The government's decision to give the semaphore flags to Heathrow airport's expansion comes at a point when airlines are under intense pressure. The price war on the runway looks just as vicious as that which continues to unfold in the supermarket aisles and issues such as terrorist incidents have weighed on demand in the recent past, while fears about what Brexit might mean are creating jitters about the future.

Whether or not you think Heathrow is the right place to expand the country's airport capacity, one thing analysts strongly agree on is that expansion is needed.

Stephen Furlong, analyst at Davy, said while there might be political and economic concerns about the runway, he said there was "no economic case for not having it". He pointed out that China was in the process of building 25 new airports, so one runway in the UK was hardly moving the dial on a comparative basis. Putting the political hurdles aside, extra runway space in the UK sounds like a positive thing for airlines, but investors need to ensure they're backing the stocks that will still be flying when the tarmac in west London is actually laid.

Clipping their wings

The key obstacle for airlines at the moment appears to be managing their costs. Of course, this is always important, but with fares seemingly stuck in a downward spiral it's imperative airlines tighten their belts one way or another.

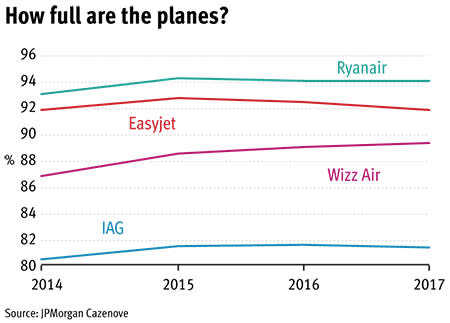

The drop in oil prices means fuel costs have fallen in the past 18 months and this benefit is largely locked in due to the airlines' hedging policies, which have secured the majority of their fuel costs at a set rate for the forthcoming year at least. Given the price of oil is out of airlines' control, investors need to watch which way ex-fuel costs are moving, as well as the revenue per available seat metric. Load factors are also important as, should airlines overexpand, they could be flying planes with too few passengers on them to make the trips cost-effective.

Davy's Mr Furlong reckons Ryanair (RYA) will be the winner when it comes to controlling costs among the discount brethren calling it the "cost leader in Europe and probably the world". With the legacy carriers, he views International Consolidated Airlines' (IAG) return on invested capital story as credible. He said the latter group was benefiting from its acquisition of Irish carrier Aer Lingus, which brought with it more primary airport slots and further transatlantic capacity.

Ryanair's unit costs fell 5 per cent excluding fuel in its latest results, better than easyJet (EZJ) which published results this week showing ex-fuel costs had fallen by 1.1 per cent on a constant currency basis.

Navigating Brexit

Another major factor for investors to consider is how airlines are using their capacity. Supply in the European short-haul industry continues to outpace demand and yet broker Liberum expects capacity to grow by roughly 8 per cent this winter.

Regardless of whether Heathrow's expansion remains on track, the biggest near-term issue is balancing the supply of flights from the UK given the uncertainty the EU referendum vote has caused.

Moves have already been made by some of the low-cost players, with Ryanair reducing its planned second-half UK capacity growth from 12 per cent to 5 per cent while Wizz Air (WIZZ) said in July that it would halve its planned UK growth. Broker JPMorgan Cazenove said Ryanair was the best-positioned airline for the long term, with its UK exposure below all other European low-cost carriers, except for Wizz Air. IAG and easyJet, on the other hand, were described by the broker as "the most heavily geared airlines to the UK". Indeed, easyJet marginally revised up capacity growth to 9 per cent for the 2017 financial year and is expanding its UK footprint as well as launching a European operating company to protect itself from any negative fallout from the Brexit negotiations.

While Wizz is benefiting from increasing interest in flying to and from eastern Europe, there is a small but growing concern that it might not have it so easy if other airlines turn their attention to similar geographies. JPMorgan Cazenove said Wizz could face "potential rising interest in eastern European markets from Ryanair, depending on the impact of Brexit".

Cloudy outlook?

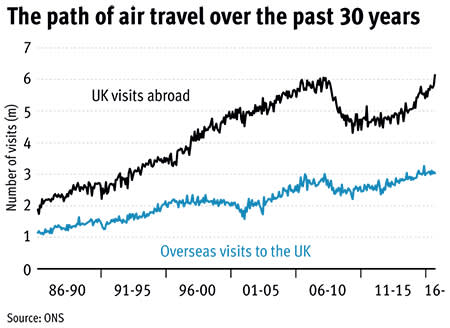

The steep fall in the pound in recent months has increased speculation that the UK could be a tougher market where outbound tourism is concerned. This is because sterling weakness has made it more expensive to holiday across both the Channel and the Atlantic.

But data from the Office for National Statistics suggests demand could well be stickier than people perceive. This is a sentiment often echoed by airline chief executives following terror attacks - effectively that demand might take a near-term hit but will recover as the desire to travel trumps any insecurities about flying.

The ONS said there had been an upward trend in the number of people visiting the UK since late 2012, but this "has not been driven by the value of the pound, which had also been on an upward trend until earlier this year".

Instead, the increase in visitors has been largely driven by a rise in the number of visitors from Europe, including countries that recently joined the EU. "There have also been large proportional increases in visitors from China and other emerging economies who now have the money to travel further afield," it added.

And encouragingly for the airlines, there is no data yet to suggest the popularity of 'staycations' - UK citizens having holidays in good old Blighty - has risen. The number of UK residents travelling abroad has "continued to rise in line with the trend seen since the economic downturn in 2008", the ONS said. This may be because there is no evidence (at this stage), to show a fall in the pound has had an effect on air fares or the prices of package holidays.

This comes back to the issue of cost. If an airline can reduce costs by a greater amount than it is reducing its fares, then it can likely continue to perform even as the outlook regarding Brexit looks more uncertain than usual.

Favourites

We recently upgraded our view on the eastern European-focused Wizz Air due to its low exposure to the UK and strong links to countries where air travel is becoming increasingly popular. Our take on Ryanair is more tempered, although this is largely a valuation-based decision seeing as we're confident about it operationally. We also continue to back easyJet which, in spite of a tough 2016, has a solid balance sheet and provides investors with a more certain income stream thanks to its dividend.

Outsiders

Exeter-based airline Flybe (FLYB) would have to be our big outsider. The group recently lost its chief executive and is intent on increasing capacity in spite of the supply landscape and its previous problems with overexpansion. It is also opening a new European base in Düsseldorf, which seems brave in the short term given strong industry capacity growth but may turn out to be a useful Brexit hedge.