it subsumed recent acquisition Bwin Party.

It's not looking up for the media sector, though, with Sky (SKY) agreeing not to pay a dividend in 2017 due to its expected deal with 21st Century Fox, and in travel predictions are for a hefty 16 per cent dividend cut by easyJet (EZJ) on lower earnings.